Stamp Duty Victoria: Your Ultimate Guide for 2026

Purchasing a property in Victoria is a significant achievement, but the journey is often clouded by the complexity of calculating the final costs. For many, the single largest of these is land transfer duty, more commonly known as stamp duty. The intricate rules, confusing jargon, and fear of missing out on valuable concessions can turn an exciting time into a stressful one. Understanding the specific requirements of stamp duty victoria is the first step toward taking control of your budget and buying with confidence.

This ultimate guide for 2026 is designed to be your trusted partner, providing the clarity and support you need. We will walk you through the entire process, step by step. You will learn how to accurately calculate the duty payable on your property, discover every available concession and exemption to legally reduce your bill, and gain a clear understanding of the payment timeline. Our goal is to demystify this complex tax, empowering you to manage your property purchase costs with complete peace of mind.

What is Stamp Duty in Victoria? A Clear Explanation

When you purchase a property in Victoria, one of the most significant costs you’ll encounter, aside from the property price itself, is stamp duty. Officially known as ‘land transfer duty’, it is a state government tax levied on the transfer of property, including homes, apartments, and vacant land. Understanding what stamp duty is on a broader level helps clarify its role in property transactions. In simple terms, it’s a fee you, the purchaser, must pay to the State Revenue Office (SRO) to legally register the change in ownership.

To better understand this concept, particularly regarding potential savings, the video below offers a helpful overview:

This tax is a crucial source of revenue for the state government. The funds collected from stamp duty victoria are channelled back into the community, helping to pay for essential public services that we all rely on, such as schools, hospitals, emergency services, and public transport infrastructure.

Why You Pay Stamp Duty (Land Transfer Duty)

Beyond its function as a tax, paying land transfer duty serves several key purposes. It is a mandatory step for the legal transfer of the property title into your name, formalising the transaction with the government. Without paying it, you cannot be legally recognised as the new owner. This process ensures there is an official record of ownership, providing security and certainty for all parties involved while funding the public infrastructure that supports Victorian communities.

Key Terms You Need to Know

Navigating the world of property and tax can feel complex. To support your understanding, here are a few essential terms you will frequently encounter:

- Dutiable Value: This is the value on which the duty is calculated. It is either the price you paid for the property or its current market value, whichever amount is higher.

- Contract Date: The date when both the buyer and the seller have signed the contract of sale. This date is often used to determine which concessions or exemptions apply.

- Settlement Date: This is the final step in the process, when ownership of the property is officially transferred to you and you pay the balance of the purchase price. Stamp duty is typically paid on or before this date.

- PPR (Principal Place of Residence): This refers to the home you primarily live in. Concessions on stamp duty victoria are often available if the property will be your PPR.

How Stamp Duty is Calculated: Rates and Tiers for 2026

Understanding how stamp duty Victoria is calculated is the first step towards confidently managing your property purchase budget. Unlike a flat tax, it operates on a sliding scale using marginal rates. This means the rate of duty increases as the property’s value crosses certain thresholds. In simple terms, the more valuable the property, the higher the percentage of duty you will pay.

Navigating these calculations can feel complex, but our goal is to provide clear guidance. Below, we break down the rates, provide a practical example, and explain the crucial concept of ‘dutiable value’.

