Tax Return Deadline with a Tax Agent: Your 2026-26 Guide

Using a tax agent is the key to gaining valuable extra time, and complete peace of mind lies in understanding the special tax return deadline tax agent lodgement programs provide. Engaging a professional partner not only provides expert support but also allows you to secure a later due date, often extending well into the following year. This extension is one of the most significant, yet often misunderstood, benefits of working with a registered agent.

Let us provide some clarity and guidance you need to demystify the different lodgement dates available to you. Let us explain how this partnership helps you avoid unnecessary stress and costly fines, and give you a clear plan to confidently meet your obligations. Let us help you turn tax time from a source of anxiety into a well-managed process.

Understanding the ATO Lodgement Program for Tax Agents

Many Australians believe that using a tax agent simply grants them a random, lengthy extension. However, the reality is far more structured. The extended deadlines are part of the Australian Taxation Office (ATO) Lodgement Program, a formal system designed to manage the immense volume of tax returns lodged each year. This program staggers due dates, preventing a system overload on the standard 31 October deadline and ensuring a smooth workflow for the ATO. When you partner with a registered tax agent, you are added to their client list with the ATO, which is the key to accessing these later lodgement dates.

Why Do Tax Agents Get Extended Deadlines?

The extended tax return deadline tax agent clients receive is a practical solution to a major logistical challenge. The entire Australian taxation system relies on timely and accurate reporting, and this program ensures the process remains efficient for everyone involved. The key reasons for this system are:

-

To Manage Volume: It allows the ATO to process millions of tax returns steadily throughout the year, rather than being inundated on a single day.

-

To Acknowledge Professional Work: It provides tax agents with the necessary time to offer professional guidance, review your information thoroughly, and ensure your return is accurate and compliant.

-

To Smooth Out Processing: Staggered lodgements create a predictable, manageable workflow for the ATO, resulting in faster processing overall.

-

To Benefit Everyone: This organised approach is a win-win, providing taxpayers with more time, agents with a manageable schedule, and the ATO with an efficient system.

