How to Grow Your Small Business in Australia: A Strategic Guide

Has your business reached a plateau? It’s a common challenge for dedicated owners: you’ve built something strong, but now you’re feeling stuck, juggling the countless demands of daily operations while trying to map out the future. If you find yourself constantly searching for a clear answer to the question, ‘how to grow my small business in Australia,’ you are not alone. This ambition to scale is exciting, but it often brings valid concerns about managing cash flow, mastering marketing, and avoiding the risk of growing too quickly.

Consider this guide your trusted partner on the journey ahead. We are moving beyond abstract theories to provide the practical support you need. Here, you will discover a strategic, step-by-step roadmap designed to give you clarity and confidence. We’ll provide actionable guidance across the critical pillars of expansion—from strategic planning and finance to marketing and operations—so you can achieve sustainable growth, increase profitability, and build a resilient business that is ready for success.

Step 1: Laying the Foundation – Is Your Business Truly Ready for Growth?

The ambition to expand is a powerful driver for any entrepreneur. However, before you start scaling, it’s crucial to ask a fundamental question: is your business built on a foundation strong enough to support that growth? Attempting to grow on a weak base often leads to instability, cash flow problems, and even failure. This first step is about conducting an honest diagnostic to ensure your business is truly ready. Understanding what defines a small business in the Australian context also provides perspective on the unique challenges and opportunities you face. This assessment is the most critical part of learning to successfully grow my small business in Australia.

Conducting a Financial Health Check

True financial health goes far beyond a simple profit-and-loss statement. As your trusted partner, we advise a deeper look at the numbers to understand your business’s real-time stability and growth potential. Before making any expansion plans, take the time to analyse these key metrics:

-

Profit Margins: Review your gross, operating, and net profit margins. Are they healthy, stable, or declining? This shows how efficiently your business converts revenue into actual profit.

-

Cash Flow: Examine your cash flow statements for the last 12-24 months. Consistent positive cash flow is the lifeblood of a business and essential for funding growth.

-

Balance Sheet: Assess your assets, liabilities, and owner’s equity. A strong balance sheet indicates financial resilience.

-

Break-Even Point: Do you know exactly how much you need to sell each month to cover all your costs? This figure is critical for setting realistic sales targets.

Defining Clear and Measurable Growth Goals

Vague ambitions like "get bigger" are not actionable. To provide clear direction, your growth objectives must be defined using the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of "increase sales," a SMART goal would be: "Increase total revenue by 20% to A$600,000 in the next fiscal year by acquiring 50 new clients." Documenting these goals and aligning them with your personal financial objectives will provide the focus needed to turn your vision into reality.

Reviewing Your Business Plan and Value Proposition

The market is always changing. Does your original business plan still reflect your current goals and the market reality? More importantly, is your unique value proposition (UVP)—the core reason customers choose you over competitors—still clear and compelling? Reconfirm what makes you different, and ensure your core mission and operational model can scale without compromising the quality that your customers value. A solid UVP is the cornerstone of sustainable growth in the competitive Australian market.

