Div 293 Tax Explained: A Clear Guide for High-Income Earners

Receiving an unexpected notice from the Australian Taxation Office (ATO) can be unsettling, especially when it concerns your superannuation. If you’re a high-income earner, that notice might be for the div 293 tax, a charge that often feels like a penalty for diligently saving for your retirement. This feeling of confusion is common, but you’re not alone, and managing this liability doesn’t have to be a source of stress.

At Gartly Advisory, we believe in providing clear, practical guidance to help you navigate the complexities of the Australian tax system with confidence. We want to be your trusted partner in securing your financial future, and that begins with understanding exactly where your money is going and why. This guide is designed to give you that clarity and control.

Here, we will demystify the Division 293 tax in simple terms. We’ll break down what it is, how the ATO calculates it, and explore the strategic options you have for payment-whether from your super fund or your personal cash flow. Our goal is to provide you with the knowledge to not only handle your current notice but also to plan effectively, ensuring your superannuation strategy remains as tax-efficient as possible.

What is Division 293 Tax? (And Why Does It Exist?)

In simple terms, Division 293 tax is an additional tax on superannuation contributions for high-income earners in Australia. Its purpose is not to penalise success, but to make the superannuation system more equitable. It reduces the tax concession on super contributions for individuals whose combined income and super contributions exceed A$250,000 per year, ensuring the system’s benefits are better targeted.

To help you visualise how this works, the video below offers a clear explanation:

