ATO Audit Help for Melbourne Businesses: Your Guide to a Stress-Free Resolution

Few things can disrupt a business owner’s day quite like a formal notice from the Australian Taxation Office (ATO). The immediate feeling of dread, the fear of unexpected penalties, and the thought of navigating complex tax law can be overwhelming, pulling your focus away from what you do best. In these moments, securing professional ATO audit help for businesses melbourne provides a crucial lifeline, transforming a daunting challenge into a manageable process.

We understand your concerns, and you don’t have to face this journey alone. This guide is your first step towards a stress-free resolution. We’ll provide the clear guidance you need to understand the audit process, what to expect, and how a trusted partner can advocate on your behalf to achieve the best possible outcome. Let us help you gain peace of mind and get back to running your business with confidence.

Key Takeaways

- An ATO audit notice isn’t an accusation of wrongdoing; understanding its purpose is the first step towards a stress-free resolution.

- Seeking immediate professional ATO audit help for businesses Melbourne is the most critical action to protect your rights and navigate the process correctly from day one.

- Discover the common audit hotspots for SMEs to proactively assess your own records and strengthen your compliance before the ATO even calls.

- Expert guidance can significantly reduce the time and pressure an audit places on you, ensuring you can continue to focus on running your business.

Understanding an ATO Audit: What It Means for Your Melbourne Business

Receiving a notification from the tax office can be an unsettling experience for any business owner. However, it’s crucial to understand that an audit is not an accusation of wrongdoing. It is a standard procedure used by the Australian Taxation Office (ATO) to verify that businesses are meeting their tax and superannuation obligations, thereby ensuring the integrity of our national tax system. The key is to be prepared, understand the process, and seek professional guidance from the outset.

To better understand what the ATO is looking for, the following video offers some valuable insights into their key areas of focus.