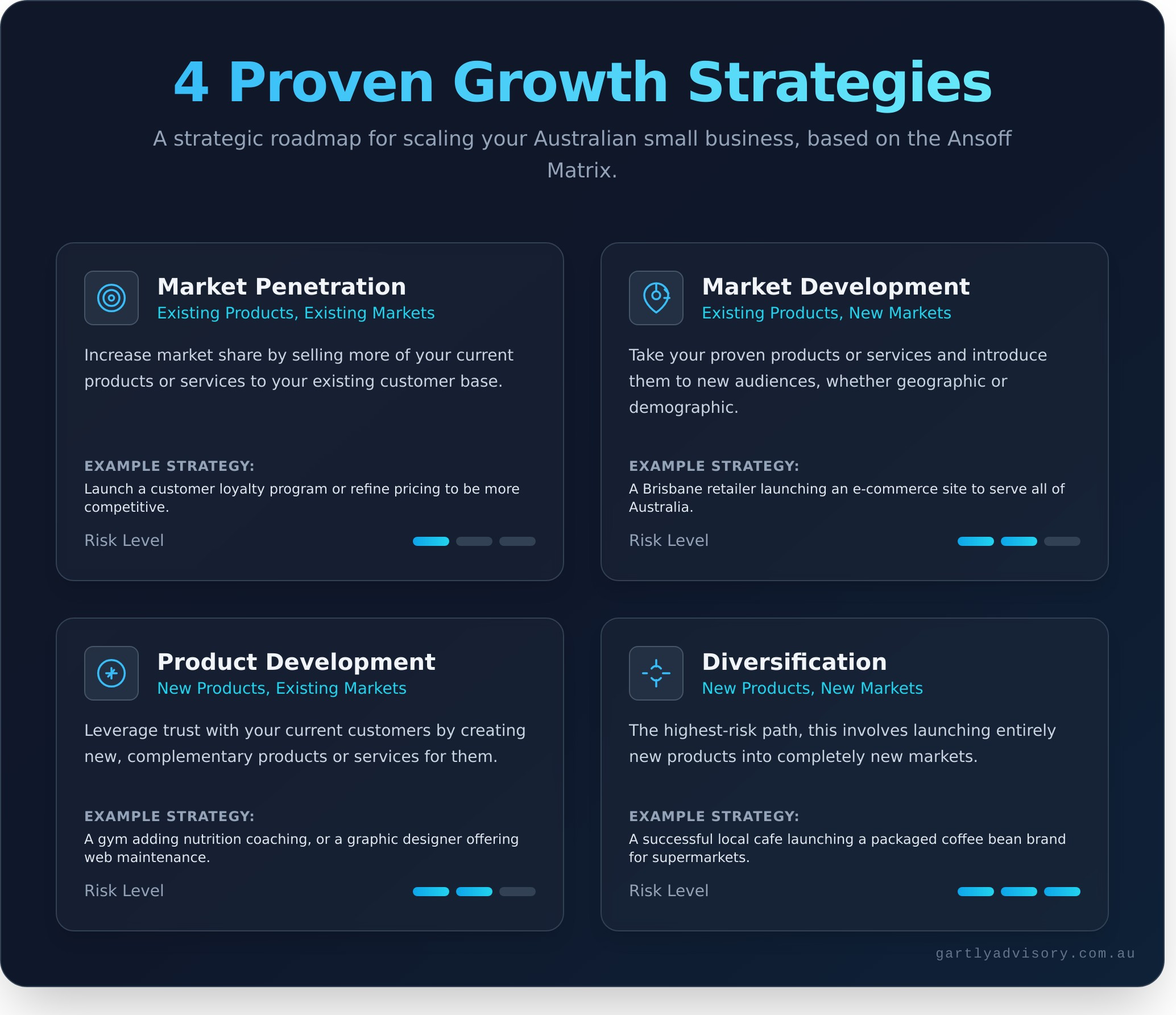

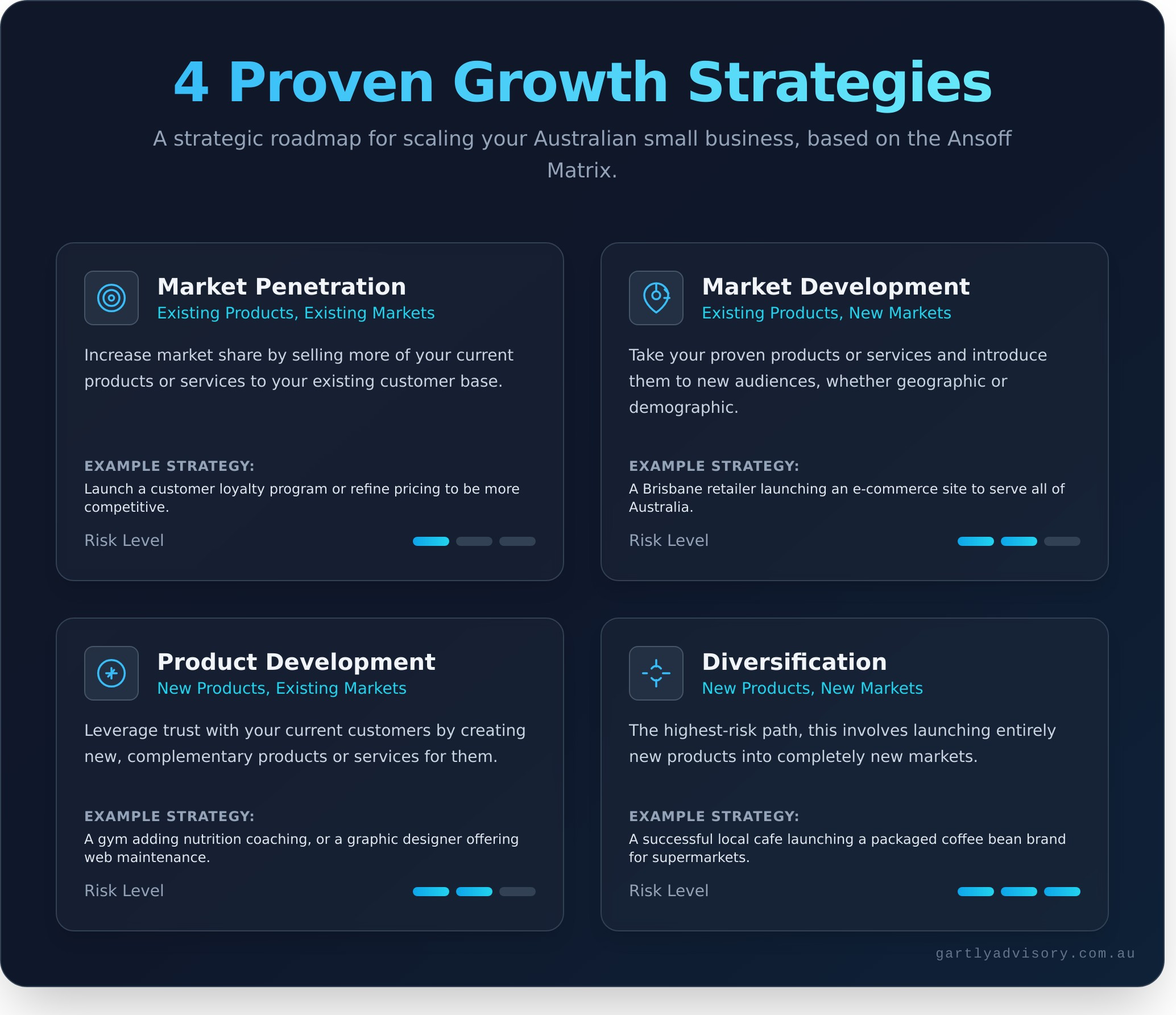

Step 2: Choosing Your Growth Strategy – Four Proven Paths

Once you have a solid foundation, the next question is often, ‘How to grow my small business in Australia?’ There is no single correct answer; the best path depends on your unique strengths, resources, and appetite for risk. To provide clarity, we can use a trusted framework that outlines four core growth strategies. Evaluating each path will help you focus your efforts and invest your resources wisely, turning ambition into a measurable plan that we can support you with.

Market Penetration: Selling More to Your Existing Market

This is often the safest and most immediate path to growth. The goal is to increase your market share by selling more of your current products or services to your existing customer base. Strategies can include introducing a customer loyalty program, refining your pricing to be more competitive, or boosting your marketing efforts to attract customers from your direct competitors in the Australian market. It’s about doing more of what you already do well.

Market Development: Finding New Markets for Your Products

This strategy involves taking your proven products or services to new audiences. This could mean geographic expansion, such as a Brisbane-based retailer opening a store in Sydney or launching an e-commerce site to serve customers nationwide. It could also mean targeting a new customer segment—for example, a B2B service provider adapting its offering for sole traders. Success here hinges on thorough market research to ensure your offering resonates with the new market.

For a great example of an e-commerce business that has expanded its reach nationwide, you can visit Sweet Trolley.

Product Development: Creating New Offerings for Existing Customers

Here, you leverage the trust you’ve already built with your customers by creating new offerings for them. This approach capitalises on your existing relationships and brand reputation. Examples include a gym adding nutrition coaching services or a graphic designer offering website maintenance packages. This aligns with many modern growth strategies that focus on increasing customer lifetime value, though it requires investment in research and development.

Diversification: New Products for New Markets

As the highest-risk strategy, diversification involves launching new products into entirely new markets. This is a significant undertaking that requires careful planning and substantial investment. An example could be a successful Melbourne cafe deciding to launch a packaged coffee bean brand for national supermarket distribution. While it holds the potential for high rewards, this path is typically pursued when other growth avenues have been maximised and requires expert financial guidance.

Step 3: Fuelling Growth – Marketing and Sales for Australian SMEs

A meticulously crafted business plan provides the map, but a powerful marketing and sales engine provides the fuel. For business owners asking how to grow my small business in australia, the answer lies in consistently attracting and retaining customers. Growth isn’t about a single campaign; it’s about building a sustainable system that combines strategic digital outreach with a deep focus on customer loyalty. This approach requires building a repeatable sales process that can scale with your team and, crucially, measuring your return on investment (ROI) to ensure every dollar is working hard for your business.