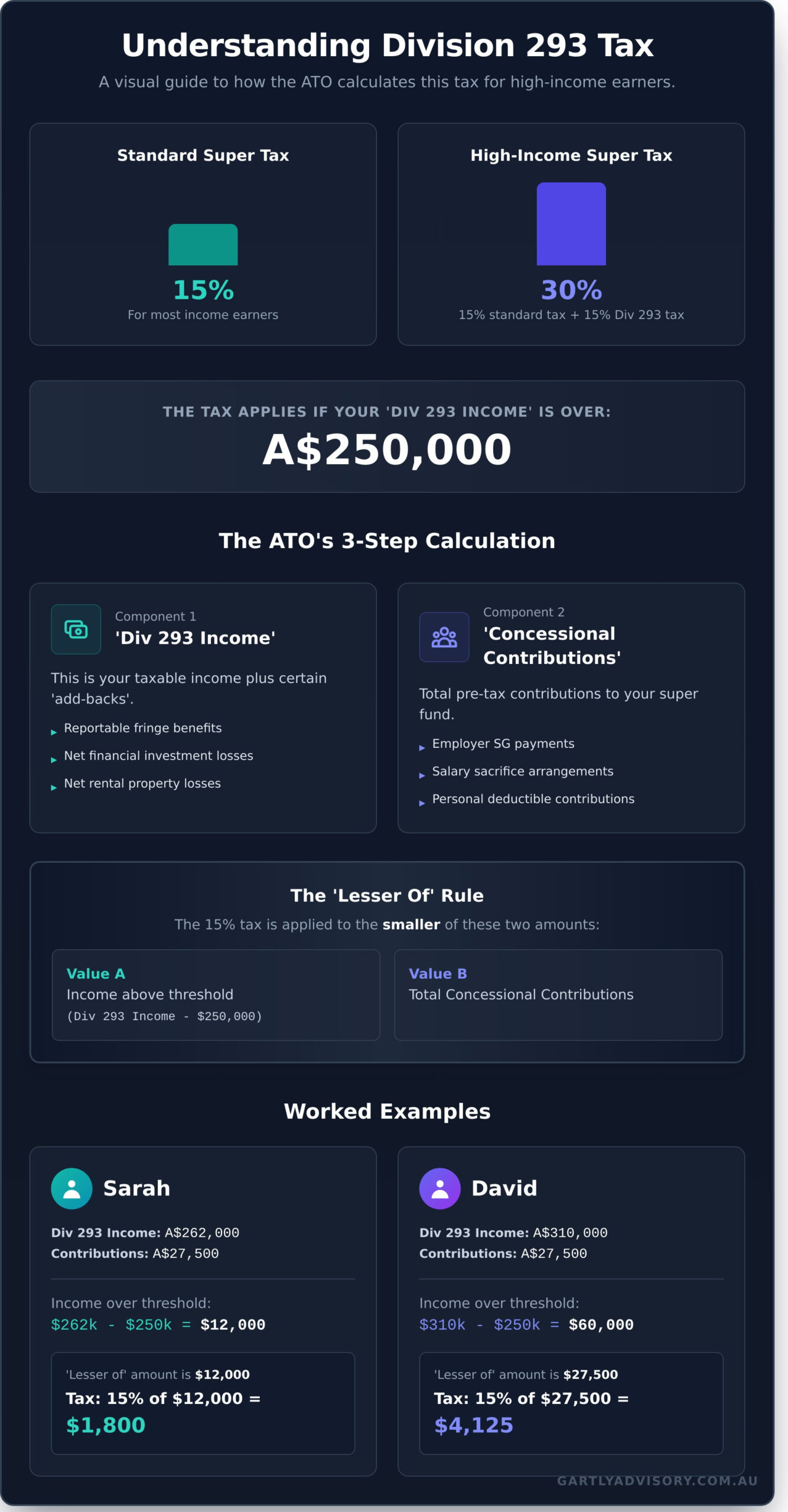

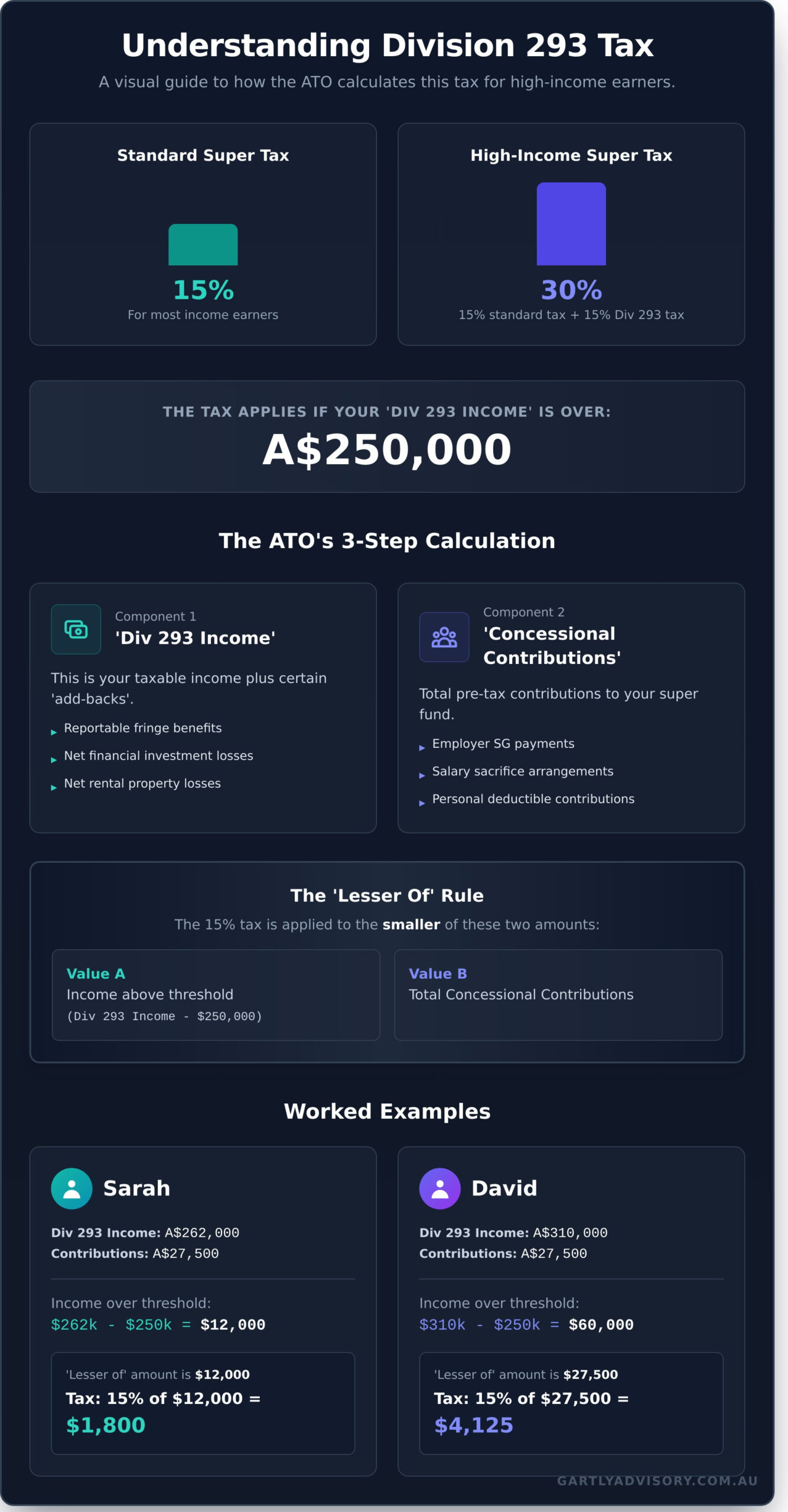

The Standard Super Tax vs. The Div 293 Rate

Typically, concessional (before-tax) super contributions are taxed at a flat rate of 15%. This offers a significant tax saving for most Australians compared to their marginal income tax rate. The div 293 tax addresses the larger concession received by high-income earners by applying an additional 15% tax, bringing their total tax on affected contributions to 30%. This principle is a key component of the overall framework for the Taxation of superannuation in Australia.

Here’s a simple comparison:

| Income Level | Tax on Concessional Super Contributions |

|---|---|

| Low-to-Middle Income | 15% |

| High Income (above A$250,000) | 30% (15% + 15% Div 293) |

Who is Typically Affected by Div 293 Tax?

This tax most commonly impacts individuals in high-earning roles. While not an exhaustive list, we often provide guidance and support to:

- Senior executives and directors

- Medical and legal specialists

- High-performing sales professionals

- Successful business owners

- IT contractors and consultants

The financial success of these professionals often comes with demanding schedules and the need for efficient travel. For many, managing time is as critical as managing tax, leading them to explore options like private aviation. You can find a definitive guide to this at flyelitejets.com.

It’s also important to note that you don’t need a consistently high salary to be affected. A one-off event, such as a large capital gain from selling an asset or receiving a significant annual bonus, can push your income over the threshold for that financial year. Encountering this tax is a common milestone for successful individuals, and with proactive advice, it can be managed effectively as part of your overall financial strategy.

How the ATO Calculates Your Div 293 Tax: A Step-by-Step Breakdown