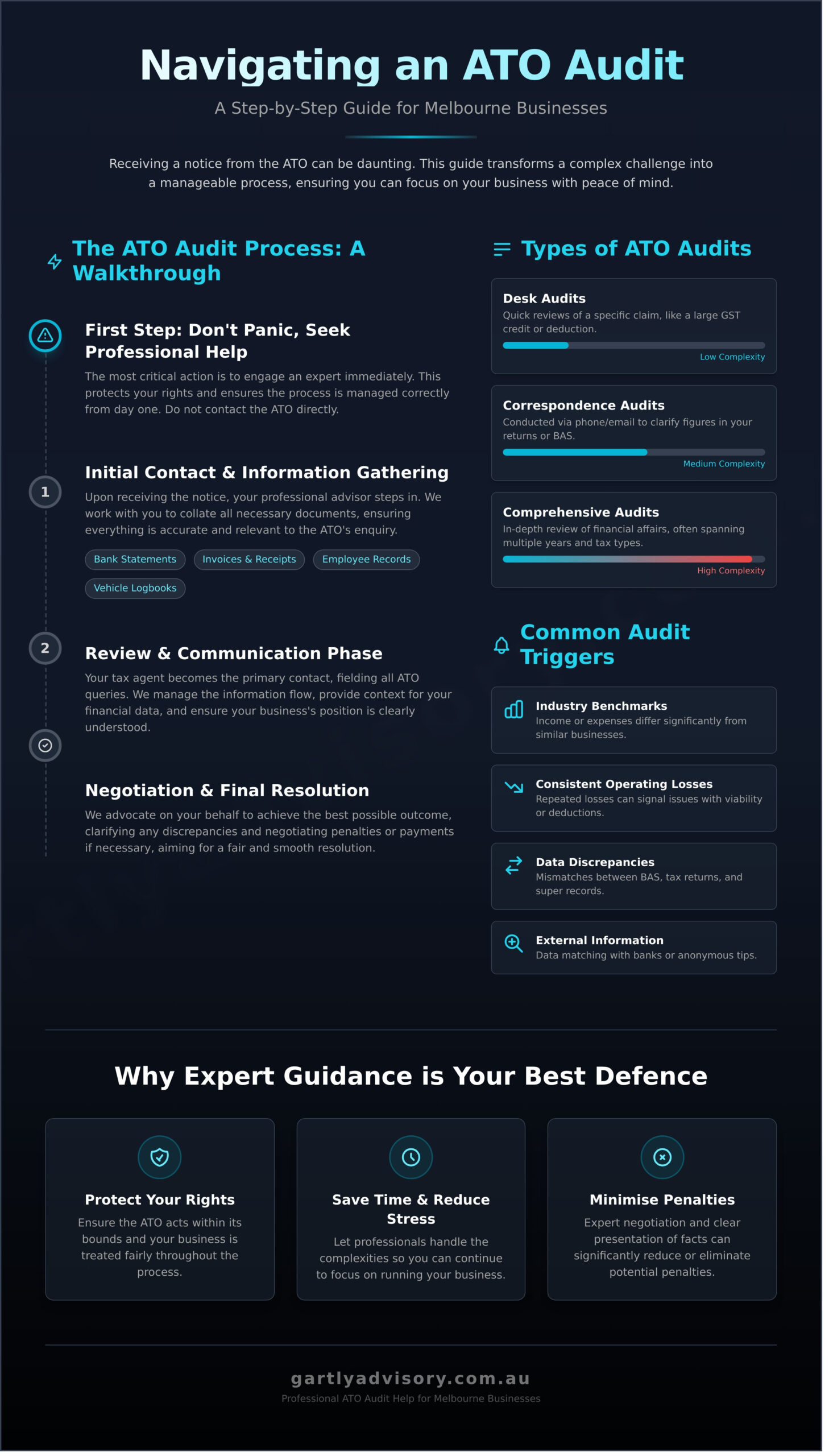

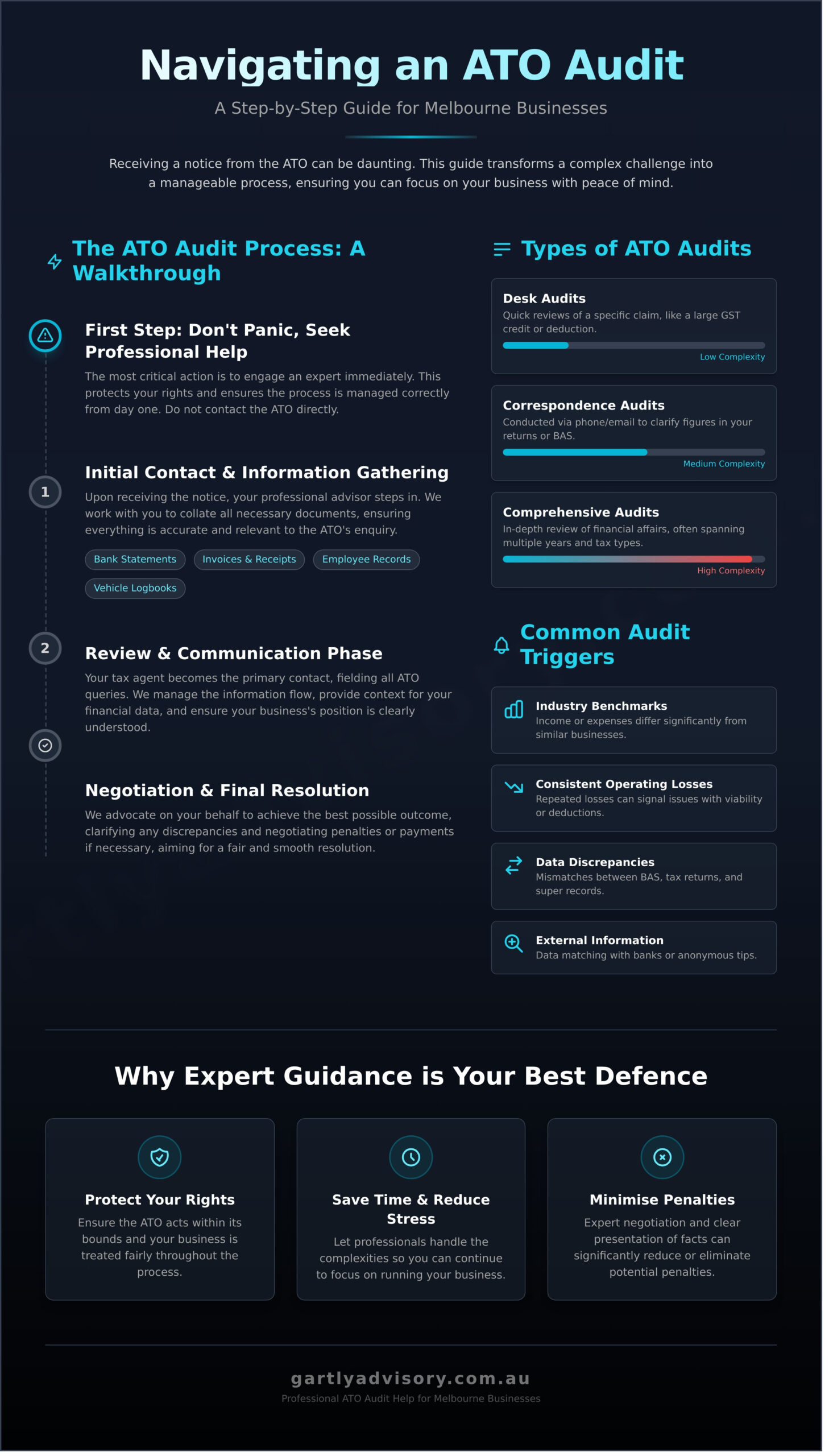

Types of ATO Audits and Reviews

An “audit” can range from a quick query to a comprehensive investigation. The main types include:

- Desk Audits: These are typically quick reviews of a specific claim, such as a large GST credit or a significant deduction, where the ATO simply needs to verify the details.

- Correspondence Audits: Conducted entirely via phone, email, or official letters, these audits request further information or documentation to clarify figures reported in your tax returns or BAS.

- Comprehensive Audits: This is an in-depth review of your business’s financial affairs, potentially covering multiple years and various tax types like income tax, GST, FBT, and superannuation guarantee obligations.

Common Triggers for an ATO Audit

While some audits are random, many are triggered by specific data points and risk profiles. Common reasons for selection include:

- Industry Benchmarks: Your business’s income or expenses fluctuate significantly from the established benchmarks for similar businesses in your industry.

- Consistent Operating Losses: Repeatedly reporting losses can signal to the ATO that a business may not be commercially viable or could be incorrectly claiming deductions.

- Data Discrepancies: Mismatches between information reported on BAS, income tax returns, and employee superannuation payment records.

- External Information: Anonymous tips or data matching with third-party sources like banks, financial institutions, and other government agencies.

The ATO often sharpens its focus on specific industries within Victoria that it deems high-risk. Having a trusted partner provides the professional ATO audit help for businesses in Melbourne that is essential for a smooth and fair resolution. Understanding these triggers is the first step toward effective preparation and management.

The ATO Audit Process: A Step-by-Step Walkthrough

Receiving a notification from the Australian Taxation Office (ATO) can be a daunting experience for any business owner. The formal language and request for detailed records often cause immediate stress. However, the most important first step is not to panic. The notice will outline what the ATO is reviewing, the specific time periods, and the initial deadline for providing information. This is the moment to pause, take a breath, and seek professional guidance. Engaging an expert early is the key to managing the process calmly and effectively.