Mastering Digital Marketing in Australia

In today’s market, a targeted digital presence is non-negotiable. It allows you to connect directly with your ideal customers where they spend their time. A well-rounded strategy provides guidance and builds trust before a potential client even contacts you.

-

Focus on Local SEO: Attract customers in your immediate vicinity by optimising your Google Business Profile and using location-specific keywords (e.g., "accountant in Chatswood"). This is a cost-effective way to capture high-intent local searches.

-

Utilise Targeted Social Media: Platforms like Facebook and Instagram are powerful for reaching specific demographics across Australia, while LinkedIn is essential for B2B businesses. Use targeted ads to focus your budget on the most relevant audience.

-

Build an Email List: Email marketing is a direct line to your audience, perfect for sharing updates, promotions, and valuable advice. It’s a key asset for nurturing leads and encouraging repeat business, just be sure to comply with Australia’s Spam Act.

-

Create Authoritative Content: Through blogs, guides, or videos, you can solve your customers’ problems and establish your expertise. This content marketing approach builds authority and attracts qualified leads organically over time.

Building Customer Loyalty and Increasing Lifetime Value

While acquiring new customers is exciting, retaining your existing ones is more profitable. It can cost five times as much to attract a new customer as to retain a current one. Loyal customers provide predictable revenue, are more likely to try new offerings, and become your most powerful marketing tool through word-of-mouth referrals.

-

Implement a Feedback System: Actively seek out customer opinions through simple surveys or direct conversations. More importantly, act on that feedback to show you value their support and are committed to improving.

-

Create Loyalty Programs: Reward repeat business with exclusive offers, a simple discount, or a points-based system. This gives customers a tangible reason to choose you over a competitor.

-

Deliver Excellent Customer Service: Exceptional service turns a simple transaction into a lasting relationship. It is one of the most effective, yet often overlooked, marketing strategies for any small business.

Step 4: Scaling Your Operations – People, Processes, and Technology

As your business gains momentum, the complexity of managing it grows exponentially. What worked for a one-person operation will not sustain a larger enterprise. A crucial part of understanding how to grow my small business in australia is proactively planning for this expansion. To avoid common growing pains, you must build a strong foundation based on the right people, streamlined processes, and smart technology. The goal is to create a business that can run efficiently without your constant hands-on involvement.

Hiring and Developing Your Team

Your team is your greatest asset in the scaling process. Bringing on new staff requires careful planning to ensure you build a capable and cohesive unit. We provide guidance to our clients on how to:

-

Meet your obligations: Understand your responsibilities as an employer under Australian law, including awards, superannuation, and entitlements. The Fair Work Ombudsman is an essential resource.

-

Hire for attitude: While skills are important, hiring for cultural fit and a proactive attitude often yields better long-term results. Skills can be taught; a great work ethic is invaluable.

-

Invest in training: Support your team’s development to improve their capabilities and boost retention.

-

Outsource strategically: Delegate non-core tasks like bookkeeping or IT support to external experts, allowing you to focus on what you do best.

Implementing Systems and Processes

Robust systems are the framework that supports sustainable growth. By documenting key workflows, you ensure every task is performed consistently and with quality, regardless of who performs it. Start by implementing tools that create efficiency, such as cloud accounting software like Xero or MYOB to manage finances, project management platforms like Asana to track tasks, and a Customer Relationship Management (CRM) system to organise client interactions. These systems provide clarity and control as your operations expand.

Leveraging Technology for Efficiency

Technology is a powerful enabler for scaling businesses. Use it to automate repetitive administrative tasks, freeing up valuable time for you and your team to focus on high-impact activities. Modern tools can also provide powerful data analytics, helping you make informed, evidence-based decisions instead of relying on gut feelings. As you grow, ensure your IT infrastructure and cybersecurity measures are robust enough to protect your business and customer data. Remember, technology should be a tool that supports and empowers your team, not replace them. For expert support in building a scalable operational foundation, Gartly Advisory is your trusted partner.

Step 5: Funding and Financial Management for Sustainable Growth

Expansion is exciting, but it almost always requires capital. To move from planning to execution, proactive financial management is non-negotiable. A solid strategy for funding and managing your finances is a critical component of how to grow my small business in australia, ensuring that your growth is both ambitious and sustainable.

Mastering Cash Flow Forecasting

Understanding your cash flow is more important than simply tracking profit. A profitable business can fail if it runs out of cash. Create a detailed 12-month cash flow forecast to anticipate potential shortfalls and plan accordingly. It’s vital to update this forecast monthly with your actual figures to maintain accuracy. This involves actively managing your accounts receivable to get paid faster and strategically handling your accounts payable to maintain healthy cash reserves.