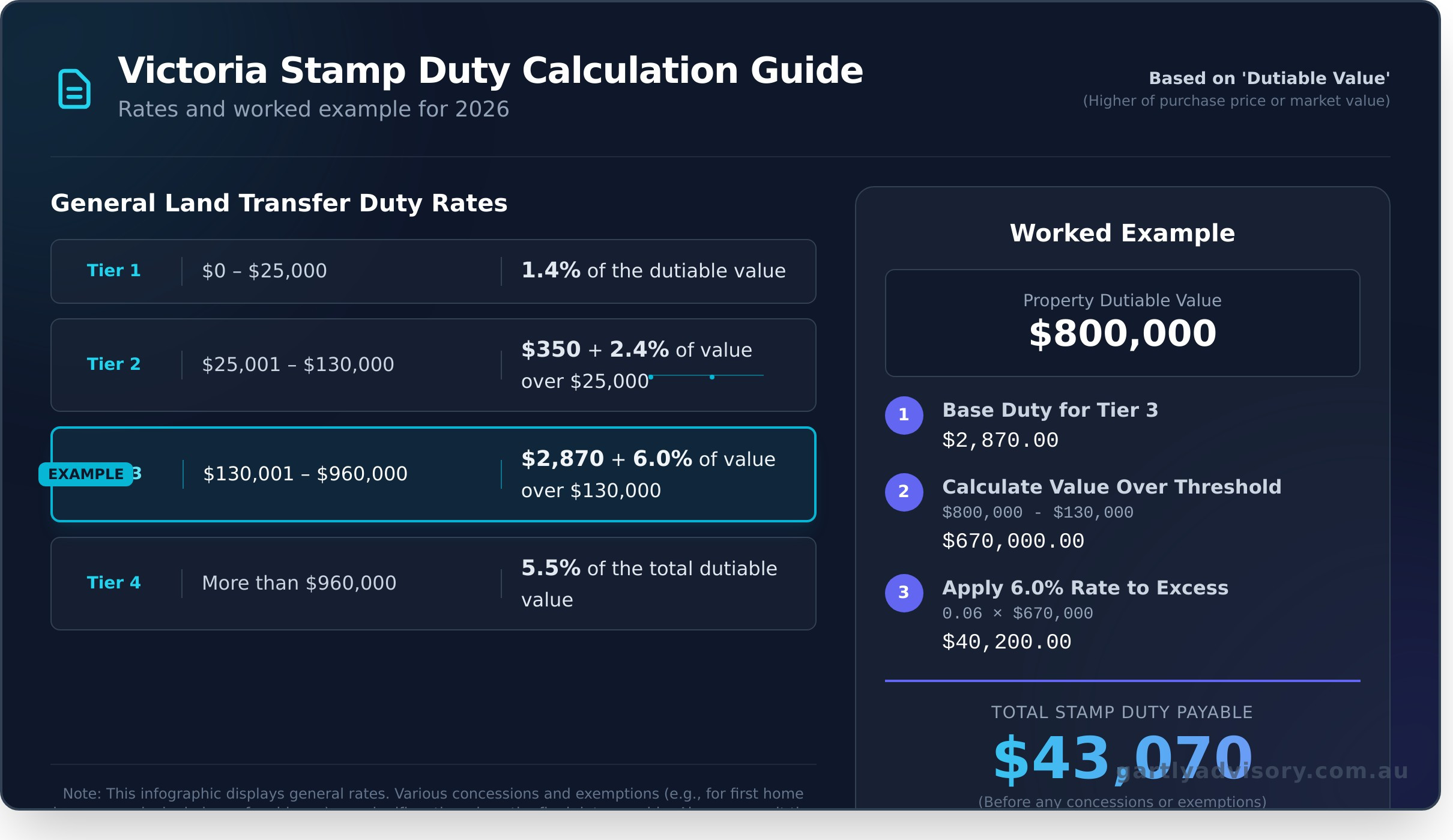

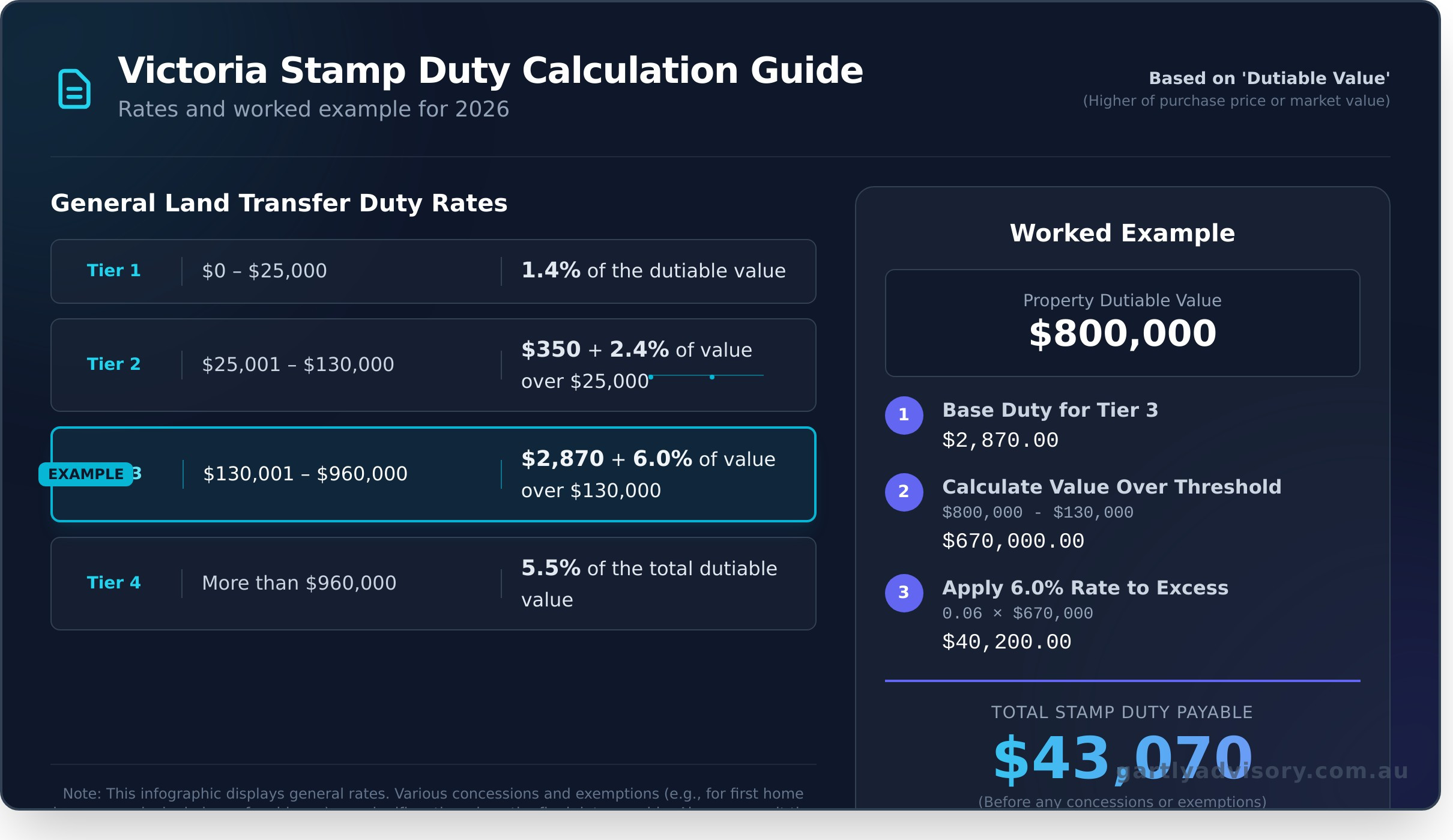

General Stamp Duty Rates in Victoria

The amount of stamp duty you pay is determined by the dutiable value of your property. The following table outlines the general transfer duty rates for 2026. It is essential to remember that these rates can be adjusted in government budgets. For the most current figures, we always recommend consulting the Victorian Government’s official stamp duty information on the State Revenue Office (SRO) website.

| Dutiable Value Bracket (A$) | Rate of Duty |

|---|---|

| $0 – $25,000 | 1.4% of the dutiable value |

| $25,001 – $130,000 | $350 + 2.4% of the value over $25,000 |

| $130,001 – $960,000 | $2,870 + 6.0% of the value over $130,000 |

| More than $960,000 | 5.5% of the total dutiable value |

Worked Example: Calculating Duty on an $800,000 Home

To make this tangible, let’s calculate the stamp duty on a home with a dutiable value of A$800,000. Based on the table above, this property falls into the ‘$130,001 – $960,000’ bracket.

- Step 1: Identify the base duty and the excess value. The formula is $2,870 + 6.0% of the value over $130,000.

- Step 2: Calculate the value exceeding the threshold: $800,000 – $130,000 = $670,000.

- Step 3: Apply the 6.0% rate to this excess amount: 0.06 x $670,000 = $40,200.

- Step 4: Add the base duty to the calculated amount: $2,870 + $40,200 = $43,070.

Therefore, the total stamp duty payable on an $800,000 property would be A$43,070, before any concessions or exemptions are applied.

The Importance of ‘Dutiable Value’

A common point of confusion is the term ‘dutiable value’. This is not always the same as the contract price. The SRO calculates duty on the greater of either the price you paid for the property or its current market value. This rule prevents property from being transferred between parties at an artificially low price to avoid tax. The dutiable value includes the value of the land, buildings, and any fixed items like ovens, air conditioners, and built-in wardrobes. It’s also important to note that off-the-plan purchases have unique valuation rules that can affect the final duty payable.

Key Exemptions & Concessions: How to Reduce Your Stamp Duty Bill

While stamp duty is a significant upfront cost, it’s not always set in stone. This section is arguably the most important for your budget, as it details the key pathways to legally reduce your bill. The Victorian Government offers several exemptions and concessions designed to make property ownership more accessible. Understanding which ones you might qualify for can save you thousands, or even tens of thousands, of dollars.

