Why You Need a Specialist SMSF Accountant for Your Fund

Managing a Self-Managed Super Fund (SMSF) offers incredible control over your retirement, but it also comes with a significant weight of responsibility. The labyrinth of ATO compliance, the ever-changing regulations, and the constant fear of a costly misstep can be overwhelming. It often leaves trustees wondering if their current financial advice is truly sufficient to protect and grow their nest egg. While a general accountant is invaluable for many things, do they possess the deep, specialised knowledge required for superannuation law? For many Australians, this is where the support of a dedicated smsf accountant becomes an absolute necessity.

This is more than just ticking boxes; it’s about securing your future. In this guide, we will provide the clarity you need. We’ll explore the critical differences between a generalist and a specialist and offer practical guidance on how to choose the right expert for your fund. Our goal is to help you find a trusted partner who can ensure your SMSF is compliant, secure, and strategically optimised for growth, giving you complete peace of mind on your journey to a comfortable retirement.

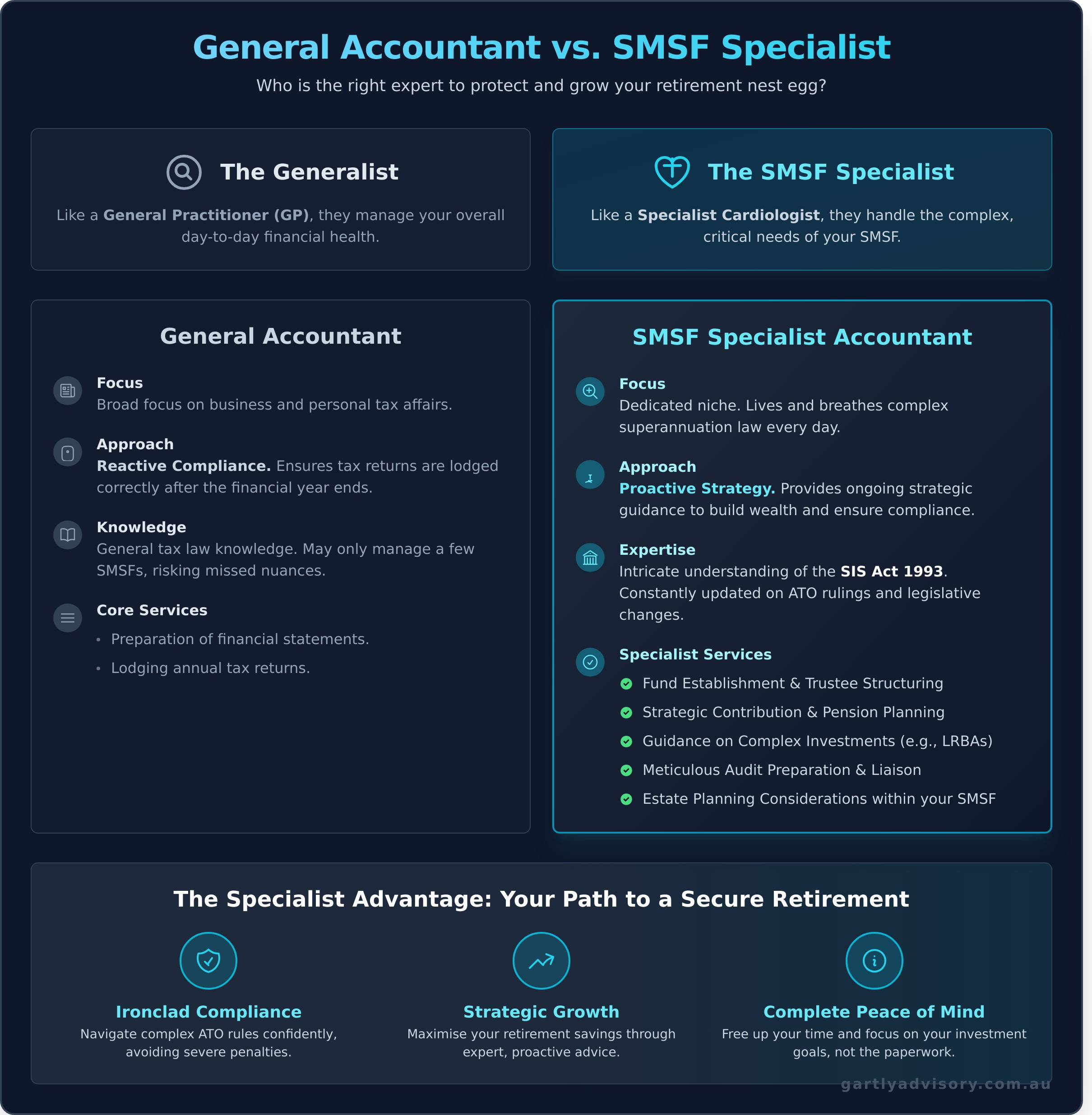

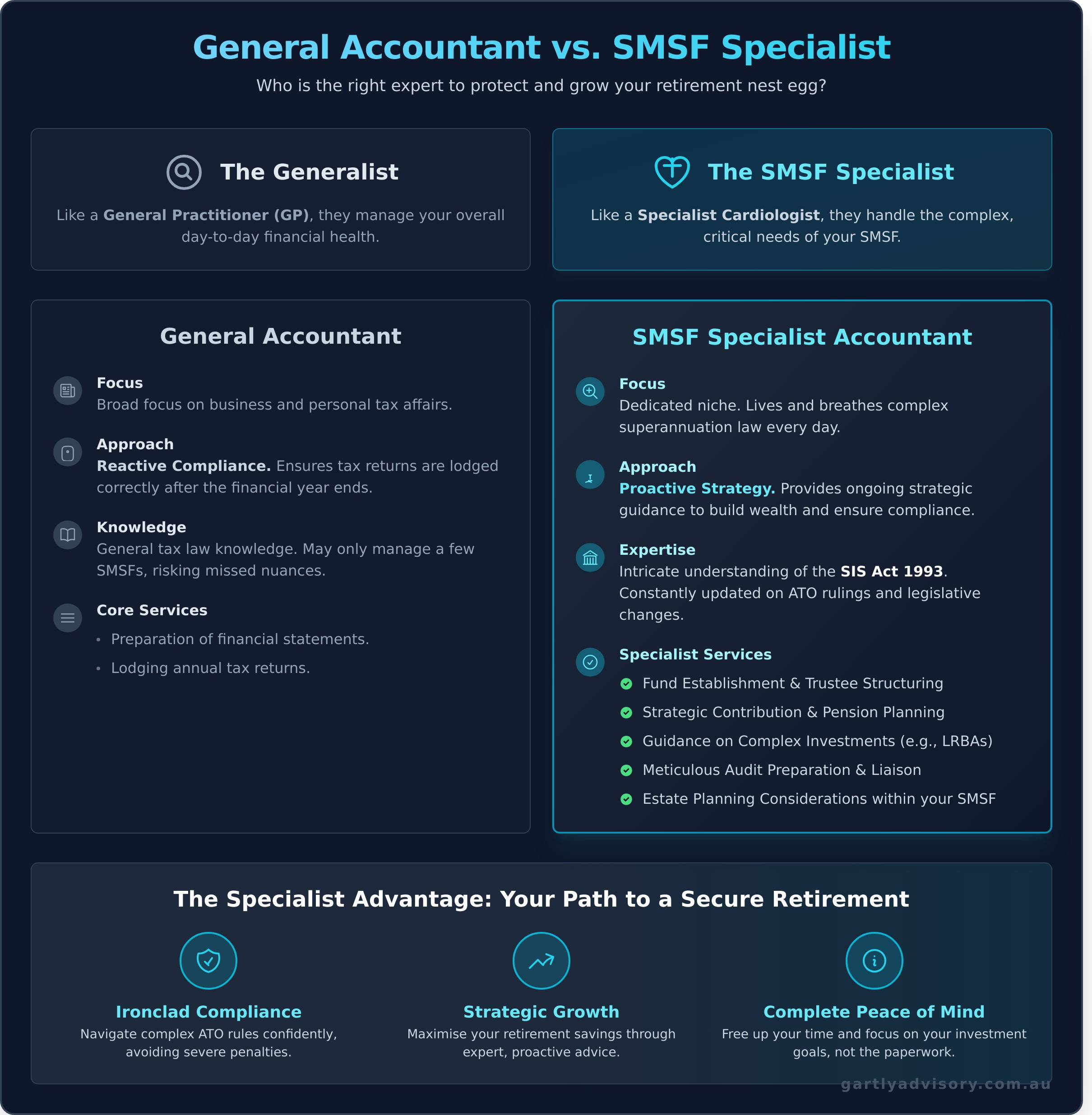

The Critical Difference: General Accountant vs. SMSF Specialist

As a business owner or individual investor, you likely have a trusted general accountant who has expertly managed your business and personal tax affairs for years. They are an invaluable partner for your day-to-day financial health. However, when it comes to managing a Self-Managed Super Fund (SMSF), the landscape changes dramatically. An SMSF is not just another financial entity; it is a highly specialised and regulated structure governed by complex superannuation law.

