Xero Accounting: A Small Business Guide to Streamlining Your Finances

For many Australian small business owners, the dream of entrepreneurship is often overshadowed by the reality of financial admin. If you’re tired of being buried in spreadsheets, chasing unpaid invoices, and dreading your next BAS statement, you’re not alone. The constant struggle to maintain accurate books can make strategic decisions feel like guesswork. This is where embracing a powerful platform like Xero accounting can fundamentally change your business, providing the clarity and support you need to move forward with confidence.

In this comprehensive guide, we’ll walk you through how this intuitive software can become your most trusted financial partner. We will explore how to automate time-consuming tasks, gain a real-time view of your cash flow, and simplify your compliance obligations for good. Prepare to transform your operations, save valuable time, and unlock the data-driven insights essential for sustainable growth. Let us provide the guidance you need to make your finances work for you, not against you.

What is Xero and Why is It Essential for Modern Small Businesses?

For many Australian small and medium-sized businesses, managing finances can feel like a constant challenge. This is where modern tools become indispensable. Xero is a powerful, cloud-based accounting software designed specifically to simplify this complexity. It represents a fundamental shift in financial management—moving you from reactive, historical record-keeping to proactive, forward-looking decision-making. By centralising your financial data, Xero creates a single source of truth, giving you the clarity and confidence to steer your business effectively.

To see how this powerful platform works in practice, this short video provides a helpful overview:

