Business Tax Return Melbourne: A Guide for Local SMEs

For many Melbourne SME owners, the end of the financial year brings a familiar wave of stress. The complexity of lodging a business tax return, Melbourne businesses can be confident in, the worry of missing crucial deductions, and the lingering fear of attracting unwanted ATO attention can feel overwhelming. It’s a time-consuming process that can easily distract you from what you do best: running and growing your business.

But what if tax time could be a source of confidence, not anxiety? What if it could be an opportunity for strategic growth? This guide is designed to provide you with the clarity and support you need. We will walk you through the essential steps to ensure compliance, highlight proactive strategies to legally minimise your tax liability, and provide clear advice on what to look for in a trusted accounting partner who can guide you on your journey. Let’s transform this annual obligation into a genuine advantage for your business.

Why Your Business Tax Return is More Than Just a Compliance Task

For many small and medium-sized enterprise (SME) owners in Melbourne, lodging an annual business tax return feels like a necessary but burdensome chore. It’s often viewed as a costly obligation, a complex task to be completed as quickly as possible. However, we encourage our clients to see it differently: your tax return is one of the most powerful financial ‘health checks’ your business will undergo all year. It’s an opportunity to look beyond the surface-level numbers and gain crucial insights into your operational performance, cash flow, and profitability.

Shifting your mindset from compliance to strategy unlocks immense value. To help you understand the practical side of lodging, this video provides a helpful overview for sole traders:

