Small Business Accounting: A Complete Guide for Australian Owners

As a Melbourne business owner, you launched your venture to bring a vision to life-not to spend late nights deciphering financial jargon and navigating complex ATO requirements. The constant pressure of managing cash flow and staying compliant can feel overwhelming, turning a crucial part of your operations into a source of stress. We understand that mastering the essentials of small business accounting is the bedrock of success, but it often feels like a significant barrier to it.

Think of this comprehensive guide as your trusted partner on this journey. We’ve designed it to provide clear, step-by-step support that cuts through the complexity. Here, you will learn everything from initial setup and key compliance obligations to using your financial data to fuel strategic growth. Our goal is to help you feel in control of your finances, empowering you to make the informed decisions that will allow your business to thrive.

Why Accounting is Your Business’s Most Powerful Growth Tool

For many Australian business owners, accounting is a box of receipts and a source of stress that peaks at tax time. But it’s time to reframe that thinking. Far from being a chore focused on compliance, great small business accounting is a strategic tool that tells the ongoing story of your business’s health and performance. It provides the clarity you need to seize opportunities and navigate challenges. At its core, understanding what is accounting? is about transforming numbers into a narrative that guides your journey. Think of it as the dashboard for your business-providing real-time data to steer forward, not just a rear-view mirror showing where you’ve been.

To better understand the foundational steps, this video from a fellow Chartered Accountant offers excellent guidance:

A proactive approach to your finances provides the foundation to secure loans, attract investors, and ultimately increase your business’s valuation. It’s about moving from reactive record-keeping to proactive, strategic management.

Compliance: Staying on the Right Side of the ATO

First and foremost, accurate accounting ensures you meet your obligations to the Australian Taxation Office (ATO). This includes managing Goods and Services Tax (GST), Pay As You Go (PAYG) withholding for employees, and Superannuation contributions. Maintaining precise records not only prepares you for any potential audits but also provides invaluable peace of mind, allowing you to focus on running your business, not worrying about compliance.

Decision-Making: Using Data to Drive Your Business

Your financial reports are a goldmine of information. With proper analysis, you can make informed, data-driven decisions that directly impact your bottom line. Effective small business accounting helps you:

- Identify your most (and least) profitable products or services.

- Manage cash flow effectively to avoid shortfalls and plan for large expenses.

- Set appropriate pricing that covers costs and delivers a healthy margin.

- Determine the right time to hire new staff or invest in new equipment.

Growth & Planning: Building a Foundation for Success

Looking to the future? Your financial data is the key. Budgets and cash flow forecasts are not just restrictive documents; they are roadmaps for sustainable growth. A clear financial picture allows you to set realistic and achievable goals, measure your progress against them, and pivot your strategy when necessary. This forward-looking approach is what separates thriving businesses from those that stagnate.