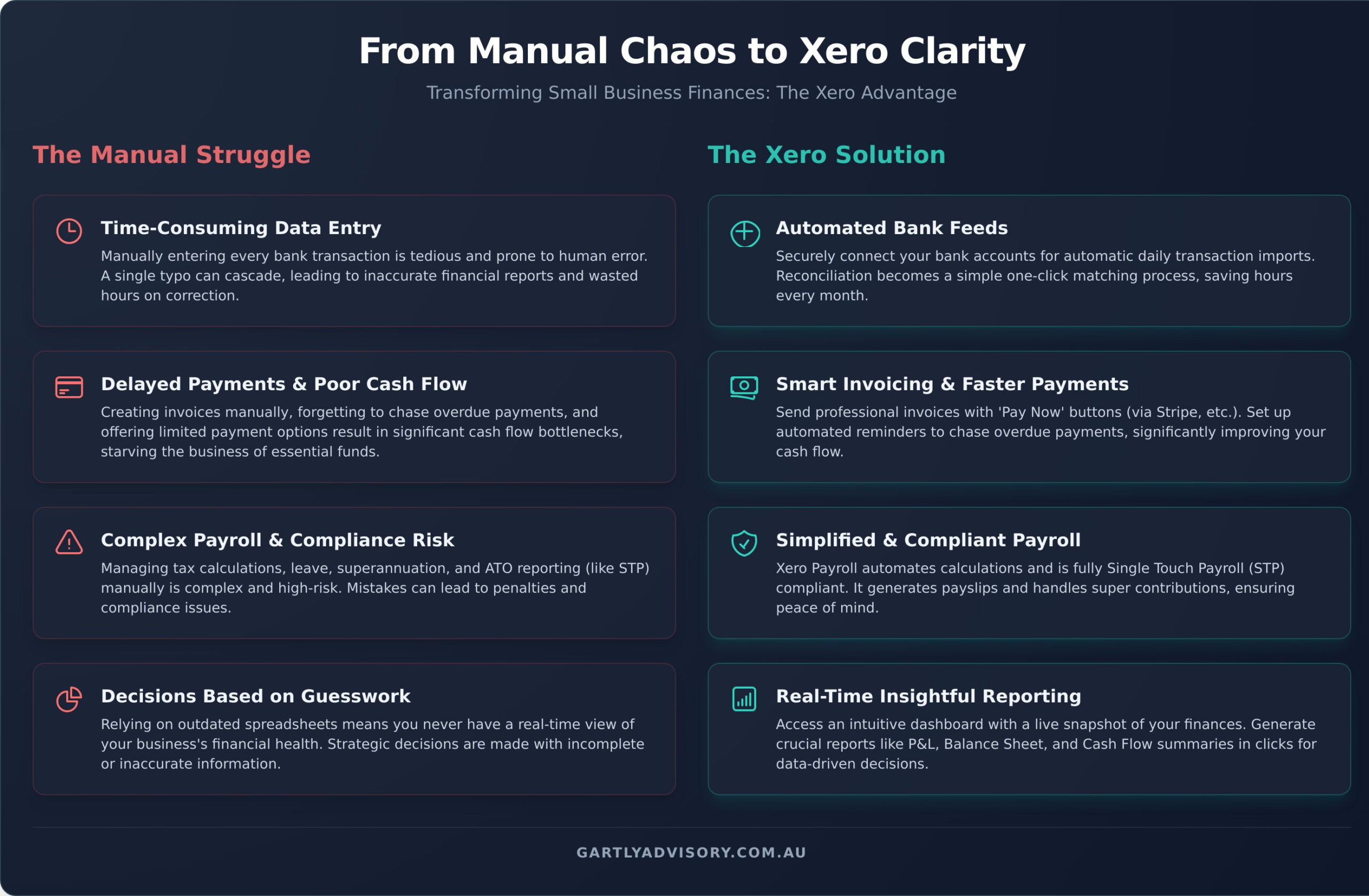

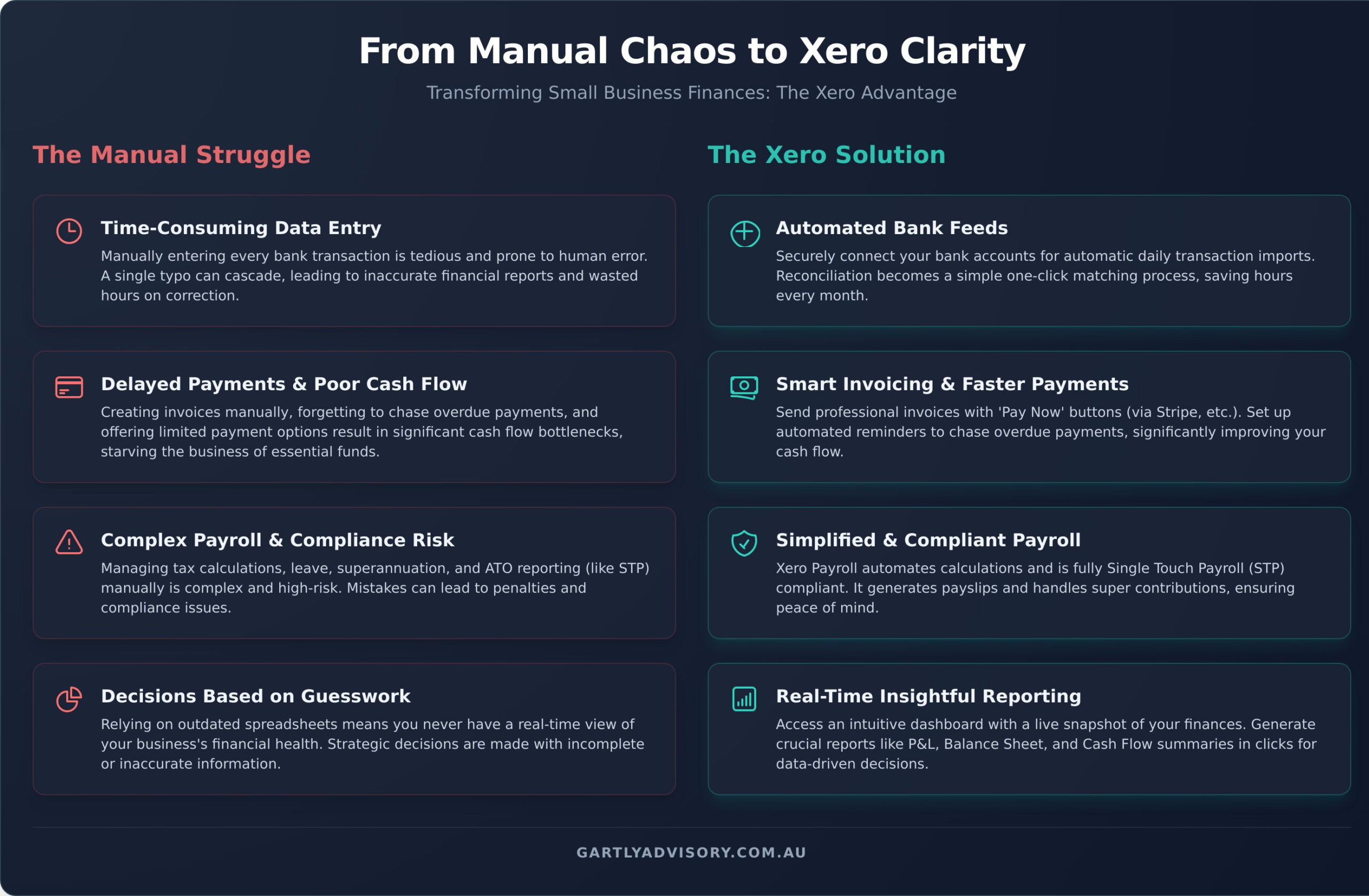

Moving Beyond Spreadsheets: The Limits of Manual Bookkeeping

Many businesses begin their journey using spreadsheets, but quickly discover their limitations. Manual bookkeeping is prone to significant risks that can hinder growth and create compliance headaches. These pitfalls include:

- Human Error: A single typo or incorrect formula can have a cascading effect, leading to inaccurate reports.

- Data Corruption: Spreadsheets can become corrupted or accidentally deleted, with no simple way to recover lost information.

- Version Control Issues: It becomes difficult to know which file is the most current, especially when multiple people are involved.

Cloud-based Xero accounting provides a secure, automated, and collaborative alternative, ensuring your data is always accurate, backed up, and accessible.

The Power of Real-Time Financial Visibility

One of Xero’s most significant advantages is the immediate insight it provides into your business’s financial health. The intuitive dashboard offers a live snapshot of key metrics like bank balances, outstanding invoices, and upcoming bills. You can instantly generate crucial reports, such as a Profit & Loss statement or a Cash Flow summary, without waiting for month-end. This real-time visibility allows you to spot trends, identify potential cash flow issues early, and make agile, data-driven decisions with confidence.

Simplifying Australian Tax Compliance (BAS, GST, Payroll)