However, the rules can be complex and eligibility is strict. It is vital to seek professional guidance to ensure you meet all the necessary criteria before you sign a contract.

First Home Buyer Duty Exemption and Concession

For those entering the property market for the first time, this is the most generous scheme available. You may be eligible for a full exemption from stamp duty if your new home is valued at A$600,000 or less. For properties valued between A$600,001 and A$750,000, a concession is available on a sliding scale, reducing the total amount payable.

Key eligibility criteria include:

- You and your partner/spouse must be first home buyers (i.e., have never owned property in Australia before).

- At least one buyer must be an Australian citizen or permanent resident.

- You must intend to live in the home as your principal place of residence (PPR) for at least 12 continuous months, starting within the first year of ownership.

Principal Place of Residence (PPR) Concession

This valuable concession isn’t limited to first home buyers. If you are purchasing a property to be your primary home and its dutiable value is A$550,000 or less, you may be eligible for the PPR concession. This provides a significant discount on the standard rate of duty. A key condition is that you must move into the property within 12 months of settlement and live there continuously for at least one year. This helps reduce the cost for many owner-occupiers moving up the property ladder.

Other Common Concessions and Exemptions

Beyond the main homebuyer schemes, several other situations can reduce your stamp duty victoria bill:

- Off-the-Plan Concession: If you buy a new property off-the-plan, you may only pay duty on the ‘dutiable value’ at the time of contract, which can be significantly lower than the finished price.

- Pensioner and Concession Cardholder Duty Reduction: Eligible pensioners may receive a one-off exemption or concession when buying a home.

- Transfers Between Spouses or Partners: Transferring a property to your partner or spouse is generally exempt from duty, provided it is your principal place of residence.

Navigating the specific requirements for each of these schemes is crucial to securing your savings. For definitive criteria and calculation tools, the Victorian State Revenue Office provides the official source of information. As your trusted partner, we can provide the guidance needed to ensure you claim every concession you’re entitled to.

The Stamp Duty Process: When and How to Pay

Navigating the final steps of a property purchase can feel complex, but understanding the stamp duty process is simpler than it appears. The key is knowing the timeline and the critical role your conveyancer or solicitor plays. With proper preparation and professional support, you can confidently manage this significant cost without any last-minute stress. This section breaks down the essential steps to ensure you are well-prepared for a smooth and timely settlement.

When is Stamp Duty Due in Victoria?

In Victoria, the land transfer duty (stamp duty) must be paid to the State Revenue Office (SRO) within 30 days of the property settlement date. It is a common misconception that this is 30 days from when you sign the contract. Your legal representative will manage the lodgement, but they will require the funds from you at or before the day of settlement. This allows them to hold the payment in their trust account and ensure it is paid on your behalf, meeting the strict deadline.

How to Lodge and Pay Your Stamp Duty

The entire process of calculating, lodging, and paying stamp duty victoria is streamlined and handled electronically by your conveyancer or solicitor. They use a system called Duties Online to submit all the necessary documentation to the SRO on your behalf.

Once lodged, they will provide you with clear instructions on how to pay. The most common payment methods accepted by the SRO include:

- Electronic Funds Transfer (EFT) from your bank account.

- BPAY, using the specific biller code and reference number provided.

- Credit Card via the SRO website (please note that processing fees typically apply).

Your conveyancer will guide you through this, ensuring you have the correct reference numbers so your payment is allocated correctly to your property transaction.

Meeting the payment deadline is crucial, as the SRO imposes penalty tax and interest on late payments. While your conveyancer is your trusted partner in the transaction itself, understanding all financial obligations is vital for a successful property journey. For strategic advice on managing the overall costs of your purchase, contact Gartly Advisory for professional guidance.

Navigating Stamp Duty with Expert Financial Guidance

Understanding the rules and concessions for stamp duty is the first step. The next, more crucial step is integrating this significant capital expense into your financial strategy. It’s more than a tax; it’s a major investment decision that impacts your cash flow, borrowing capacity, and long-term wealth creation. Simply using an online calculator gives you a number, but professional guidance provides a plan. At Gartly Advisory, we provide advice that goes beyond the numbers, ensuring your property purchase aligns perfectly with your financial goals.