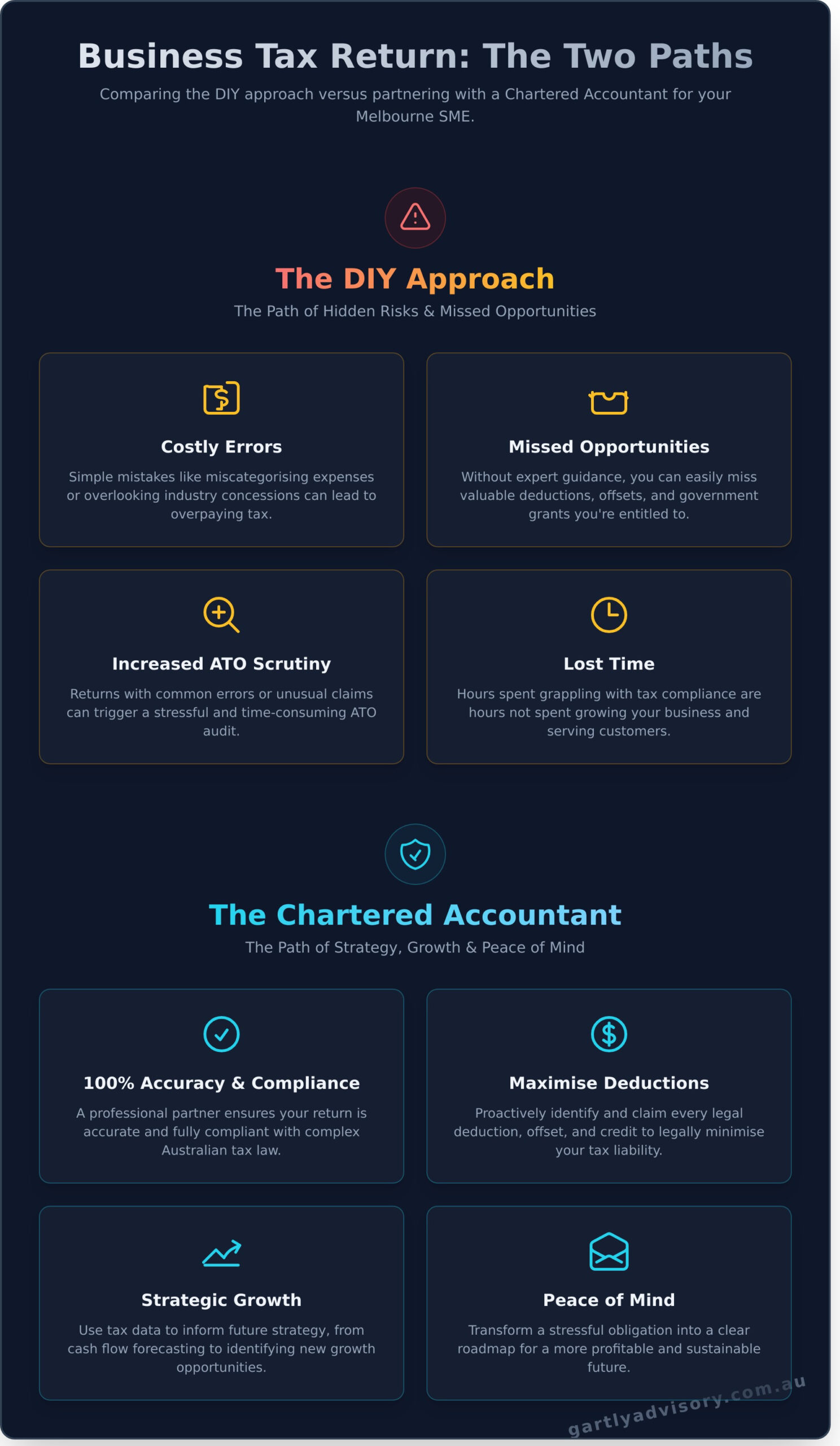

While DIY software can seem like a cost-effective solution, it often comes with hidden risks that can cost your business far more in the long run.

The Risks of a DIY Approach

-

Costly Errors: Off-the-shelf software can’t interpret your unique business context. Simple mistakes, such as miscategorising expenses or overlooking specific industry concessions, can lead to overpaying tax.

-

Missed Opportunities: The Australian tax code is complex and ever-changing. Without expert guidance, you can easily miss out on valuable deductions, offsets, and government grants you are legally entitled to claim.

-

Increased ATO Scrutiny: Returns with common errors or unusual claims can attract the attention of the Australian Taxation Office (ATO), potentially leading to a stressful, time-consuming audit.

-

Lost Time: The hours you spend grappling with tax compliance are hours you’re not spending on growing your business, serving your customers, or focusing on what you do best.