As your trusted partner, we provide the dedicated ATO audit help for businesses melbourne companies need to navigate this complex journey. We immediately establish a clear timeline and manage all communications, allowing you to focus on running your business while we handle the intricacies of the audit.

Stage 1: Initial Contact and Information Gathering

Once you receive the notice, we step in to manage the process. The ATO will specify the audit’s scope-whether it’s a review of your GST, income tax, or employee obligations. Our first task is to work with you to collate all necessary documents. This often includes:

- Business bank statements and credit card statements

- Invoices, receipts, and expense records

- Employee superannuation and PAYG records

- Vehicle logbooks and asset registers

We ensure every piece of information provided is accurate, complete, and directly relevant to the ATO’s enquiry, preventing unnecessary complications down the line.

Stage 2: The Review and Communication Phase

With a professional tax agent managing the audit, you no longer have to deal with the ATO directly. We act as your primary contact, fielding all queries and managing the flow of information. Our role is to provide context for your financial data, explaining the commercial reality behind your transactions and ensuring your business’s position is clearly understood. This is crucial for demonstrating compliance with Australian tax law, as detailed in resources like the government’s official Business Income Tax Guide. If the ATO identifies potential discrepancies, we meticulously analyse their findings and prepare a clear, evidence-based response on your behalf.

Stage 3: Finalisation, Objections, and Appeals

At the conclusion of the review, the ATO will issue a position paper or a notice of assessment outlining their final decision. If there is a tax shortfall, our focus shifts to negotiation. With our deep experience, we can often negotiate a reduction in penalties and interest charges. We will provide clear advice on the outcome and, if you disagree with the decision, we will guide you on your rights and the merits of lodging a formal objection or appealing to the Administrative Appeals Tribunal (AAT).