Why Your Accountant Should Be Part of the Conversation

Engaging an accountant early in your property journey transforms stamp duty from a simple transaction cost into a managed part of your financial picture. We help you look beyond the sale price and deposit to understand the full financial commitment. Our support includes:

- Comprehensive Budgeting: Factoring in stamp duty, legal fees, and other acquisition costs to provide a true picture of the capital required.

- Cash Flow Assessment: Analysing the impact of this large, one-off expense on your personal or business finances to ensure stability.

- Tax Implications: Providing clear advice on how stamp duty is treated for tax purposes, especially for investment properties where it forms part of the asset’s cost base for future Capital Gains Tax calculations.

Planning for Property Within Your Broader Financial Strategy

A property purchase rarely exists in isolation. It’s a key component of your larger financial plan, and the structure of the purchase has lasting consequences. We provide strategic guidance on complex areas such as the implications of purchasing property within your Self-Managed Super Fund (SMSF) or advising on the most effective ownership structure—be it as an individual, joint tenants, or through a trust. The right structure can significantly influence not only the initial stamp duty victoria liability but also future land tax and CGT outcomes.

Don’t let a major financial decision be an afterthought. Let us be your trusted partner, providing the proactive advice you need to build your wealth with confidence. Schedule a consultation today.

Secure Your Property Future with Expert Stamp Duty Guidance

Understanding the complexities of property tax is a critical step in your home-buying journey. As we’ve covered, calculating the correct amount, identifying all available concessions, and meeting payment deadlines can significantly impact your financial position. Navigating the nuances of stamp duty victoria requires careful planning and up-to-date knowledge, but you don’t have to manage this process alone.

A proactive and strategic approach can save you time, stress, and thousands of dollars. At Gartly Advisory, our team of Chartered Accountants brings over 35 years of experience to the table. As trusted business advisors with 70+ 5-Star Google Reviews, we provide the expert guidance needed to ensure your property purchase aligns perfectly with your long-term financial goals.

Talk to us about your property purchase and financial strategy.

Let us be your trusted partner on your journey towards success. We’re here to provide the support you need to move forward with clarity and confidence.

Frequently Asked Questions About Stamp Duty in Victoria

How much is stamp duty in Victoria for a first home buyer?

For first home buyers in Victoria, a full exemption from stamp duty is available for properties valued up to A$600,000. If your first home is valued between A$600,001 and A$750,000, a concession is applied on a sliding scale, reducing the total amount you need to pay. This is a significant saving designed to support you in entering the property market. It is crucial to ensure your purchase meets all eligibility criteria to receive this benefit.

Can I add stamp duty to my home loan in Victoria?

While you cannot directly add stamp duty to your mortgage as a separate item, many lenders allow you to increase your total loan amount to cover it. This is often referred to as capitalising the stamp duty. This approach is subject to the lender’s approval and depends on your Loan to Value Ratio (LVR) and overall borrowing capacity. We can provide guidance on structuring your finances to accommodate this cost effectively and responsibly.

What happens if I pay my stamp duty late?

Paying your stamp duty after the due date, which is typically within 30 days of settlement, will result in penalties from the State Revenue Office (SRO) Victoria. These penalties include interest on the unpaid amount and a penalty tax, which can increase significantly the longer the payment is overdue. Prompt payment is essential to avoid these unnecessary additional costs. We advise planning for this payment well in advance to ensure compliance and financial peace of mind.

Is there stamp duty on inherited property in Victoria?

Generally, you do not have to pay stamp duty when you inherit a property in Victoria, provided the transfer is made to a beneficiary in accordance with the terms of a will or the laws of intestacy. This valuable exemption applies to the transfer from the deceased’s estate to the named beneficiary. Seeking professional advice is important to ensure all legal requirements are met for a smooth, duty-free transfer of the asset during a difficult time.

Do I pay stamp duty on vacant land?

Yes, stamp duty is payable on the purchase of vacant land in Victoria. The duty is calculated based on the dutiable value (the higher of the price paid or market value) of the land at the time of sale. However, if you are a first home buyer intending to build your home on the land, you may be eligible for the first home buyer duty exemption or concession, provided the combined value of the land and building contract meets the required thresholds.

Is stamp duty different for investment properties versus a primary residence?

The fundamental rates for stamp duty victoria are the same regardless of the property’s purpose. The key difference lies in the availability of concessions and exemptions. A property purchased as your principal place of residence (PPR) may be eligible for a PPR concession or first home buyer benefits, which do not apply to investment properties. Consequently, the final amount payable for an investment property is often higher than for an equivalent owner-occupied home.