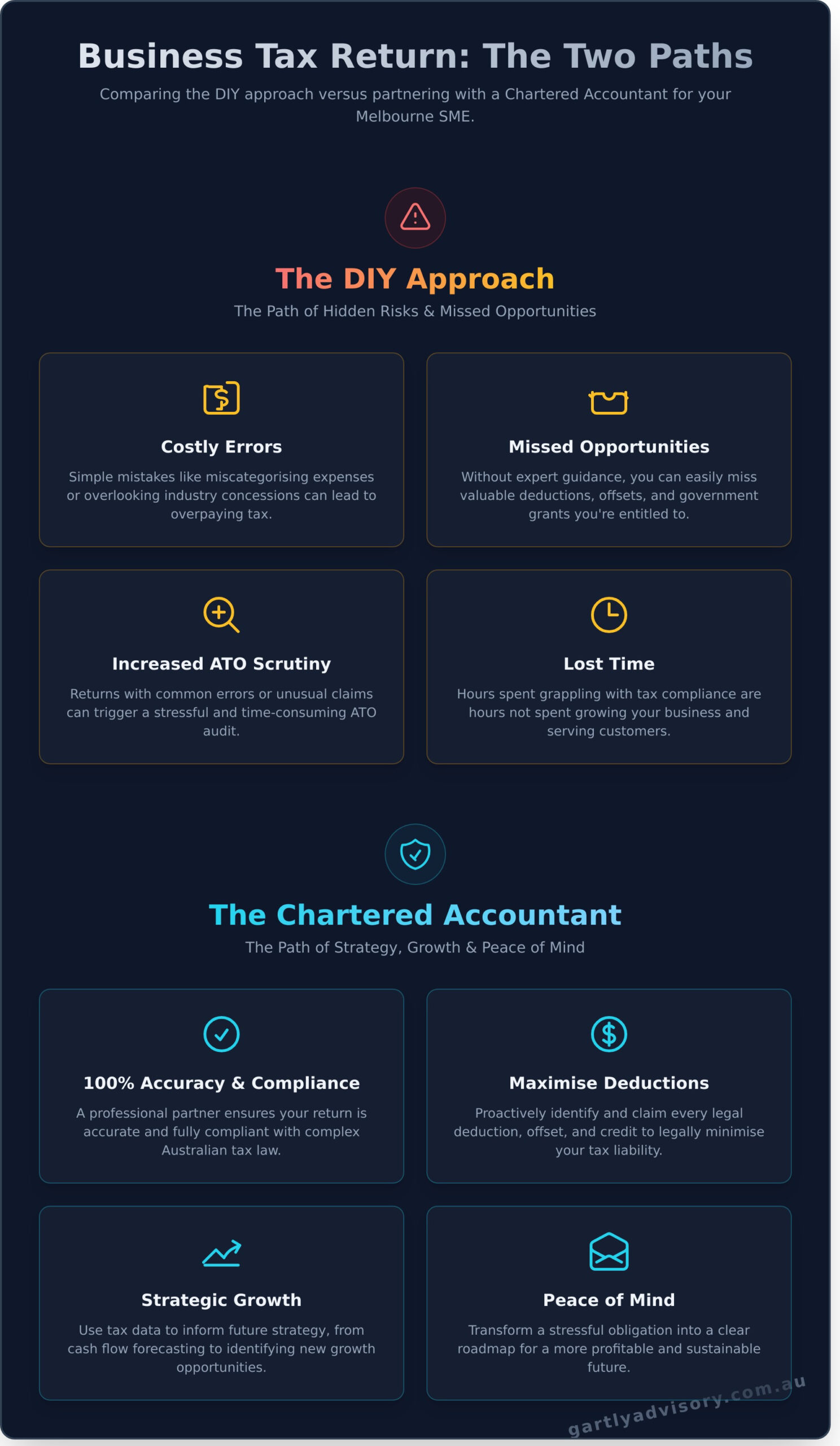

The Strategic Advantage of a Chartered Accountant

Engaging a professional for your business tax return Melbourne transforms the process from a reactive task into a proactive strategy. A trusted Chartered Accountant acts as your partner, ensuring not only 100% accuracy and compliance but also looking for ways to improve your financial position. We delve into the data to understand the story behind the numbers, helping you navigate the complex Australian taxation system with confidence.

This partnership provides year-round support, using your tax return data to inform future strategy, from cash flow forecasting to identifying growth opportunities. It’s about turning historical data into a roadmap for a more profitable and sustainable future, offering peace of mind and a clear path forward.

Preparing for Your Melbourne Business Tax Return: A Checklist

A successful and stress-free tax season begins long before the deadline. For Melbourne SMEs, thorough preparation is the single most effective way to ensure accuracy, maximise potential deductions, and make the entire process smoother for you and your accountant. By gathering your information methodically, you provide us with the complete financial picture needed to deliver the best possible outcome for your business tax return Melbourne.

To support you, we have developed this comprehensive checklist. Think of it as your roadmap to a well-organised and efficient tax time.

Essential Financial Records Checklist

These documents form the foundation of your tax return, providing a clear overview of your business’s performance throughout the financial year. Having them in order is crucial for accurately calculating your taxable income.

-

Profit and Loss Statement and Balance Sheet: These core reports summarise your income, expenses, assets, and liabilities. They give your accountant a high-level view of your financial health.

