What Can You Claim on Tax? A Comprehensive Australian Guide

As tax time approaches, a familiar question echoes for many Australians: “Am I claiming everything I’m entitled to?” The fear of missing out on a legitimate deduction is real, as is the worry of making a mistake that could attract unwanted attention from the ATO. Navigating the complexities of what can you claim on tax can feel overwhelming, from deciphering home office rules to keeping the right logbooks for your car. It’s easy to feel uncertain, leaving you questioning whether you’re truly maximising your return.

This comprehensive guide is designed to provide clarity and confidence. We will walk you through the key rules for tax deductions in Australia, uncover the most common (and often overlooked) expenses you can claim, and explain the essential record-keeping practices you need to follow. Let us be your trusted partner in turning tax-time stress into a feeling of security, ensuring you lodge your return knowing you have achieved the best possible outcome.

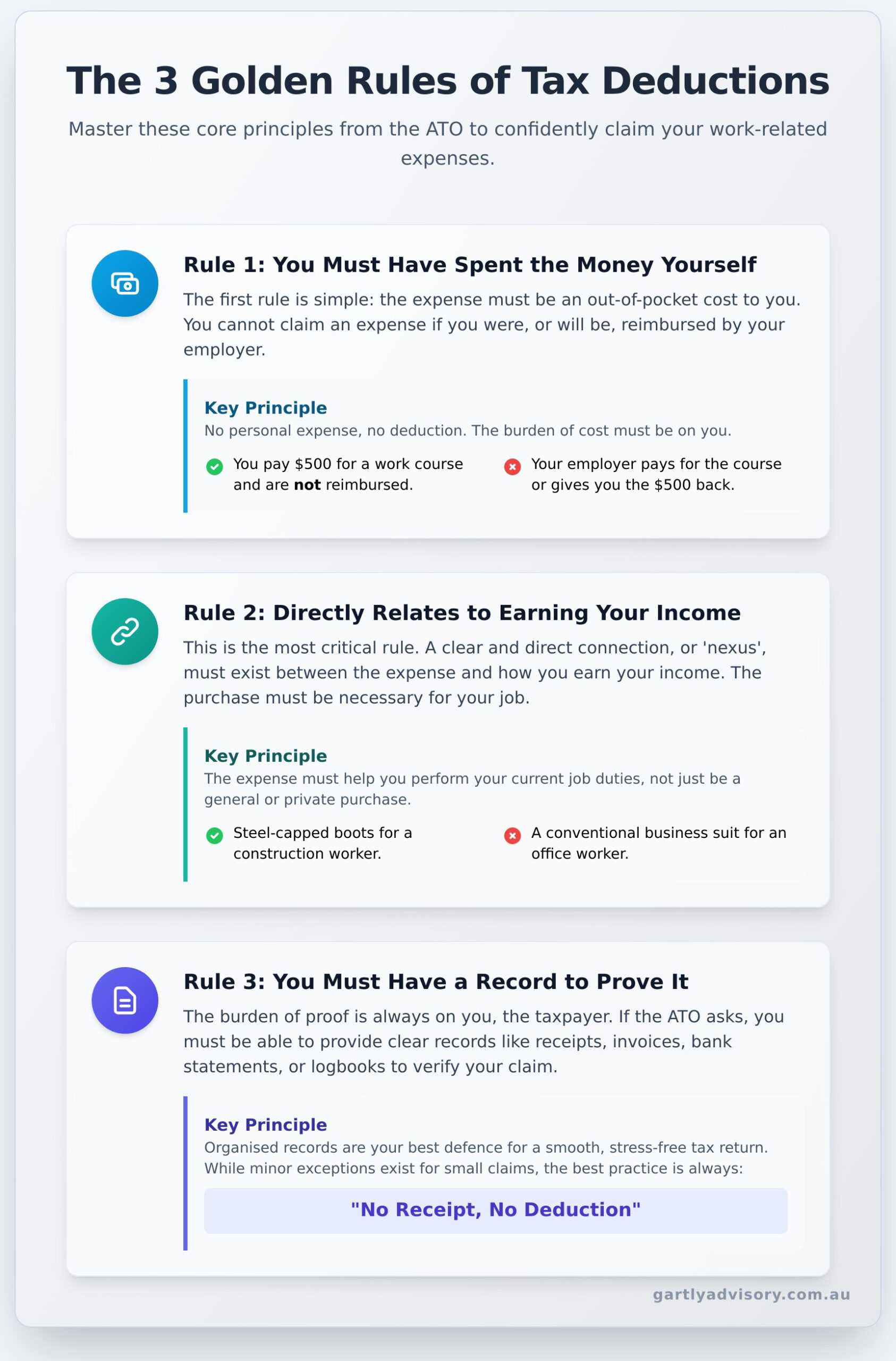

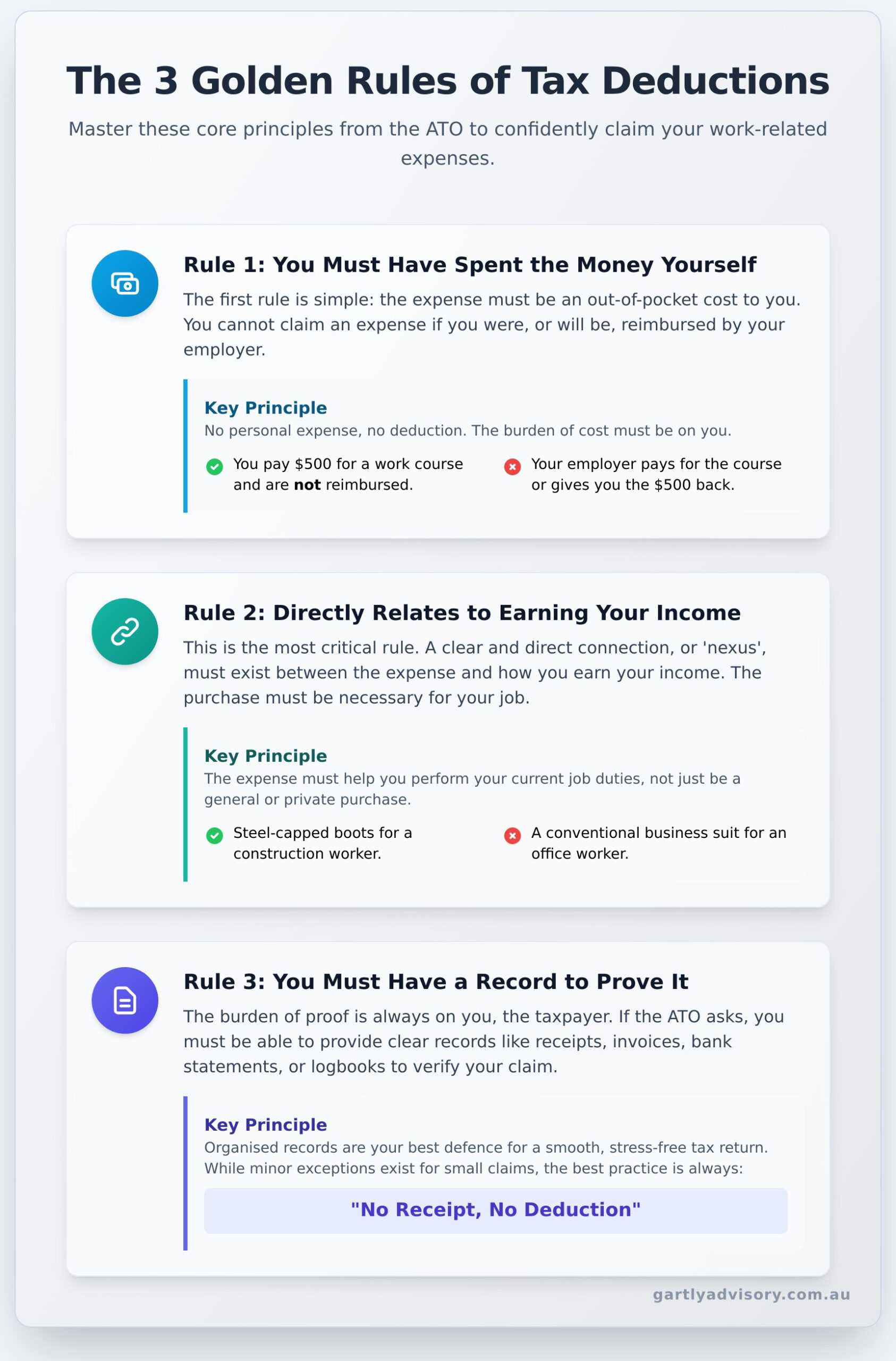

The 3 Golden Rules for Claiming Any Tax Deduction

Before diving into a long list of potential deductions, it’s essential to understand the foundation upon which every claim is built. A tax deduction is simply a work-related expense you can subtract from your assessable income, which in turn reduces the amount of tax you are required to pay. Navigating the Australian taxation system can feel complex, but the Australian Taxation Office (ATO) uses three core principles to assess every claim.