Thinking of it this way helps: you trust your General Practitioner (GP) for your overall health, but for a complex heart condition, you would seek the advice of a specialist cardiologist. The same principle applies here. An SMSF requires a dedicated expert who operates in this niche every single day.

To better understand the responsibilities involved, this video offers a clear perspective on when an SMSF is a suitable choice.

The crucial difference lies in the approach. A general accountant often provides reactive compliance—ensuring your tax return is lodged correctly. A specialist smsf accountant, however, provides proactive strategic guidance, helping you build wealth within the fund while ensuring you remain fully compliant. Let’s explore what this means in practice.

Navigating Complex Compliance and Legislation

A specialist lives and breathes the Superannuation Industry (Supervision) Act 1993 (SIS Act). They possess an intricate understanding of its rules, which form the backbone of the entire Australian superannuation system. They are constantly updating their knowledge on new ATO rulings and legislative amendments. A generalist who only manages a handful of SMSFs may inadvertently miss critical nuances, potentially leading to compliance breaches and severe penalties from the ATO.

Strategic Advice Beyond the Tax Return

A true SMSF specialist provides advice that goes far beyond simple tax preparation. Their role is to help you legally and effectively maximise your retirement savings. This includes providing guidance on:

- Contribution Strategies: Optimising concessional (before-tax) and non-concessional (after-tax) contributions to grow your fund.

- Pension Planning: Structuring tax-effective retirement income streams and managing transition-to-retirement strategies.

- Complex Investment Rules: Navigating the regulations around specific investments, such as property acquisitions using a Limited Recourse Borrowing Arrangement (LRBA).

The Auditor Relationship

Every SMSF must be audited annually by an independent, registered SMSF auditor. An experienced smsf accountant is your fund’s best advocate in this process. They meticulously prepare all necessary financial statements and documentation, understanding precisely what auditors scrutinise. This proactive preparation not only ensures a smooth and efficient audit but also significantly reduces the risk of costly issues or breaches being identified and reported to the ATO.

Core Responsibilities: What a Specialist SMSF Accountant Does For You

Engaging a specialist is an investment in the security and success of your retirement savings. It’s about gaining a trusted partner who navigates the complexities of superannuation law on your behalf, providing you with complete peace of mind. By outsourcing these intricate tasks, you not only ensure compliance but also free up your valuable time and energy to focus on your investment goals. Let’s break down the support you receive across the entire lifecycle of your fund.

Fund Establishment and Setup

Getting the foundation of your SMSF right is critical to its long-term success and compliance. A specialist provides expert guidance from day one to ensure your fund is structured correctly for your specific circumstances. This initial support includes:

- Advising on the most appropriate structure, such as an individual vs. a corporate trustee.

- Preparing the fund’s trust deed and managing all necessary registrations with the Australian Taxation Office (ATO).

- Assisting with the seamless and compliant rollover of funds from your existing superannuation accounts.

Annual Administration and Compliance

The ongoing management of your fund is where a specialist’s value truly shines. The ATO enforces strict compliance rules, and fully understanding the risks and responsibilities of an SMSF is non-negotiable. A dedicated smsf accountant ensures every detail is managed correctly, from meticulous record-keeping to timely lodgements. Key annual services include:

- Preparation of annual financial statements, including an operating statement and a statement of financial position.

- Lodging the annual SMSF tax return accurately and on time.

- Managing all compliance documentation, including trustee minutes and resolutions.

- Monitoring contribution caps and ensuring minimum pension payment obligations are met.

Strategic and Investment Support

A proactive advisor goes beyond the numbers to offer strategic guidance that aligns with your financial objectives. While we don’t provide financial advice, we support trustees in making informed decisions. This includes assisting you in formulating a compliant investment strategy document, providing guidance on complex asset valuation rules, and advising on crucial estate planning considerations within your SMSF to ensure your wealth is protected for future generations.

Let our experts handle the complexity so you can focus on what matters. Discuss your SMSF needs with us.

How to Choose the Right SMSF Accountant: 7 Key Questions to Ask

Choosing the right advisor for your Self-Managed Super Fund is one of the most important decisions you will make for your financial future. This isn’t just about annual compliance; it’s about finding a trusted partner to help you navigate the complexities of superannuation law and safeguard your retirement savings. To empower you in this crucial process, here are seven key questions to ask any potential smsf accountant.

1. Qualifications and Licensing

Start with the fundamentals. Proper credentials are non-negotiable for anyone managing your fund’s complex obligations. A dedicated specialist will be intimately familiar with the intricate compliance details, from investment strategy rules to the official requirements for setting up an SMSF as outlined by the ATO. Ask them directly:

- Are you a Chartered Accountant (CA) or Certified Practising Accountant (CPA)? These designations signify a high standard of professional training and ethical conduct.