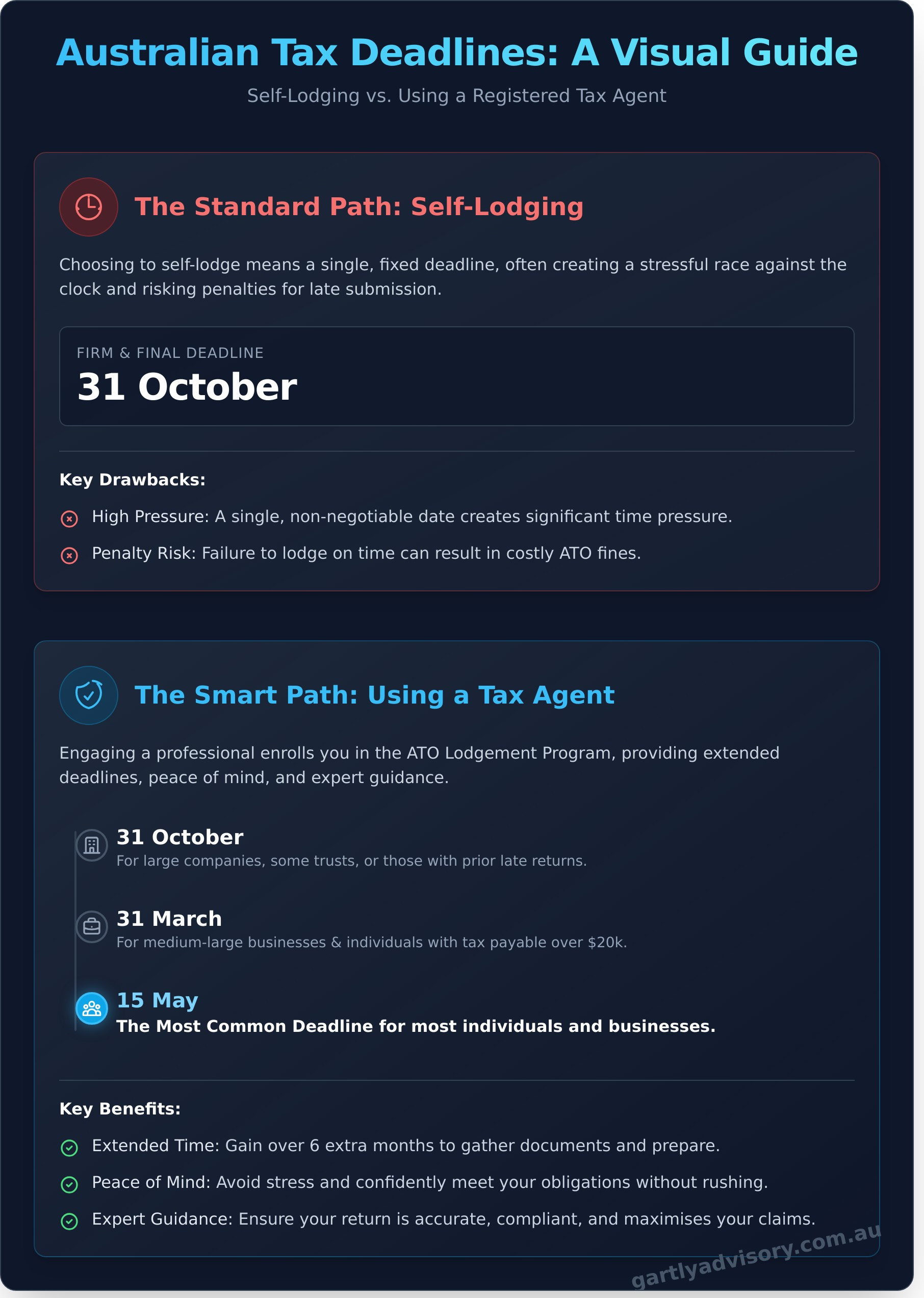

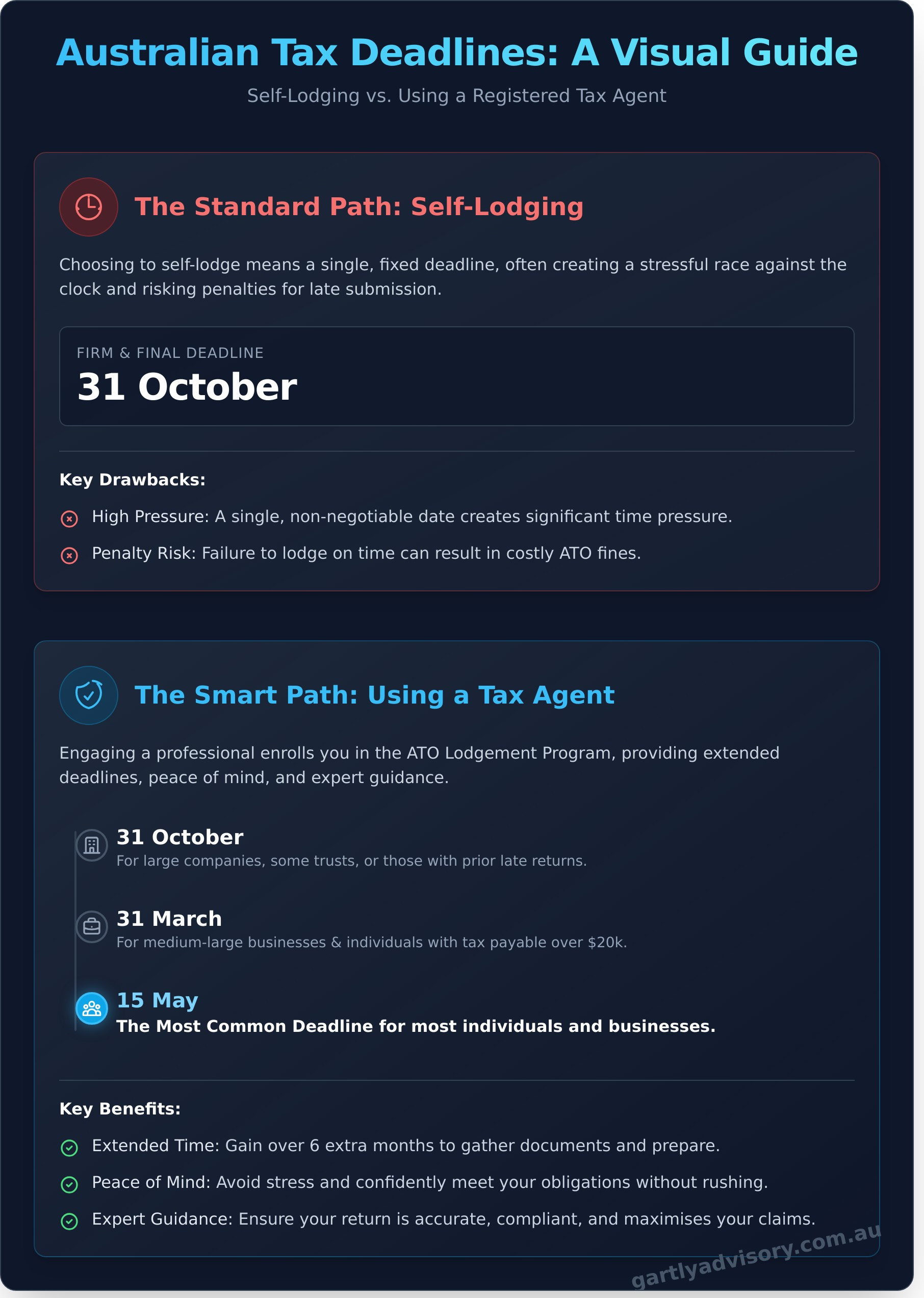

Self-Lodgers vs. Tax Agent Clients: A Key Distinction

It is crucial to understand the fundamental difference between lodging your own tax return and engaging a professional. For individuals who choose to self-lodge, the deadline is almost always fixed: 31 October following the end of the financial year on 30 June.

However, the moment you engage a registered tax agent like Gartly Advisory, this rule no longer applies to you. You are automatically moved from the self-lodger category into the agent lodgement program. Your new deadline is determined by your agent’s specific schedule with the ATO, which can extend well into the following year, often as late as May. This provides the valuable time and support needed to prepare a comprehensive return without unnecessary stress.

Key Tax Return Deadlines When Using a Tax Agent

When you partner with a registered tax agent, you gain access to the Australian Taxation Office (ATO) lodgment program. This program provides extended deadlines far beyond the standard 31 October cut-off for self-lodgers, giving you valuable extra time to get your affairs in order. It’s important to remember these dates apply to the tax return for the financial year that ended on the previous 30 June.

To provide clear guidance, here is a quick overview of the key lodgment dates. While these are the standard deadlines, your specific date can vary based on your history, so we always confirm your personal deadline with the ATO.

| Lodgment Deadline | Who It Generally Applies To |

|---|---|

| 31 October | Large companies, certain trusts, and clients with prior-year late returns. |

| 31 March | Medium-large businesses and individuals with prior tax payable over A$20,000. |

| 15 May | Most individuals, partnerships, and trusts. |