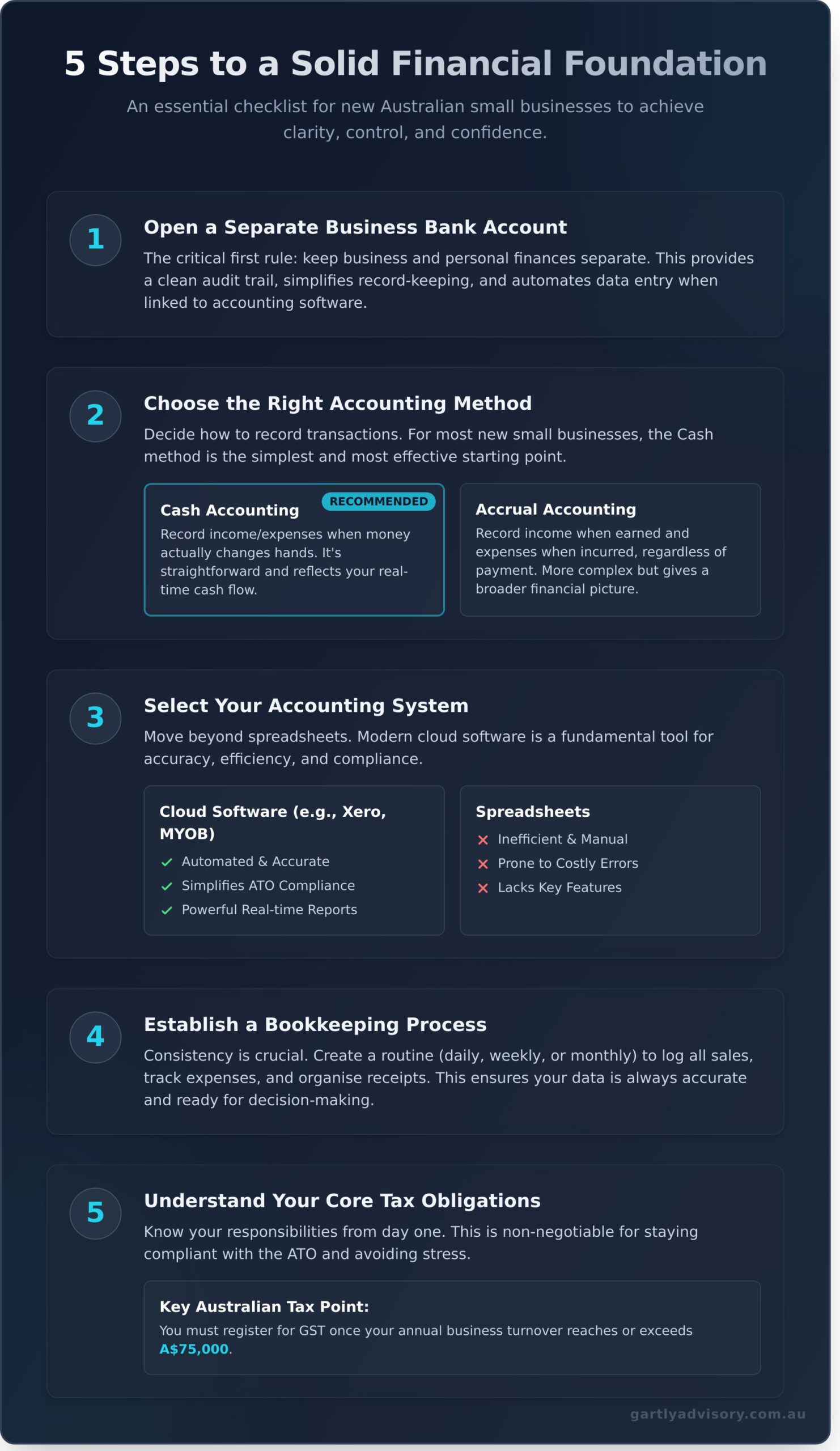

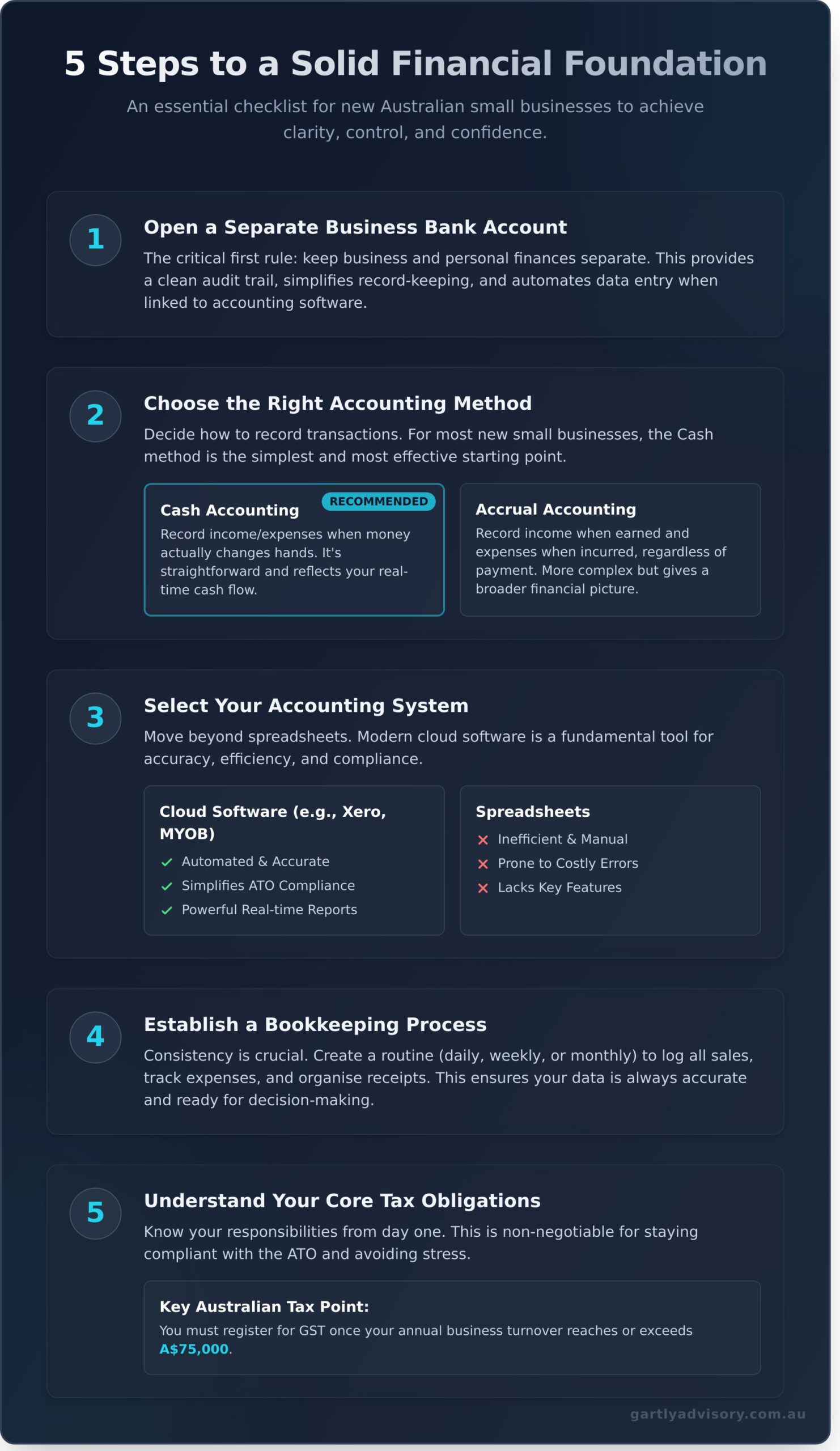

Setting Up Your Financial Foundations: The First 5 Steps

Building a successful Australian business requires a solid financial foundation. Getting your small business accounting right from the very beginning is not just about compliance; it’s about creating clarity, control, and confidence. Taking the time to establish these core practices will save you significant headaches and position your business for sustainable growth. Think of this as the essential checklist to build upon.

Step 1: Open a Separate Business Bank Account

The first and most critical rule of business finance is to keep it separate. Mixing personal and business funds creates a bookkeeping nightmare, complicates tax time, and can obscure the true financial health of your business. A dedicated business bank account provides a clean audit trail for the ATO, simplifies your record-keeping, and helps you look professional to clients and suppliers. Most importantly, it can be linked directly to your accounting software, automating much of the data entry.

Step 2: Choose the Right Accounting Method

You need to decide how you will record your financial transactions. There are two primary methods:

- Cash accounting: Income is recorded when you receive the money, and expenses are recorded when you pay them. It’s straightforward and reflects your immediate cash flow.

- Accrual accounting: Income is recorded when it’s earned (e.g., when an invoice is sent) and expenses when they are incurred, regardless of when cash changes hands.