-

Bank and Credit Card Statements: Provide statements for all business accounts for the full financial year. This allows for cross-referencing and ensures no transactions are missed.

-

Records of All Income: This includes sales invoices, receipts, and details of any other income sources. Complete income records are essential for understanding how business income tax works and ensuring compliance.

-

Details of All Business Expenses: Collate receipts, invoices, and records for every business-related purchase. Proper documentation is your proof for claiming legitimate deductions and reducing your tax liability.

Asset and Liability Information

Tracking the changes in your business’s assets and debts is vital for calculating depreciation and claiming relevant deductions. This information helps build a complete picture of your company’s net worth.

-

New Asset Purchases: Keep invoices for any significant purchases like vehicles, machinery, or computer equipment. These are needed to claim depreciation correctly.

-

Records of Asset Sales: If you sold any business assets, you need the sale price and date to calculate any capital gains or losses.

-

Loan Statements: Provide statements for all business loans, including hire purchase agreements. This allows us to accurately claim the interest paid as a deduction.

-

Stocktake Records: If your business holds stock, a detailed valuation at the end of the financial year (30 June) is required.

Other Key Documentation

Finally, a few additional documents are needed to cover compliance obligations and provide important historical context for your tax affairs.

-

Employee and Superannuation Records: This includes PAYG payment summaries and evidence of superannuation contributions paid on time.

-

Previous Years’ Tax Returns: Supplying last year’s return and notice of assessment ensures consistency and helps identify any carried-forward losses or relevant changes.

-

Government Grant Information: If you received any support like JobKeeper or other grants, details of the amounts and dates are essential as they may be treated as assessable income.

Feeling overwhelmed by the paperwork? That’s completely understandable, and it’s why we’re here to help. Let our team guide you through the preparation process.

Navigating Tax Returns for Different Business Structures

The structure of your business is the single biggest factor determining your tax obligations. How you report income, the deductions you can claim, and the forms you need to lodge all stem from whether you operate as a sole trader, partnership, company, or trust. We understand this complexity can seem daunting, but a trusted partner can provide the guidance needed for peace of mind. For a foundational overview, the Australian government guide to lodging business tax returns is a useful resource, but tailored advice is essential for optimising your position.

Sole Traders

As a sole trader, your business is legally inseparable from you. Your tax obligations are managed through your personal tax return, but require careful record-keeping.

-

Lodgement: Business income and expenses are reported in the business and professional items section of your individual income tax return.

-

Key Deductions: Maximising claims for home office and vehicle expenses is crucial, but requires strict adherence to ATO rules on apportionment and logbooks.

-

PAYG Instalments: You will likely need to pay Pay As You Go (PAYG) instalments throughout the year to pre-pay your income tax, avoiding a large bill at tax time.

Partnerships

A partnership involves two or more people or entities running a business together. While the partnership itself doesn’t pay income tax, it has its own reporting obligations.

-

Separate Tax Return: The partnership must lodge its own annual partnership tax return to the ATO, reporting its total income and deductions.

-

Income Distribution: Net income or loss is then "distributed" to the partners, who each report their share on their own individual tax returns.

-

Partnership Agreement: A clear agreement is vital, as it dictates how profits and losses are distributed, which directly impacts each partner’s tax liability.

Companies

A company is a separate legal entity from its owners (shareholders). This structure brings more complex compliance but also offers distinct advantages when lodging a business tax return Melbourne companies must file correctly.

-

Company Tax Return: Your company must lodge its own tax return and pay tax on its profits at the current company tax rate.

-

Franking Credits: When profits are distributed to shareholders as dividends, they can come with franking credits, which prevent the double taxation of company profits.

-

Director & Shareholder Obligations: Careful management of director fees, shareholder loans, and dividend payments is critical for compliance.

Trusts

A trust is an entity that holds assets or income for the benefit of others (beneficiaries). They are a flexible structure but require precise administration to be tax-effective.