31 October Deadline Group

This first deadline is typically for clients whose circumstances require earlier attention from the ATO. It often applies to large companies and certain trusts. You may also fall into this group if you have one or more outstanding tax returns from previous years. The ATO requires these to be brought up to date promptly to be eligible for later deadlines in the future.

31 March Deadline Group

The next key date is for medium to large businesses and trusts that don’t fall into the 31 October category. This deadline also applies to individuals and trusts whose tax payable on their last return was more than A$20,000. Additionally, Self-Managed Super Funds (SMSFs) that were identified as late lodgers in the previous year are generally required to lodge by this date.

15 May: The Most Common Deadline

For the vast majority of Australians, this is the final and most common tax return deadline tax agents can provide. If you don’t meet the criteria for the earlier dates, you generally have until 15 May to lodge. This gives you more than six extra months to gather your documents and work with your accountant, compared with lodging yourself. It’s a significant benefit that reduces stress and ensures a more accurate return.

Navigating these dates can seem complex. Not sure which deadline applies? Let us clarify your situation.

Factors That Determine Your Specific Lodgement Date

While the 15 May deadline is the most common date for those using a tax agent, it’s a mistake to assume it applies to everyone. The Australian Taxation Office (ATO) doesn’t use a one-size-fits-all approach. Instead, it assesses several factors related to your tax history and circumstances to place you into a specific lodgement group. This system is designed to manage workflow and prioritise higher-risk or more complex returns.