Xero is built with the Australian tax landscape in mind, offering robust support to help you meet your obligations. It automates the tracking of GST on sales and purchases, which dramatically simplifies the process of preparing and lodging your Business Activity Statement (BAS). Furthermore, Xero’s integrated payroll system is fully compliant with the Australian Taxation Office’s Single Touch Payroll (STP) reporting requirements, ensuring your employee payments and superannuation are managed correctly and efficiently.

Core Features of Xero Accounting: A Practical Breakdown

Modern accounting software is about more than just numbers; it’s about reclaiming your time and gaining clarity over your business finances. The Xero accounting platform is designed to solve the most common challenges small business owners face, automating tedious tasks so you can focus on growth. Let’s explore the core features that provide the most significant, practical benefits.

Automated Bank Feeds and Reconciliation

The Problem: Manually entering every single bank transaction is time-consuming and prone to human error.

The Xero Solution: Xero securely connects directly to your business bank and credit card accounts. Your transactions flow into the software automatically each day. The bank reconciliation process then becomes a simple matter of matching these imported transactions to your invoices and bills, rather than typing them in from scratch. This single feature can save you hours of administrative work every month.

Smart Invoicing and Faster Payments

The Problem: Poor cash flow caused by late or unpaid invoices.

The Xero Solution: Create and send professional, branded invoices from your desktop or mobile device. To help you get paid faster, you can set up automated reminders that politely follow up on overdue payments for you. By integrating with payment gateways like Stripe or GoCardless, you can add a ‘Pay Now’ button directly to your invoices, allowing clients to pay instantly online.