Think of these as a three-point checklist. If an expense you’ve incurred meets all three of these “golden rules,” you are on solid ground to claim it. Mastering these rules provides the guidance you need to confidently determine what you can claim on tax.

To help you better understand these fundamental concepts, the video below offers a helpful overview:

Let’s break down each of these rules to give you the clarity and support you need at tax time.

Rule 1: You Must Have Spent the Money Yourself

The first rule is straightforward: the expense must be an out-of-pocket cost to you. You cannot claim any expense that you did not pay for or for which you have been reimbursed. For example, if you personally pay A$500 for a professional development course and your employer does not pay you back, you can likely claim it. However, if your employer paid for the course directly or reimbursed you for the A$500 fee, it is no longer your expense to claim.

Rule 2: The Expense Must Directly Relate to Earning Your Income

This is the most critical principle. There must be a clear and direct connection—or ‘nexus’—between the expense and your job. The purchase must be necessary for you to perform your duties and earn your income. For instance, a tradesperson buying steel-capped boots is a direct work expense. In contrast, a new suit for an office worker is typically considered a private expense, even if they wear it to work, because it’s conventional clothing.

Rule 3: You Must Have a Record to Prove It

If the ATO asks, you must be able to prove your claim. The burden of proof always rests with the taxpayer. This means keeping clear records like receipts, invoices, bank statements, or a logbook for car expenses. While there are minor exceptions for very small total claims (which we cover later), the best practice is always: no receipt, no deduction. Having organised records is your best defence and ensures a smooth, stress-free tax return process.

A Checklist of Common Work-Related Deductions for Employees

For PAYG employees, understanding what you can claim on tax can make a significant difference to your refund. The key is to always apply the ATO’s ‘3 Golden Rules’: you must have spent the money yourself and weren’t reimbursed, the expense must directly relate to earning your income, and you must have a record to prove it. This checklist covers the most common deductions, but it is essential to understand the specific details outlined in the ATO’s rules for claiming deductions to ensure full compliance.

Vehicle and Travel Expenses

While your daily commute from home to your main workplace is considered private travel and isn’t claimable, other work-related travel often is. This includes driving between different job sites, visiting clients, or attending off-site training or conferences. To claim these expenses, you can use either:

- The cents per kilometre method: A simple way to claim up to 5,000 business kilometres per car, per year, without detailed receipts, though you need to show how you calculated the distance.

- The logbook method: This requires you to keep a detailed logbook for 12 consecutive weeks to determine the work-use percentage of your car, which you can then apply to all your car expenses.

Home Office Expenses

If your role requires you to work from home, you can claim a portion of your home office running expenses. The ATO provides two methods: the straightforward fixed rate per hour (which covers electricity, internet, phone, and stationery) or the actual cost method, where you calculate the specific work-related portion of your bills. It is important to note that for employees, occupancy expenses like rent, mortgage interest, or council rates are generally not claimable.

Clothing and Laundry Expenses

This is one of the most misunderstood areas when determining what can you claim on tax. A deduction is only allowed if the clothing is a compulsory uniform bearing your employer’s logo, is protective in nature (e.g., steel-capped boots), or is specific to your occupation (e.g., a chef’s uniform). A standard business suit is not claimable, even if you must wear it to work. For eligible clothing, you can also claim laundry expenses using the ATO’s reasonable rates.

Self-Education and Professional Development

You can claim a deduction for self-education expenses if the course directly relates to your current employment and is likely to improve your skills or increase your income in that specific role. Claimable costs include course fees, textbooks, stationery, and travel to the place of education. However, you cannot claim a deduction for a course that is only generally related to your job or that is designed to help you get a new job in a different field.

Other Deductions You Shouldn’t Overlook

When thinking about what you can claim on tax, it’s easy to focus solely on direct, job-related costs. However, some of the most valuable deductions are often missed because they fall outside of day-to-day work expenses. Overlooking these can make a significant difference to your tax refund. As your trusted partner, we want to ensure you have a complete picture of your entitlements. Don’t forget to consider these common claims.