As your trusted partner, we can provide clarity and peace of mind. Your registered tax agent has access to an online portal that shows the exact lodgement date assigned to you by the ATO. Maintaining a strong compliance record is the best way to ensure you continue to receive the maximum available extension.

Your Lodgement History

Your past behaviour is the most significant factor in the ATO’s decision. They reward taxpayers who consistently lodge on time, up to the latest possible deadlines. Conversely, if you have a history of late or overdue returns, your deadline may be significantly advanced. The ATO’s position is clear:

-

Overdue Returns: Having one or more prior-year returns outstanding can trigger a 31 October deadline, removing any extension.

-

Good Compliance: A clean lodgement record generally secures you a date in March or May of the following year.

-

First-Time Lodgers: If it’s your first time lodging through an agent and your record is clean, you are typically granted the standard 15 May deadline.

Tax Liability and Entity Type

The nature of your tax affairs also plays a crucial role. The ATO often requires earlier lodgement for entities it deems to have a larger or more complex tax liability. For example, individuals with a tax bill over A$20,000 in their last return may have an earlier due date. Furthermore, your business structure directly impacts your schedule. Companies, Self-Managed Super Funds (SMSFs), and trusts often operate on different lodgement programs than individual taxpayers.

Becoming a Client of a New Tax Agent

Timing is critical if you are engaging a tax agent for the first time or switching to a new one. To be eligible for the extended tax return deadline tax agent program, you must be on your agent’s client list with the ATO by 31 October. If you wait until November or later to seek professional support, it is often too late for the agent to add you to their list for that financial year, meaning your original 31 October deadline will still apply.

The Real Benefits of Using a Tax Agent (Beyond Just More Time)

While the extended tax return deadline provided by tax agents is a significant advantage, it’s merely the entry point to a much deeper level of value. Viewing your accountant solely as a way to get more time misses the bigger picture. The true benefit lies in transforming a mandatory compliance task into a strategic opportunity for financial growth and peace of mind.

A proactive tax agent is a partner in your financial journey, offering guidance and support that extends far beyond lodging your forms correctly and on time.

Maximise Deductions and Minimise Tax

An experienced tax agent understands the nuances of Australian tax law far beyond standard online tools. They are trained to identify every legitimate deduction you are entitled to, often in areas you may not have considered, such as complex work-from-home calculations, vehicle usage, or depreciation on equipment. This expertise frequently results in a larger refund or a smaller tax bill, meaning the agent’s fee often pays for itself and then some.

Ensure Accuracy and Reduce Audit Risk

Lodging an incorrect tax return can attract unwanted scrutiny from the ATO, leading to stress, penalties, and audits. A professional agent acts as your safeguard. Using specialised software and comprehensive checklists, they ensure your return is accurate and compliant. They are trained to spot potential red flags before lodgement, significantly reducing the risk of an audit and giving you confidence that your tax affairs are in order.

Strategic Advice for the Future

Your annual tax return is more than just a summary of the past; it’s a detailed snapshot of your financial health. A great Chartered Accountant uses this information to provide proactive, forward-looking advice. They can help you assess business structures, plan investments, optimise superannuation contributions, and identify growth opportunities. This transforms the conversation from "what do I owe?" to "how can I build a better financial future?" Building this long-term relationship provides you with a trusted advisor who understands your complete financial story.

Don’t just meet the deadline-maximise the opportunity. Partner with us for support beyond the numbers.

What Happens If You Miss the Tax Agent’s Deadline?

Realising you’ve missed your tax agent’s internal deadline can be stressful, but it’s important not to panic. The consequences are generally manageable, especially when you have a professional partner on your side. The most critical step is to communicate openly with your agent rather than avoiding the issue. A proactive approach allows your agent to work with the Australian Taxation Office (ATO) on your behalf to mitigate potential penalties.

Forgetting, or being unable to meet, the tax return deadline doesn’t mean you are without options. Here’s a breakdown of what can happen and how we can provide support.

Failure to Lodge (FTL) Penalties

If your return is lodged after the official due date, the ATO can apply a Failure to Lodge (FTL) penalty. This penalty is calculated based on the lodgement’s late submission. The amount is determined by "penalty units," with one unit applied for every 28-day period the return is overdue, up to a maximum of five units. As of 1 July 2023, a penalty unit is A$313, so penalties for individuals and small businesses range from A$313 to A$1,565.