One of the few reassuring aspects of the Division 293 tax is that you don’t need to calculate it yourself. The Australian Taxation Office (ATO) automatically assesses your liability after you lodge your annual tax return. However, understanding the mechanics is crucial for effective tax planning. The calculation hinges on two key components and a simple ‘lesser of’ rule.

Component 1: Your ‘Division 293 Income’

This isn’t just your salary. The ATO uses a specific, adjusted income figure to determine if you meet the threshold (currently A$250,000). It starts with your taxable income for the year and then adds back several items to get a more complete picture of your earnings. Common ‘add-backs’ include:

- Reportable fringe benefits

- Net financial investment losses

- Net rental property losses

- Amounts on which family trust distribution tax has been paid

Component 2: Your ‘Concessional Super Contributions’

This figure represents the total pre-tax contributions made to your superannuation fund during the financial year. These are the contributions that have already received a 15% tax concession inside your super fund. They typically include your employer’s Superannuation Guarantee (SG) payments, any salary sacrifice arrangements, and personal deductible contributions. It’s important to note that non-concessional (after-tax) contributions are not included in this calculation.

The ‘Lesser Of’ Rule and Worked Examples

Once the ATO has both figures, it applies the div 293 tax of 15% to the lesser of your concessional contributions or the amount of your Division 293 income that exceeds the A$250,000 threshold. This is a critical point that often limits the total tax payable. For a detailed breakdown of these rules, you can refer to the official guidance from the Australian Taxation Office (ATO), which we use to support our clients’ strategic planning.