Cost of Managing Your Tax Affairs

Seeking professional guidance to manage your tax obligations is a smart investment, and the Australian Taxation Office (ATO) recognises this. The fee you pay to a registered tax agent, like Gartly Advisory, for preparing and lodging your tax return is fully deductible in the financial year you pay it. This also includes any reasonable travel costs incurred to see your accountant for tax-related advice.

Gifts and Donations

Your generosity can also provide a tax benefit, provided you follow the rules. To claim a deduction for a gift or donation, it must meet specific criteria:

- It must be made to an organisation registered as a Deductible Gift Recipient (DGR).

- The donation must be A$2 or more.

- It must be a true gift, meaning you receive nothing tangible in return. This is why purchasing raffle tickets, event tickets, or merchandise from a charity does not count as a deductible donation.

Income Protection Insurance

Premiums paid on insurance that protects your income are generally tax-deductible. This policy provides financial support if you are temporarily unable to work due to illness or injury. It’s crucial to understand that this deduction only applies to income protection insurance. Premiums for other policies such as life insurance, trauma insurance, or critical care insurance are not claimable. Furthermore, if your income protection is held within your superannuation fund, you cannot claim the premiums personally as they are paid by the fund.

Maximising your return involves looking at every available avenue. While the deductions above apply broadly, the scope of what you can claim on tax expands significantly if you are a sole trader or run a small business. The rules around business tax deductions are distinct and require careful record-keeping. We can provide the support and guidance needed to navigate both personal and business claims with confidence.

Record Keeping: How to Prove Your Claims to the ATO

Maximising your tax return isn’t just about knowing what can you claim on tax; it’s about being able to prove it. The Australian Taxation Office (ATO) requires you to substantiate your claims, and for many, this paperwork can feel like the most daunting part of tax time. However, establishing a simple system for record-keeping not only ensures compliance but also provides peace of mind and helps you confidently claim every dollar you are entitled to. Think of it as the foundation of a stress-free, successful tax return.

What Counts as a Valid Record?

The ATO accepts several forms of evidence to prove an expense. These include tax invoices, receipts, and bank or credit card statements that clearly show the nature of the expense. To be considered valid proof of purchase, a document should ideally contain:

- The name of the supplier

- The amount of the expense, in A$

- The nature of the goods or services

- The date the expense was paid

- The date of the document

For ease and security, consider using digital record-keeping apps. These tools can help you capture receipts on the go and store them securely in the cloud, eliminating the risk of lost or faded paper copies.

The Rules on Claiming Without Receipts

While keeping every receipt is the gold standard, the ATO does allow for some minor claims without one. You can claim a total of up to $300 for work-related expenses without receipts, provided the claims are for expenses you genuinely incurred. It’s important to note this does not apply to claims for car expenses, travel allowances, or meal allowances.

Additionally, there is a provision for small expenses where you can claim items costing $10 or less, up to a total of $200 for the year, without a receipt. Even in these cases, you must be able to explain the expense and how it relates to your work if the ATO asks for clarification.

Logbooks and Diaries: When Are They Essential?

For certain claims, a simple receipt isn’t enough. If you are claiming car expenses using the logbook method, keeping a detailed logbook for a continuous 12-week period is mandatory. This logbook must capture every journey, both business and private, to establish a credible business-use percentage for your vehicle. Similarly, if you’re claiming deductions for working from home, a diary or timesheet record of the hours you worked from home is essential to prove your claim.

Feeling overwhelmed by the details? You don’t have to manage it all alone. Let our experts handle the details for you. We can provide the guidance and support you need to ensure your records are perfect.

Deductions for Sole Traders and Businesses: What’s Different?

If you run your own business, whether as a sole trader or through a company, you’ll know that your financial landscape is more complex than that of a salaried employee. The question of what can you claim on tax expands significantly, opening up more opportunities but also introducing greater complexity. This section provides a high-level overview to help you understand the key principles of business deductions.

The ‘Incurred in Running Your Business’ Principle

While employees can only claim expenses directly related to earning their employment income, the rule for businesses is much broader. The core principle is that you can generally claim a deduction for any expense that was incurred in the course of running your business and generating income. This provides a wider scope for claims, including costs such as:

- Rent for your commercial premises or a portion of your home office costs.

- Wages, salaries, and superannuation paid to your staff.

- Marketing and advertising campaigns to attract customers.

- Inventory or the cost of goods sold.

- Insurance, bank fees, and professional subscription costs.