General Interest Charge (GIC)

In addition to FTL penalties, if you have a tax liability (meaning you owe the ATO money), a General Interest Charge (GIC) will be applied to the unpaid amount. This interest is calculated on a daily compounding basis from the date the tax was due until it is paid in full. It is crucial to lodge your return as soon as possible, even if you can’t pay immediately, as this will stop FTL penalties from accumulating further.

How Your Tax Agent Can Help

This is where having a trusted advisor makes all the difference. Instead of facing the ATO alone, your tax agent can act as your advocate and guide you through the process. We provide support by:

-

Communicating with the ATO: We can contact the ATO on your behalf to explain the situation and manage correspondence, saving you time and stress.

-

Requesting Penalty Remission: If there are extenuating circumstances for the delay, such as illness or a natural disaster, we can formally request that the ATO reduce or waive the penalties.

-

Arranging a Payment Plan: If you have a tax debt you cannot pay at once, we can help negotiate a manageable payment plan with the ATO, allowing you to meet your obligations without undue financial hardship.

If you’re concerned about a late tax return, the best course of action is to seek professional advice immediately. Let us be your trusted partner in navigating your tax obligations. Talk to us and let us help you find the best path forward.

Navigate Your Tax Deadlines with Confidence

Engaging a registered tax agent provides a significant advantage: access to the ATO’s extended lodgement program, pushing your deadline well beyond the standard 31 October. However, it’s crucial to remember that your final date is tailored to your unique tax profile, and the real value of an agent extends far beyond just more time-it lies in expert guidance and strategic advice.

Understanding your specific tax return deadline tax agent lodgement date is the first step towards a stress-free tax season. At Gartly Advisory, our team of Chartered Accountants brings over 35 years of experience to every client relationship. With a reputation for proactive support, backed by over 70+ 5-Star Google Reviews, we are here to be your trusted partner in navigating Australia’s complex tax system.

Don’t leave your tax obligations to chance. Contact our experienced team to ensure your tax is lodged correctly and on time. Let us provide the clarity and peace of mind you deserve.

Frequently Asked Questions

Is it too late to hire a tax agent after 31 October?

No, it is not too late. While the 31 October date is important, a proactive tax agent can still provide immense support. By engaging an agent, you show the ATO your intent to comply. We can communicate with the ATO on your behalf, often helping to minimise or avoid late lodgement penalties. The most important step is to act promptly rather than delay the matter any further.

Does the tax agent deadline extension also apply to paying my tax bill?

No, the lodgement extension does not automatically extend your payment due date. Your tax payment deadline is set by the date your notice of assessment is issued by the ATO, which happens after your return is lodged. It is crucial to separate the two deadlines in your financial planning. We can provide guidance on managing your tax obligations and planning for payments to avoid any surprises.

How do I know what my specific deadline is once I hire an agent?

Once you are officially on our client list, we can access the ATO’s agent portal to confirm your specific lodgement date. The tax return deadline tax agents can access is part of a special lodgement program that varies based on your history. We will clearly communicate this new deadline to you and ensure we have a plan to meet it, offering you complete clarity and peace of mind.

What if I have several years of unlodged tax returns?

This is a situation we can certainly help you resolve. Our experienced team will provide clear guidance on gathering the required information for each outstanding year. We will then prepare and lodge the returns and can communicate with the ATO on your behalf to manage the process and negotiate a fair outcome regarding any penalties. Taking action is the first step toward becoming compliant again.

Can a tax agent help me if I’ve already received a penalty notice from the ATO?

Yes, we can absolutely provide support if you have received an ATO penalty notice. We will review the situation and can request a remission of the penalty on your behalf, particularly if there are extenuating circumstances or a strong compliance record. Having a professional Chartered Accountant represent you shows the ATO you are serious about rectifying the issue and managing your obligations correctly moving forward.

Does the business activity statement (BAS) deadline also change with a tax agent?

Yes, registered tax and BAS agents have access to a different lodgement schedule for Business Activity Statements (BAS). This often provides an extension of up to four weeks beyond the standard due date for each period. This is a significant advantage for businesses, allowing for better cash flow management and more time for accurate preparation. We can manage these deadlines as your trusted partner, ensuring you remain compliant.