Exploring Business Funding Options in Australia

When you need external capital, it’s important to know your options. A strong financial plan is your key to securing investment and convincing lenders of your vision. Some common funding avenues in Australia include:

-

Traditional Business Loans: Offered by major banks and credit unions for significant investments, often requiring a detailed business plan and sometimes property as security.

-

Government Grants and Programs: The Australian government offers various grants, such as the R&D Tax Incentive or the Export Market Development Grant (EMDG), which support businesses in specific industries or activities.

-

Asset Finance: A specialised loan for purchasing essential equipment, vehicles, or machinery. The asset itself typically serves as the security for the loan.

-

Line of Credit: A flexible funding option that provides access to a pre-approved amount of capital, perfect for managing short-term working capital needs during expansion.

The Importance of a Trusted Financial Advisor

Navigating financial decisions alone can be overwhelming. A skilled accountant or business advisor offers guidance that goes far beyond tax compliance. They help you interpret complex financial data, turning numbers into actionable insights for strategic decision-making. Furthermore, an experienced advisor can be invaluable when preparing loan applications and financial models, significantly increasing your chances of securing funding. Let us be your trusted partner in your growth journey.

Your Partner in Sustainable Business Growth

Growing a small business is a journey, not a destination. As we’ve explored, it begins with a solid foundation and a deliberate strategy, supported by robust marketing, scalable operations, and smart financial management. Answering the question of how to grow my small business in australia requires a clear vision and a practical, step-by-step plan.

You don’t have to navigate this complex path alone. As Chartered Accountants and specialists in business advisory with over 35 years of experience, Gartly Advisory has earned the trust of local business owners—a fact reflected in our 70+ 5-star Google Reviews. We pride ourselves on providing proactive advice that goes beyond the numbers, focusing on your long-term success and seizing opportunities for growth.

Ready to turn your ambitions into a clear, actionable strategy? Schedule a complimentary consultation to discuss your business growth strategy. Let us be your trusted partner on your journey towards success.

Frequently Asked Questions About Growing Your Small Business

What are the most common mistakes small businesses make when trying to grow?

Many ambitious owners try to do everything themselves, leading to burnout and missed opportunities. Another common pitfall is poor cash flow management; revenue growth without corresponding cash can be disastrous. Neglecting marketing or failing to adapt to market changes are also significant errors. A proactive approach involves building a strong support network and focusing on sustainable, profitable growth rather than just expansion at any cost. We can provide guidance to help you avoid these common issues.

How do I know which growth strategy is right for my business?

The right strategy depends on your unique situation, including your industry, resources, and goals. A business with a strong existing customer base might focus on market penetration (selling more to current clients), while another might pursue market development by expanding to new locations. Understanding the best approach starts with a clear analysis of your position. A trusted business advisor can help you assess your options and create a practical, tailored plan for sustainable growth.

Are there any specific government grants for growing a small business in Australia?

Yes, various grants and support programs are available at both the federal and state levels to help businesses grow. These can range from funding for research and development (R&D) to export market development grants. The eligibility criteria are often very specific. The official business.gov.au website is an excellent starting point to search for grants. A proactive advisor can also help identify opportunities you might not be aware of, ensuring you meet the requirements for a successful application.

How much should I budget for marketing when trying to grow?

While there is no single magic number, a common guideline for an established small business is to allocate 5-10% of revenue to marketing. For a new business or one in a high-growth phase, this could be closer to 12-20% to build awareness. The key is to treat marketing as an investment, not an expense. We can help you analyse your financial position to determine a budget that supports your growth ambitions without overextending your resources.

When is the right time to hire my first employee?

The right time is typically when your workload consistently prevents you from focusing on high-value, growth-oriented tasks. If you’re turning down work or spending too much time on administrative duties that someone else could handle, it’s a strong sign. Before hiring, ensure you have clear cash flow projections to comfortably cover the salary and associated costs, such as superannuation. An employee should be an investment that frees you up to generate more revenue.

How can an accountant or business advisor help me grow my business?

A proactive business advisor goes beyond tax compliance to become your trusted partner in growth. We provide strategic guidance by helping you understand your key financial drivers, create accurate cash flow forecasts, and set realistic growth targets. Getting expert advice is a critical step in effectively growing my small business in Australia, ensuring your decisions are based on sound financial data and strategic foresight. Let us help you build a clear path to success.