- Do you hold an Australian Financial Services (AFS) licence for providing SMSF advice? This is a legal requirement for certain types of financial product advice related to superannuation.

- What percentage of your practice is dedicated specifically to SMSFs? You want a specialist whose core business is SMSFs, not a generalist who only handles a few on the side.

2. Experience and Proactive Guidance

Beyond qualifications, proven experience is a powerful indicator of competence. You want an advisor who has navigated various market cycles and complex client situations, offering proactive guidance, not just reactive reporting at year-end. This is the difference between a simple bookkeeper and a strategic partner.

- How many years have you been providing dedicated SMSF advice? Decades of experience often translate into deeper insights and a more stable, reliable service.

- Can you describe your experience with funds similar to mine? Whether your fund holds property, international shares, or collectibles, ensure they have relevant expertise.

- How do you work proactively with clients throughout the year? Look for an accountant who offers ongoing support and strategic advice to help you seize opportunities and avoid pitfalls.

3. Fee Structure and Communication

Clarity on fees and communication is essential for a healthy long-term partnership. A transparent structure ensures there are no surprises, while clear communication channels build trust and ensure you always feel supported.

- What is your fee structure? A fixed annual fee provides cost certainty, whereas hourly rates can be unpredictable. Ask what is included and what might incur extra charges.

- Who will be my primary point of contact? Knowing you have a dedicated person to speak with ensures consistency and a deeper understanding of your fund’s unique needs.

The High Cost of Inexperience: Risks of DIY or Non-Specialist Advice

While managing your SMSF yourself or using a general accountant may seem like a way to save on fees, it’s a false economy that can expose your retirement savings to catastrophic risk. The Australian Taxation Office (ATO) holds trustees to an extremely high standard, and ignorance is no defence. The fees for a specialist are not just a cost; they are insurance against financial penalties, lost opportunities, and immense personal stress.

Severe ATO Penalties

The ATO has the power to impose significant administrative penalties on trustees for compliance breaches, with fines often exceeding thousands of dollars per trustee, per contravention. Common mistakes that attract the ATO’s attention include:

- Illegal Loans to Members: Providing financial assistance to a member or their relative is a serious breach.

- Incorrect Asset Valuations: Failing to value assets at market value, especially property, can trigger an audit.

- In-House Asset Rule Breaches: Exceeding the 5% limit for in-house assets is a common and costly error.

The ultimate penalty is having your fund declared ‘non-complying’. This results in the ATO taxing the fund’s assets at the highest marginal rate of 45%—a devastating blow that can wipe out nearly half of your retirement nest egg.

Missed Strategic Opportunities

Beyond avoiding penalties, a non-specialist approach means you miss out on crucial strategic guidance. A proactive smsf accountant does more than just compliance; they provide advice that grows your wealth. Inexperience often leads to:

- Sub-optimal Contribution Strategies: Failing to correctly time and structure contributions can cost you tens of thousands of dollars in lost growth over the life of your fund.

- Inefficient Pension Planning: Poorly structured pension payments can create unnecessary tax liabilities in retirement.

- Flawed Property Investments: Incorrectly structuring an SMSF property purchase can lead to major compliance breaches and legal complications.

The Burden of Personal Liability

As a trustee, you are personally liable for every decision made within the fund. If you receive incorrect advice from a non-specialist and act on it, the responsibility for the breach still rests entirely on your shoulders. The consequences extend beyond fines; the time and stress involved in rectifying mistakes, dealing with ATO audits, and potentially unwinding complex transactions can be overwhelming. Protecting your fund means protecting yourself from this significant personal burden. Engaging an expert is about gaining a trusted partner to safeguard your financial future.

Why Partner with Gartly Advisory for Your SMSF in Melbourne

Choosing the right professional for your Self-Managed Super Fund is one of the most critical financial decisions you will make. It’s about more than annual compliance; it’s about securing a trusted partner who is genuinely invested in your long-term success. At Gartly Advisory, we bring together decades of specialised expertise with a supportive, client-first approach to provide Melbourne trustees with the clarity and confidence needed to manage their fund effectively.

Chartered Accountants & Licensed SMSF Advisers

Our team holds the industry’s highest professional qualifications. As both Chartered Accountants and Licensed SMSF Advisers, we are held to rigorous ethical standards and are committed to continuous professional development. This dedication ensures that the advice you receive on ever-changing superannuation law is not only current and fully compliant but also strategically aligned with your unique investment and retirement goals, giving you complete peace of mind.