Let’s look at two practical examples:

Example 1: Income Just Over the Threshold

Sarah has a Division 293 income of A$262,000 and total concessional contributions of A$27,500.

- Her income exceeds the threshold by: A$262,000 – A$250,000 = A$12,000.

- Her concessional contributions are A$27,500.

- The lesser amount is A$12,000.

- Tax Payable: 15% of A$12,000 = A$1,800.

Example 2: Income Significantly Over the Threshold

David has a Division 293 income of A$310,000 and total concessional contributions of A$27,500.

- His income exceeds the threshold by: A$310,000 – A$250,000 = A$60,000.

- His concessional contributions are A$27,500.

- The lesser amount is A$27,500.

- Tax Payable: 15% of A$27,500 = A$4,125.

You’ve Received a Div 293 Notice: Understanding Your Payment Options

Receiving a notice from the Australian Taxation Office (ATO) regarding your div 293 tax liability can be unexpected. This assessment will typically arrive in your myGov inbox and clearly outlines the amount you owe. It’s crucial to act promptly, as you generally have 21 days to decide how you will pay. This decision has direct implications for both your current cash flow and your long-term retirement savings.

You have two primary methods for settling this tax liability, each with distinct advantages and disadvantages.

Option 1: Pay with Your Own Money

The most straightforward method is to pay the ATO directly from your personal bank account. You can use standard payment options like BPAY or a credit/debit card to settle the amount before the due date.

- Pro: Your superannuation balance remains fully invested, allowing it to continue benefiting from compound growth without interruption. This protects the long-term potential of your retirement savings.

- Con: This requires available cash on hand, which can directly impact your personal budget or short-term financial plans.

Option 2: Release Funds from Your Super

Alternatively, you can elect to have the tax liability paid directly from your superannuation fund. To do this, you must complete and submit the ‘Division 293 tax due and payable’ election form provided by the ATO. This process, also covered in external resources like Vanguard’s guide to Division 293 tax, instructs your fund to release the required amount to the ATO on your behalf.

- Pro: There is no immediate impact on your out-of-pocket cash flow, preserving your personal liquidity for other investments or expenses.

- Con: This payment directly reduces your retirement nest egg. That money is no longer working for you, meaning you lose out on its future compound earnings.

Which Payment Method is Right for You?

There is no single ‘best’ answer; the right choice is a personal one that depends on your unique financial circumstances. You should consider your current cash flow needs, your long-term investment goals, and the performance of your superannuation fund. If your super fund is generating strong returns, you may prefer to leave your balance untouched. Conversely, if preserving your personal cash flow is a higher priority, paying from super may be the more practical option.

Navigating this choice requires a clear understanding of your complete financial picture. Our advisors can help you assess your situation and make a decision that aligns with your overall wealth creation strategy.

Proactive Strategies to Plan for and Minimise Div 293 Tax

Receiving a tax notice from the ATO is rarely a pleasant surprise. Rather than reacting to a bill, the key to managing your obligations is proactive, forward-looking planning. The following strategies are not about illegal tax avoidance; they are about structuring your financial affairs intelligently to legally manage your tax position. This is particularly crucial if you anticipate significant changes in your income.

Navigating these complexities requires expert guidance. We always recommend discussing your specific circumstances with a qualified financial advisor or Chartered Accountant to ensure any strategy is right for you.

The principle of seeking specialized help is universal. Just as you need a tax expert in Australia, English-speaking professionals navigating life abroad may need dedicated legal support; for those in Israel, for example, you can learn more about SALIOR Law Office.

Managing Lumpy Income: Bonuses and Capital Gains

A large, one-off payment from a performance bonus, commission, or the sale of an asset can easily push your income over the threshold for a single year, triggering an unexpected div 293 tax liability. Where possible, consider the timing of these events. For instance, realising a capital gain in a year where your other income is lower, or deferring it to the next financial year, could be a viable option. For less flexible income like bonuses, the best strategy is foresight-anticipate the liability and set aside the necessary funds to avoid cash flow pressure when the notice arrives.