Streamlined Payroll and Superannuation

The Problem: Managing payroll and staying compliant with Australian tax obligations is complex.

The Xero Solution: Xero Payroll simplifies pay runs, automatically calculating tax, leave entitlements, and superannuation contributions. It generates payslips for your employees and, crucially, is fully compliant with the ATO’s Single Touch Payroll (STP) reporting requirements. This ensures your payroll data is reported correctly and on time, giving you peace of mind.

Insightful Reporting and Dashboards

The Problem: You need a clear, up-to-date view of your financial performance to make smart decisions.

The Xero Solution: Your main dashboard provides an at-a-glance overview of your key financial metrics, such as cash in and out, outstanding invoices, and account balances. With just a few clicks, you can generate essential reports, including:

- Profit & Loss Statement

- Balance Sheet

- Aged Payables & Receivables

- Cash Flow Statement

The platform’s comprehensive reporting capabilities are frequently highlighted as a key strength, as noted in this detailed Forbes Advisor review of Xero, helping you understand the health of your business. For even more specialised needs, the Xero App Store offers hundreds of integrated apps to extend functionality for specific industries or tasks.

Choosing the Right Xero Plan for Your Business

One of the greatest strengths of Xero is its scalability. The platform offers several subscription plans, each designed to meet the specific needs of businesses at different stages of their journey. Selecting the right plan is a crucial first step in setting up your xero accounting system, ensuring you have the tools you need today without paying for features you won’t use until tomorrow. The key is to align your operational needs—such as transaction volume and international activity—with the features offered in each tier.

For Sole Traders and Startups (Xero Starter)

The Starter plan is the ideal entry point for freelancers, sole traders, and new businesses with low transaction volumes. Priced affordably (around A$32/month), it covers the absolute essentials. However, it’s important to understand its limitations: you can only send up to 20 invoices and enter 5 bills per month. This plan is perfect for getting started, but if you find your business consistently exceeding these caps, it’s a clear sign that you’re ready to upgrade.

For Growing SMEs (Xero Standard)

For most established small and medium-sized enterprises, the Standard plan is the sweet spot. It removes the limitations of the Starter plan, offering unlimited invoicing, bill entry, and bank statement reconciliation. This comprehensive feature set makes it the most popular choice for service businesses, retailers, and consultants. As many an in-depth Xero review will confirm, the Standard plan provides the robust functionality most SMEs require for effective day-to-day financial management.

When to Consider Advanced Plans (Xero Premium)

The decision to move to a Premium plan is typically driven by one key need: multi-currency support. If your business buys or sells goods and services internationally, deals with overseas suppliers, or has foreign bank accounts, this plan is essential. It automatically handles exchange rates and provides a real-time view of your financial position across different currencies. Premium plans also include advanced tools like project profitability tracking and expense claims management, making your financial system a true business powerhouse. Need help choosing a plan? Let’s find the perfect fit for you.

How a Xero Accountant Unlocks True Business Growth

Adopting Xero is a powerful first step towards financial clarity, but the software itself is a tool. Its true potential is unlocked when a skilled professional uses it not just for record-keeping, but for strategic guidance. The real value isn’t in tracking past transactions; it’s in using that data to build a more profitable and secure future. By sharing access with a trusted advisor, you shift the focus from simple compliance to collaborative growth.

At Gartly Advisory, we partner with our clients to go beyond the numbers, transforming their financial data into a roadmap for success. Here’s how we provide that support:

Ensuring Accurate Setup and Ongoing Compliance

A correct initial setup is the foundation of reliable financial data. We ensure your chart of accounts, tax codes, and bank feeds are configured properly from day one. This guarantees the data you see is accurate, giving you complete peace of mind that your ATO obligations, like Business Activity Statements (BAS), are managed correctly and on time.