How Expert Audit Support Can Protect Your Business

Facing an ATO audit can be an overwhelming experience, diverting your focus from running your business. The primary benefit of engaging an expert is immediate relief-reducing your stress and saving you invaluable time. Instead of deciphering complex requests and facing auditors alone, you gain a dedicated partner to manage the entire process on your behalf.

An experienced advisor acts as a crucial buffer between you and the ATO. We ensure your rights as a taxpayer are protected at every stage, translating technical jargon and managing all communications. This professional representation is essential. With our deep knowledge of Australian tax law, we build a strong, coherent case, ensuring your financial position is presented accurately and favourably. This level of professional **ATO audit help for businesses in Melbourne** gives you the confidence that your case is being handled with the utmost competence and care.

Strategic Document Preparation and Review

Our proactive approach begins before any information is sent to the ATO. We meticulously review your records to identify potential red flags and prepare clear, concise explanations in advance. By organising and presenting your documentation professionally, we pre-empt questions and demonstrate a high level of compliance, setting a cooperative tone for the entire audit process.

Skilled Negotiation and Dispute Resolution

Should the ATO propose adjustments, our role shifts to negotiation and advocacy. With decades of experience, we understand how to argue points of tax law and interpretation effectively. Our goal is always to achieve the best possible outcome for you by aiming to minimise any tax adjustments and the potential for resulting penalties. Let us be your trusted partner. Contact us for a confidential discussion.

Common Audit Hotspots for Melbourne’s Small and Medium Businesses

The Australian Taxation Office (ATO) uses sophisticated data-matching technology to identify discrepancies and target high-risk areas. For Melbourne’s dynamic small and medium businesses, understanding these hotspots is the first step toward robust compliance and peace of mind. Proactive management of your financial records is crucial, and knowing where to focus your attention can prevent significant stress down the track.

GST, BAS, and the Cash Economy

With Melbourne’s thriving hospitality, trade, and retail sectors, the ATO pays close attention to the cash economy. Common triggers for an audit include consistently reporting low sales figures compared to industry benchmarks or making errors in Business Activity Statement (BAS) lodgements. Simple mistakes like incorrectly claiming GST credits on personal expenses or GST-free items can quickly flag your business. Ensuring every BAS is reconciled against your bank statements is a fundamental step in maintaining compliance.

Employee vs. Contractor Arrangements

Misclassifying an employee as an independent contractor is a major red flag for the ATO, as it can be seen as a way to avoid superannuation and payroll tax obligations. The ATO looks beyond your written agreement to the reality of the working relationship. Key indicators they assess include:

- Control: Who dictates how, where, and when the work is done?

- Tools: Who supplies the equipment needed to perform the work?

- Delegation: Can the worker subcontract or delegate the task to someone else?

Ensuring your contractor agreements are genuine and accurately reflect the nature of the engagement is essential.

Private Use of Business Funds & Assets

For directors of private companies, the line between business and personal expenses can sometimes blur, but the ATO requires strict separation. This is where Division 7A rules apply, which treat payments, loans, or forgiven debts from a company to a shareholder (or their associate) as unfranked dividends unless a compliant loan agreement is in place. Common issues include using the business credit card for personal purchases or failing to account for private use of a company vehicle. Meticulous record-keeping, including vehicle logbooks and separate accounts, is your best defence.

Navigating these complex areas requires experience and foresight. If you’re seeking proactive guidance or need specialised ATO audit help for businesses in Melbourne, the team at Gartly Advisory is here to provide trusted support.

Why Choose Gartly Advisory for ATO Audit Help in Melbourne?

Facing an Australian Taxation Office (ATO) audit can be one of the most stressful experiences for a business owner. During this time, you need more than just an accountant; you need a trusted partner who can offer calm, expert guidance. With over 35 years of experience navigating complex tax legislation and disputes, Gartly Advisory provides the steady hand and strategic advice required to protect your interests.

Our approach is founded on partnership. We take the time to understand your unique situation, demystify the audit process, and work collaboratively with you to achieve the best possible resolution. From our local Ormond office, we offer dedicated support that is both reassuring and results-focused, ensuring you feel in control every step of the way.

A Proactive, Not Just Reactive, Partner

Our support doesn’t end once the audit is resolved. We believe in providing advice that goes ‘beyond the numbers’ to secure your business’s long-term financial health. Instead of simply defending your current position, we help you turn a stressful audit into an opportunity. We will review your systems, identify areas for improvement, and help you implement stronger compliance frameworks to minimise the risk of future scrutiny and protect your business for years to come.