For most new small businesses in Australia, the cash method is simpler and often the preferred starting point for managing finances.

Step 3: Select Your Accounting System

While a spreadsheet might seem sufficient at first, it quickly becomes inefficient and prone to costly errors. We strongly recommend investing in dedicated, cloud-based accounting software like Xero or MYOB. This technology is fundamental to modern small business accounting, automating bank feeds, ensuring accuracy, simplifying ATO compliance like Single Touch Payroll (STP), and providing you with powerful financial reports at your fingertips.

Step 4: Establish a Bookkeeping Process

Bookkeeping is the disciplined, day-to-day process of recording every financial transaction your business makes. Consistency is crucial. Whether you set aside time daily, weekly, or monthly, you must have a routine for logging all sales, tracking every expense, and organising your receipts and invoices. A reliable bookkeeping process ensures your financial data is always accurate, up-to-date, and ready for decision-making.

Step 5: Understand Your Core Tax Obligations

Finally, getting a handle on your tax responsibilities from day one is non-negotiable. This involves understanding if you need to register for GST (Goods and Services Tax)-which is mandatory once your annual business turnover reaches A$75,000-and consistently setting aside funds for your income tax payments. The Australian Government provides excellent resources for Setting up your business finances, which is a great starting point for any new owner. As your trusted partner, we can provide the specific guidance you need to ensure you are always compliant.

Mastering the Key Cycles of Small Business Accounting

Effective small business accounting isn’t about a single, yearly event; it’s about establishing a rhythm of regular, recurring tasks that keep your finances healthy and compliant. Creating a routine around these cycles removes stress and provides a clear, real-time view of your business performance. These cycles are built upon the foundational steps outlined in the excellent Australian Government guide to setting up your business finances, which covers everything from bank accounts to record-keeping systems.

Invoicing and Getting Paid (Accounts Receivable)

Cash flow is the lifeblood of your business, and it starts with getting paid. Create professional invoices that are easy to understand, including your ABN, clear payment terms, and multiple payment options. Don’t be afraid to follow up on late payments; a polite but firm reminder system is crucial. Modern accounting software can automate this entire process, from sending branded invoices to dispatching scheduled reminders, ensuring you get paid faster.

Managing Bills and Expenses (Accounts Payable)

Tracking every business expense is non-negotiable, as each one represents a potential tax deduction. Ditch the shoebox of receipts and embrace digital tools to capture and categorise expenses as they happen. Set up a system to pay your suppliers on time. This not only avoids late fees but also builds strong relationships and maintains a healthy credit history for your business, which is vital for future growth and financing.

Navigating Payroll and Superannuation

If you have employees, you have significant legal obligations. This includes withholding the correct amount of tax from wages (PAYG Withholding) and paying the Superannuation Guarantee (SG) into their nominated funds. All payroll information must be reported to the ATO in real-time through Single Touch Payroll (STP) enabled software. Be aware: the ATO enforces strict penalties for late or unpaid super, so this is one area where professional guidance is essential.

Preparing Your Business Activity Statement (BAS)

The Business Activity Statement (BAS) is how most Australian businesses report and pay their Goods and Services Tax (GST) and PAYG withholding to the ATO. For most small businesses, this is a quarterly task. The key to stress-free BAS lodgement is preparation. We strongly advise our clients to set aside the GST they collect and the tax they withhold in a separate bank account. This ensures the funds are always available when it’s time to pay your BAS.

Decoding Your Financial Reports: 3 Statements You Must Understand

Think of your financial reports as a regular health check for your business. They provide a clear, unbiased view of its performance and stability. While the names can sound intimidating, understanding these three core statements is a non-negotiable part of effective small business accounting. They empower you to make informed decisions, identify opportunities, and spot potential issues before they become critical.

Getting comfortable with these documents provides the financial clarity every Australian business owner needs to succeed.