From Data to Decisions: Interpreting Your Reports

Xero generates comprehensive reports, but without interpretation, they are just figures on a screen. A skilled advisor translates this data into actionable business intelligence. We help you understand crucial trends, such as analysing profit margins on different services, identifying cash flow patterns before they become problems, and spotting opportunities for cost savings you might have missed.

Strategic Planning and Future-Proofing

Your historical data is the key to your future success. We use the insights from your xero accounting data to help you build realistic budgets and cash flow forecasts. This proactive approach allows us to work with you to set meaningful financial goals, track your progress, and make informed decisions that future-proof your business against challenges and position it to seize opportunities.

Ultimately, a proactive accountant does more than just balance your books; they become a strategic partner in your journey. If you’re ready to leverage your financial data for genuine growth, talk to us at Gartly Advisory. Let us help you turn insights into action.

Transform Your Business with Xero and Expert Guidance

Embracing a platform like Xero is a significant first step towards mastering your business finances. As we’ve explored, its intuitive features transform daily tasks from tedious chores into sources of real-time insight. But while the software is powerful, unlocking the full potential of xero accounting requires strategic guidance from an expert who understands your goals.

At Gartly Advisory, we are more than just accountants; we are your strategic partners. As Certified Xero Advisors and Chartered Accountants with over 25 years of trusted experience, we provide the support that goes beyond the numbers. We help you interpret the data, identify opportunities, and build a clear roadmap for sustainable growth.

Take the next step towards financial clarity and control. Schedule a complimentary consultation to discuss your business needs and discover how a dedicated partner can help you achieve your ambitions.

Frequently Asked Questions About Xero Accounting

Is Xero accounting software difficult to learn for a beginner?

Xero is widely recognised for its user-friendly and intuitive design, making it one of the easier accounting platforms for beginners to learn. The dashboard provides a clear, at-a-glance view of your financial position. While the basics are straightforward, seeking professional guidance for the initial setup ensures your chart of accounts and settings are correct from the start. This foundational support helps you leverage the software’s full potential and avoid common errors down the track.

How much does Xero cost for a small business in Australia?

In Australia, Xero offers several monthly subscription plans to suit different business sizes. Prices typically start from around A$29 per month for the ‘Starter’ plan, which is ideal for sole traders and new businesses. Most established small businesses opt for the ‘Standard’ (around A$59/month) or ‘Premium’ (from A$76/month) plans to access features like payroll, quotes, and multi-currency support. We can provide advice on the most cost-effective plan for your specific needs.

Can I switch to Xero from other software like MYOB or QuickBooks?

Yes, migrating to Xero from other software like MYOB or QuickBooks is a well-established process. Xero provides conversion tools to help import your data. However, to guarantee a seamless and accurate transfer of your financial history, we recommend a professionally managed migration. As your trusted partner, we can handle the entire process, ensuring data integrity and providing training so you can begin using your new Xero accounting system with complete confidence.

Does Xero handle Australian tax requirements like GST, BAS, and STP?

Absolutely. Xero is built to handle the complexities of Australian tax compliance. It automatically calculates GST on transactions and makes preparing and lodging your Business Activity Statement (BAS) directly with the ATO a simple process. Furthermore, Xero’s integrated payroll is fully compliant with Single Touch Payroll (STP) reporting requirements, ensuring your business meets all its obligations. This robust, built-in compliance provides essential peace of mind for Australian business owners.

Do I still need an accountant if I use Xero?

While Xero is an excellent tool for managing day-to-day bookkeeping, it does not replace the strategic value an experienced accountant provides. Xero gives you organised, real-time financial data; an accountant interprets that data to offer proactive advice on tax planning, cash flow management, and business growth strategies. We partner with our clients, using the insights from Xero to provide guidance that goes beyond the numbers and helps you achieve your long-term goals.

Is my financial data safe and secure in Xero?

Xero takes data security extremely seriously, employing multiple layers of protection to keep your financial information safe. Your data is protected with the same level of encryption used by banks and is stored securely across multiple data centres. Xero also provides features like two-step authentication and custom user permissions, giving you full control over who can access your business’s sensitive financial data. It is a highly secure and reliable platform.