Optimising Concessional Contributions

For high-income earners, there is a delicate balance between maximising your superannuation and managing your tax. While making concessional contributions up to the cap is generally a tax-effective strategy, these amounts are included in the Div 293 income calculation. Strategic options to consider with your advisor include:

- Contribution Splitting: You may be able to split up to 85% of your concessional contributions from one financial year with your eligible spouse in the next financial year, helping to manage individual income thresholds.

- Non-Concessional Contributions: If triggering additional tax is a primary concern, redirecting funds towards non-concessional (after-tax) contributions could be more effective, as these do not count towards the Div 293 threshold.

The Importance of an Annual Tax Review

The most powerful tool in your financial toolkit is an annual strategic review with your accountant. This process allows you to look forward and make adjustments before the end of the financial year, preventing surprises and ensuring your structure is optimised for the year ahead. A strategic review is about more than just compliance; it’s about making informed decisions that align with your long-term goals. Let’s build your financial future together.

Your Trusted Partner in Managing Div 293 Tax

Navigating the complexities of div 293 tax can feel daunting, but understanding its core principles is the first step towards control. As we’ve explored, this tax directly impacts high-income earners’ super contributions. By grasping how your income is assessed and exploring proactive strategies, you can confidently manage its impact on your long-term financial goals.

While this guide provides a strong foundation, your personal circumstances deserve tailored, professional advice. With over 35 years of experience, our team of Chartered Accountants and SMSF Specialists at Gartly Advisory has earned the trust of the community, reflected in our 70+ 5-Star Google Reviews. We are here to provide the clarity and support you need to move forward.

Feeling overwhelmed by Div 293 tax? Schedule a complimentary consultation with our experienced advisors today. Let us become your trusted partner in building a secure financial future.

Frequently Asked Questions About Div 293 Tax

Can I avoid Div 293 tax completely?

For most high-income earners, completely avoiding Div 293 tax is challenging without significantly altering your income or superannuation strategy. The tax is triggered when your income and concessional contributions exceed the threshold. Strategic tax planning, such as timing capital gains or adjusting salary sacrifice arrangements, can help manage your liability. Seeking professional guidance is crucial to explore legitimate strategies that align with your financial goals and ensure you remain compliant with ATO regulations.

What is the Div 293 tax threshold for the current financial year?

For the current financial year, the Div 293 tax threshold is A$250,000. This figure is based on your ‘Division 293 income’, which includes your taxable income, reportable fringe benefits, and certain other amounts, plus your concessional superannuation contributions. If this combined total exceeds A$250,000, the additional 15% tax will apply to your concessional contributions. This threshold has remained consistent since the 2017-18 financial year, but it’s always wise to confirm current figures.

Does Div 293 tax apply to non-concessional (after-tax) super contributions?

No, it does not. The div 293 tax is specifically designed to reduce the tax concession on contributions made into your super fund before tax is paid (concessional contributions). Non-concessional contributions, which are made from your after-tax income, are not included in the Div 293 calculation and are not subject to this additional tax. This is an important distinction to understand when planning your superannuation strategy and contributions for the year.

Is it better to pay the Div 293 liability from my super fund or my own money?

This decision depends entirely on your personal financial situation and goals. Paying from your superannuation fund preserves your immediate cash flow but will reduce your long-term retirement savings. Paying from your own pocket protects your super balance but impacts your current disposable income. We can provide tailored advice to help you weigh the pros and cons, ensuring the choice you make is the best one for your journey towards financial success.

What happens if I disagree with the ATO’s Div 293 assessment?

If you believe your Div 293 assessment is incorrect, you have the right to lodge a formal objection with the ATO. This must typically be done within 60 days of receiving the notice of assessment. Your objection needs to be in writing, clearly stating the grounds for your disagreement with supporting evidence. Navigating this process can be complex, and as your trusted partner, we can provide the support and guidance needed to manage the objection effectively.

If my income drops next year, will I get a refund for the Div 293 tax I paid?

No, a refund for tax paid in a prior year is not available if your income drops. The Div 293 tax is assessed annually based on your income and contributions for that specific financial year. If your income falls below the A$250,000 threshold in a future year, you simply will not be issued a Div 293 assessment for that year. Each financial year is treated independently, with no mechanism for retrospective adjustments or refunds based on future earnings.