Your Local Melbourne Chartered Accountants

When you need reliable ATO audit help for businesses in Melbourne, local expertise makes a significant difference. Being based in Ormond means we are accessible, available to meet in person, and possess an intrinsic understanding of the Melbourne business landscape. Our proven track record is built on successfully guiding countless small and medium-sized enterprises through the audit process. Our client testimonials reflect our unwavering commitment to this community.

- Decades of Proven Experience: Leverage our 35+ years of specialised tax and business advisory expertise.

- Local & Accessible: We are part of your community and ready to provide face-to-face support.

- Supportive Guidance: We translate complex tax matters into clear, actionable advice.

You don’t have to manage the pressure of an ATO audit by yourself. Let us be your advocate and guide. Schedule your complimentary consultation today.

Navigate Your ATO Audit with Confidence and Support

Facing an ATO audit can be a daunting experience, but it doesn’t have to derail your business. The key takeaways are clear: understanding the audit process is your first line of defence, and proactive preparation is crucial for a smooth resolution. Most importantly, you never have to navigate this complex challenge alone. When seeking professional ATO audit help for businesses melbourne, having a dedicated and experienced team on your side makes all the difference.

At Gartly Advisory, we are committed to being your trusted partner. With over 35 years of Chartered Accountant experience and the trust of the community, evidenced by our 70+ 5-Star Google Reviews, we provide expert guidance right here from our Ormond office. We understand the local business landscape and are here to protect your interests and minimise your stress.

Don’t let an audit notice create uncertainty. Take the first step towards a clear, positive outcome. Facing an ATO audit? Schedule a confidential, complimentary consultation with our Melbourne experts. Let us help you turn this challenge into a resolved matter, allowing you to focus on what you do best-running your business.

Frequently Asked Questions About ATO Audits

What are my rights during an ATO audit?

During an ATO audit, you have the right to be treated with professional courtesy and respect. You are entitled to ask for information about the audit process, understand the reasons for the ATO’s decisions, and have a representative, such as your trusted accountant, act on your behalf. You also have the right to privacy and confidentiality regarding your financial affairs. Knowing these rights is the first step in ensuring a fair and transparent process for your business.

How long does a typical business tax audit take?

The duration of an ATO audit varies significantly based on its complexity. A simple review or query about a specific claim might be resolved in a few weeks. However, a comprehensive audit examining multiple years or complex business structures can take several months, and in some cases, over a year to complete. The timeliness of your responses and the quality of your record-keeping play a crucial role in determining the final timeline for the investigation.

What happens if I can’t provide all the documents the ATO has requested?

If you cannot locate all requested documents, it is vital to be transparent with your advisor and the ATO. Explain why the records are unavailable-for instance, they were lost or destroyed. Often, it is possible to reconstruct records or provide alternative evidence to substantiate your claims. Seeking professional ATO audit help for businesses in Melbourne is crucial in this scenario, as an experienced advisor can help you navigate the process and negotiate with the ATO on your behalf.

What are the potential penalties if the ATO finds errors in my tax returns?

If the ATO finds errors, you will be required to pay the tax shortfall plus interest. Additionally, financial penalties may be applied, which are calculated as a percentage of the shortfall. The penalty amount depends on the reason for the error, ranging from 25% for a failure to take reasonable care, up to 75% for intentional disregard of the law. Voluntary disclosure of errors before or during an audit can significantly reduce these penalties.

Can I claim the cost of hiring an accountant for audit help as a tax deduction?

Yes, in most cases, the professional fees you pay for managing your tax affairs are tax-deductible for your business. This includes the costs of hiring a Chartered Accountant to provide advice, support, and representation during an ATO audit. Engaging an expert not only provides you with essential guidance but the associated fees are a legitimate business expense, helping to offset the financial burden of the audit process itself. To see an example of an experienced firm offering such services, you can visit Brown Hamilton Partners.

Is it worth getting ATO audit insurance for my business?

ATO audit insurance can be a valuable investment for peace of mind. It covers the professional fees charged by your accountant or other advisors to respond to an audit, which can quickly become substantial. It does not cover any tax shortfalls, penalties, or interest payable. Whether it’s worthwhile depends on your business’s complexity and risk profile. It ensures you can afford the best possible professional support without financial stress when you need it most.