Decades of Proven Experience

Our practice is led by Geoff Gartly, who brings over 35 years of dedicated financial experience to every client relationship. We have a proven track record of guiding hundreds of trustees through the entire SMSF lifecycle—from setup and investment strategy to pension phase and winding up. This deep experience is why our clients stay with us for the long term, a commitment reflected in our 70+ 5-star Google reviews.

Advice ‘Beyond the Numbers’

We have built our reputation on providing advice that goes ‘beyond the numbers’. A great smsf accountant should be more than a compliance officer; they should be your strategic ally. We take the time to truly understand your retirement aspirations and financial situation. This allows us to offer proactive, supportive guidance that is tailored specifically to you, helping you solve problems, seize opportunities, and build a secure future.

Let us be your trusted partner on your journey towards a successful retirement. If you are seeking a specialist smsf accountant in Melbourne who combines expert technical knowledge with dedicated personal support, we invite you to schedule a complimentary consultation to discuss your needs.

Secure Your Retirement with a Trusted SMSF Partner

Managing a Self-Managed Super Fund is a significant responsibility, and choosing the right smsf accountant is one of the most critical decisions you’ll make. As we’ve explored, the expertise of a specialist goes far beyond standard accounting; it involves navigating complex compliance, optimising tax strategies, and safeguarding your retirement savings from costly penalties. The risks associated with non-specialist advice are simply too high when your financial future is at stake.

At Gartly Advisory, we are more than just accountants; we are your trusted partners on your journey towards success. As Chartered Accountants and Licensed SMSF Advisers with over 35 years of specialised experience, we provide the proactive guidance and support Melbourne trustees rely on. Our commitment to client success is reflected in our 70+ 5-Star Google Reviews from local clients who trust our expertise.

Take the next step with confidence. We invite you to schedule a complimentary appointment to discuss your SMSF strategy. Let us help you ensure your fund is not only compliant but also perfectly structured to achieve your long-term financial goals.

Frequently Asked Questions About SMSF Accountants

How much does an SMSF accountant typically cost in Melbourne?

In Melbourne, annual fees for a specialist SMSF accountant generally start from A$2,000 to A$3,500 for a fund with simple assets like cash and shares. Costs will increase depending on the fund’s complexity, such as the number of transactions, the presence of a rental property, or the need for more intricate strategic advice. It is always wise to seek a clear, fixed-fee proposal that outlines all services to ensure you receive the comprehensive support your fund requires.

What specific qualifications and licenses should an SMSF accountant have?

A qualified SMSF accountant in Australia should be a member of a professional body like Chartered Accountants (CA) or CPA Australia and be a Registered Tax Agent. If they provide financial advice, they must hold an Australian Financial Services Licence (AFSL) or be an authorised representative. For true expertise, look for postgraduate qualifications such as the SMSF Specialist Advisor (SSA™) designation from the SMSF Association, which demonstrates a high level of competency in this complex area.

Can my SMSF accountant also be my SMSF auditor?

No, this is strictly prohibited by Australian law. The Superannuation Industry (Supervision) Act requires the SMSF auditor to be completely independent of the firm that prepares the fund’s accounts. This separation of duties is a critical safeguard designed to ensure an impartial and objective review of your fund’s financial statements and compliance. Your accountant prepares the records, and the independent auditor checks them, providing vital accountability for you as a trustee.

My SMSF only holds cash and shares. Do I still need a specialist accountant?

Yes, absolutely. While your assets may be simple, SMSF compliance is not. The complexity lies in navigating the strict rules around contributions, pensions, and investment strategies, all of which are heavily regulated by the ATO. A specialist smsf accountant ensures your fund meets all its legal obligations, protecting you from potentially severe penalties. Their expertise is crucial for compliance and strategic guidance, regardless of the assets your fund holds.

How often should I meet or communicate with my SMSF accountant?

We recommend at least one comprehensive annual meeting to review your fund’s financial statements, tax return, and overall strategy. However, the best approach is proactive communication. You should feel comfortable contacting your accountant before any significant event, such as making a large contribution, commencing a pension, or considering a new investment. This ongoing partnership ensures you receive timely advice to make informed and compliant decisions for your future.

What is the difference between an SMSF administrator and an SMSF accountant?

An SMSF administrator typically handles the day-to-day data processing and record-keeping for your fund, such as reconciling bank transactions and maintaining paperwork. An smsf accountant provides a higher level of strategic service. They use the administrator’s data to prepare the annual financial statements and tax return, provide crucial tax planning advice, and ensure the fund remains compliant with complex superannuation laws. The accountant offers the expert oversight and guidance essential for trustees.