-

Trust Tax Return: The trust lodges its own tax return, reporting all income earned.

-

Income Distribution: Net income is distributed to beneficiaries, who then pay tax at their individual marginal rates. Any income not distributed is taxed at the highest marginal rate.

-

Trustee Resolutions: It is legally required for trustees to make and document resolutions on how income will be distributed before 30 June each year.

Common Pitfalls and How to Avoid an ATO Audit

For many Melbourne business owners, the prospect of an Australian Taxation Office (ATO) audit is a significant source of stress. The good news is that audits are not random. The ATO uses sophisticated data matching to identify inconsistencies, and understanding their red flags is the first step towards ensuring your business remains compliant and avoids unwanted scrutiny. Think of professional oversight not as an expense, but as an insurance policy for your peace of mind.

ATO Red Flags for Melbourne Businesses

The ATO’s systems are designed to flag anomalies that deviate from the norm. Being aware of these triggers is crucial when preparing your business tax return Melbourne SMEs must lodge each year. Key red flags include:

-

Unusually high expense claims: Claiming deductions that are significantly higher than the average for your industry can trigger a review.

-

Discrepancies in reporting: Mismatches between the income and GST reported on your Business Activity Statements (BAS) and what’s in your annual tax return are easily detected.

-

Consistent losses: While genuine downturns happen, year-on-year losses can suggest the business may not be a commercial enterprise or that income is being under-reported.

-

Large or unusual transactions: Significant, one-off transactions without clear documentation, especially those involving capital gains or private use of business funds, will attract attention.

The Role of Your Tax Agent in Risk Mitigation

Engaging an experienced Chartered Accountant is the most effective way to mitigate these risks. A proactive tax agent acts as your first line of defence, ensuring your financial reporting is accurate, substantiated, and compliant. We support our clients by:

-

Ensuring all claims are justified and backed by compliant records.

-

Applying complex tax laws correctly, especially in areas like Capital Gains Tax (CGT) and fringe benefits.

-

Providing clear advice on best practices for bookkeeping and record-keeping throughout the year.

-

Acting as your official representative in all communications with the ATO, handling any queries on your behalf.

This level of professional guidance turns the complex process of filing a tax return into a clear, well-managed task. By partnering with an expert, you can focus on running your business, confident that your tax obligations are in a safe pair of hands. Let us be your trusted partner on your journey towards success and compliance.

Choosing the Right Business Tax Accountant in Melbourne

Selecting an accountant is one of the most critical decisions you will make for your business. This is not just about lodging your annual tax return; it’s about finding a trusted financial partner who can provide guidance, support, and strategic advice for years to come. The right accountant becomes an extension of your team, helping you navigate challenges and seize opportunities.

Key Qualities to Look For

When assessing a potential accountant, look beyond their fees. The true value lies in their expertise and approach. A proactive, experienced advisor can save you far more than their annual cost. Focus your search on firms that demonstrate:

-

Qualifications and Experience: Ensure they are a Chartered Accountant (CA) or CPA with a proven track record of supporting businesses in your industry and of your size.

-

Proactive Strategic Advice: A great accountant doesn’t just report on the past. They look ahead, offering guidance on tax planning, cash flow management, and business structuring to help you grow.

-

Strong Client Reviews: Check their Google Reviews. Honest testimonials from other Melbourne business owners provide invaluable insight into their level of service and reliability.

Why a Local Ormond Firm Matters

In a digital world, it can be tempting to choose a national firm, but a local accountant offers distinct advantages. A firm based in Melbourne’s south-east understands the specific economic landscape you operate in. They offer the accessibility needed for face-to-face meetings to discuss complex issues and build a genuine, long-term relationship. By choosing a local partner for your business tax return Melbourne, you are also supporting a fellow small business that is invested in the success of your shared community.

Questions to Ask a Potential Accountant

During your initial consultation, come prepared with questions that reveal their approach and capabilities. This will help you determine if they are the right fit for your long-term vision.