For example, a creative sole trader like a photographer must meticulously track all these costs. A business like One Vision Photography | South Wales Wedding Photographer would deduct expenses for new lenses, advertising, and vehicle use for location shoots, all of which are essential for running their business.

The key is establishing a clear and direct connection between the expense and your business operations.

Capital Expenses vs. Operating Expenses

It’s important to understand that not all business spending can be claimed in full in the year you pay for it. The Australian tax system distinguishes between operating expenses (day-to-day running costs) and capital expenses (significant assets that have a long-term benefit).

For example, you can’t claim the full A$2,500 cost of a new work computer upfront. Instead, as a capital expense, its cost is claimed over several years through depreciation. However, government incentives like the instant asset write-off may allow for an immediate deduction, depending on the asset’s cost and current legislation. Understanding this distinction is crucial for managing cash flow and tax obligations correctly.

When to Seek Professional Business Advice

Navigating business tax goes far beyond simple deductions. You also have to consider obligations like GST, Fringe Benefits Tax (FBT) on employee benefits, and Capital Gains Tax (CGT) when selling assets. The complexity quickly grows, and a mistake can be costly.

A proactive accountant provides more than just end-of-year compliance; they offer strategic guidance to ensure your business is structured for optimal tax outcomes and sustainable growth. They provide the support and advice needed to navigate the entire financial ecosystem. If you’re managing a business, partnering with an expert isn’t an expense—it’s an investment in your success.

Partner with a Chartered Accountant to grow your business and optimise your tax.

Navigate Your Tax Return with Confidence

Navigating your Australian tax return successfully hinges on a few core principles: following the ATO’s three golden rules, maintaining meticulous records, and understanding the full scope of available deductions. Knowing precisely what can you claim on tax is the crucial first step towards ensuring you receive the maximum refund you are legally entitled to, whether you’re an employee or a sole trader.

But applying these rules to your unique situation can be complex. This is where partnering with a seasoned expert provides clarity and peace of mind. At Gartly Advisory, our Chartered Accountants leverage over 35 years of experience to deliver proactive advice that goes beyond simple compliance. As a trusted partner to Melbourne businesses, reflected in our 70+ 5-star Google reviews, we are dedicated to helping you achieve your financial goals.

Don’t leave money on the table this financial year. Ensure you claim every dollar you’re entitled to. Schedule a consultation with a Gartly Advisory tax expert today.

Frequently Asked Questions

How much can I claim on tax without receipts in Australia?

The Australian Taxation Office (ATO) allows you to claim a total of up to $300 for work-related expenses without providing receipts. This is not an automatic deduction; you must have actually spent the money and it must be directly related to earning your income. For laundry expenses specifically, you can claim up to $150 without written evidence. However, we always provide the guidance that keeping detailed records is the safest way to substantiate your claims and maximise your return.

What are the most commonly forgotten or missed tax deductions?

Many people overlook valuable deductions. Some of the most common include premiums for income protection insurance held outside of your superannuation, professional membership fees and union dues, and subscriptions to industry-specific publications. Donations of $2 or more to registered charities are also frequently missed. Our proactive approach is to review your situation carefully, ensuring we identify every legitimate deduction you are entitled to claim, providing support that goes beyond just the numbers.

Can I claim my travel costs to and from my regular workplace?

In most circumstances, travel between your home and your regular place of work is considered a private expense and cannot be claimed. However, there are important exceptions. You may be able to claim travel if you are required to work at an alternative location for the day, travel between two separate workplaces, or if you must transport bulky tools or equipment that your employer requires you to use and cannot be securely stored at the workplace.

What are the ATO’s ‘red flags’ that might trigger an audit of my deductions?

The ATO’s data-matching systems are sophisticated and look for unusual patterns. Key red flags include claiming deductions that are significantly higher than the average for your occupation and income level, or claiming a large portion of shared expenses like mobile phone or internet usage without clear justification. A sudden spike in claims compared to previous years can also attract attention. Understanding precisely what you can claim on tax is crucial to ensuring your return is accurate and avoids scrutiny.

Is it worth paying a tax agent to lodge my return if my claims are simple?

Engaging a professional can be a valuable investment, even for simple returns. Not only is the tax agent’s fee tax-deductible, but an experienced advisor can provide peace of mind that your return is lodged correctly and in compliance with tax law. We often identify deductions and entitlements that clients were unaware of, which can lead to a larger refund that more than covers our fee. We see it as being your trusted partner in navigating the complexities of the tax system.