-

How do you proactively help clients minimise their tax obligations legally?

-

What accounting software are you most familiar with, such as Xero or MYOB?

-

Can you explain your fee structure for a business of my size?

-

Beyond compliance, how do you provide strategic advice for business growth?

Finding an accountant who can confidently answer these questions is the first step towards building a successful partnership. If you are looking for an experienced, proactive team to provide support that goes beyond the numbers, we invite you to schedule a complimentary consultation with Gartly Advisory.

Transform Your Tax Obligations into Strategic Opportunities

As we’ve explored, your business tax return is far more than an annual compliance task-it’s a powerful tool for financial insight and strategic planning. By preparing diligently and understanding the nuances of your specific business structure, you can turn tax time from a stressful chore into a valuable opportunity for growth and stability.

Navigating the complexities of a business tax return Melbourne SMEs face requires expertise and a proactive approach. At Gartly Advisory, our trusted team provides strategic advice that goes ‘beyond the numbers’. As Chartered Accountants with over 35 years of experience, we have become the trusted partner for countless local businesses, a fact reflected in our 70+ 5-Star Google Reviews.

Let us help you manage your tax obligations with confidence and uncover opportunities for success. Talk to our Melbourne business tax experts today for a complimentary consultation and take the first step towards a more secure and prosperous financial future.

Frequently Asked Questions About Business Tax Returns

When is the business tax return deadline in Australia?

For businesses lodging their own return, the standard deadline is 31 October. However, by partnering with a registered tax agent like Gartly Advisory, you can often access extended deadlines, typically into the following year. This provides you with more time to ensure your records are accurate and complete. The specific lodgement date can vary, so we provide clear guidance to our clients to ensure all obligations are met on time, avoiding any unnecessary penalties from the ATO.

How much does it cost to have a business tax return prepared in Melbourne?

The cost for preparing a business tax return in Melbourne varies depending on several factors, including your business structure, the complexity of your operations, and the quality of your bookkeeping records. We provide a tailored quote based on your specific needs, ensuring a transparent and fair price. Investing in professional preparation ensures accuracy, maximises deductions, and provides you with invaluable peace of mind. Contact us for a complimentary consultation to discuss your requirements and receive a clear quote.

What is the difference between a Business Activity Statement (BAS) and an annual tax return?

A Business Activity Statement (BAS) is a periodic report to the ATO, usually lodged quarterly, to manage obligations like GST and PAYG withholding. It’s a regular snapshot of your tax liabilities. In contrast, your annual tax return is a comprehensive summary of your entire financial year’s income and expenses. It is used to calculate your final income tax liability or refund for the year. We can provide expert support for both your BAS and annual return obligations.

Can you help me lodge a late business tax return?

Yes, absolutely. We understand that circumstances can lead to late lodgements, and our team is here to provide support without judgment. It is crucial to act quickly to minimise potential ATO penalties and interest charges. As your registered tax agent, we can communicate with the ATO on your behalf to manage the process and work towards a positive outcome. Let us help you get your tax obligations back on track and relieve the stress of overdue returns.

What happens if I’ve made a mistake on a previous tax return?

Discovering a mistake on a past return is more common than you might think, and it can be corrected. We can help you prepare and lodge an amendment with the ATO to rectify the error. For most small businesses, you have a two-year window to amend a return after you receive your notice of assessment. Our experienced team will guide you through this process, ensuring the amendment is filed correctly and providing you with confidence and peace of mind.

Is your fee for preparing my tax return tax-deductible?

Yes, the fees you pay to a registered tax agent for preparing and lodging your tax returns are tax-deductible. This includes the cost of managing your tax affairs and receiving professional tax advice throughout the year. This deduction effectively reduces the net cost of our services, making professional support an even more valuable investment for your business. We ensure this deduction is properly claimed when we prepare your return, helping you maximise your financial position.