The Profit and Loss (P&L) Statement

The P&L is your business’s report card for a specific period-like a month, quarter, or financial year. It lists all your revenue and subtracts your expenses to arrive at your net profit or loss. It is the definitive tool for answering two fundamental questions:

- Am I actually making money?

- Where is all my money going?

By analysing your P&L, you can identify which services are most profitable, see if your marketing spend is delivering a return, and pinpoint where costs might be getting too high.

The Balance Sheet

If the P&L is a video of your performance over time, the Balance Sheet is a snapshot at a single moment. It’s built on a simple formula: Assets = Liabilities + Equity. In plain English, this means what your business owns (assets like cash and equipment) must equal what it owes to others (liabilities like loans) plus what the owners have invested (equity). It provides a clear answer to the question: ‘What does my business own and what does it owe?’

The Cash Flow Statement

Profit is great, but cash pays the bills. This is the most critical report for day-to-day survival, as it tracks the actual movement of cash into and out of your business. It explains why a profitable business can still run out of money. For instance, you might record a profitable A$15,000 sale, but if the client hasn’t paid the invoice yet, you don’t have the cash. This statement gives you the confidence to answer: ‘Do I have enough cash to pay wages and suppliers next month?’

Understanding these reports is foundational, but interpreting them for strategic growth is where a trusted partner can provide invaluable guidance.

When to Call an Expert: Partnering with a Small Business Accountant

As a dedicated business owner, you’re used to wearing many hats. While managing your own books with software might seem cost-effective initially, there comes a point where DIY accounting can limit your growth and expose you to significant risk. Viewing a professional accountant not as an expense, but as a strategic investment, is a crucial mindset shift. This partnership provides the stability, compliance, and expert guidance needed for long-term success.

Signs It’s Time to Get Professional Help

Recognising when you need support is a sign of strong leadership. While every business is unique, certain trigger points are universal. If you’re experiencing any of the following, it’s a clear signal that it’s time to engage an expert for your small business accounting needs:

- Time Drain: The hours you spend on spreadsheets, payroll, and BAS statements are taking you away from core business activities like strategy, sales, and customer service.

- Increasing Complexity: Your business is growing rapidly, hiring staff, or dealing with more complex transactions. Your simple financial structure no longer fits your operations.

- Major Decisions Ahead: You’re planning to apply for a significant business loan, prepare for a sale, or invest in a major expansion and require accurate financial reporting and projections.

- Compliance Concerns: You’re facing an ATO audit, have fallen behind on your tax obligations, or simply feel uncertain that you are meeting all your responsibilities.

It’s also important to understand the different roles. A bookkeeper manages daily transactions. A registered tax agent is authorised to prepare and lodge tax returns. A Chartered Accountant (CA) goes further, offering high-level strategic advice on business structuring, growth, and financial management, holding one of the profession’s highest designations.

What a Proactive Accountant Does for You

A proactive Chartered Accountant does far more than just lodge your annual tax return. A true partner provides forward-looking advice to help you seize opportunities and navigate challenges. We believe in going beyond the numbers to become a trusted advisor who helps you with:

- Strategic Planning: Offering expert guidance on the right business structure (sole trader, company, trust) for optimal tax efficiency and asset protection.

- Growth Management: Assisting with detailed cash flow forecasting, budgeting, and developing sustainable strategies to fuel your growth.

- A Trusted Sounding Board: Acting as an objective expert to discuss your ideas, concerns, and long-term vision, providing the clarity you need to make confident decisions.

Finding the Right Accountant in Melbourne

When choosing your partner, seek a Chartered Accountant with proven, hands-on experience supporting businesses like yours. Check for consistently positive client reviews and don’t hesitate to ask for testimonials to gauge their reputation and reliability. A local advisor who understands the unique Melbourne business landscape can provide invaluable, context-specific guidance.

A great accountant should feel like an extension of your own team. If you’re ready to gain clarity, confidence, and a strategic partner for your finances, we invite you to schedule a complimentary consultation with our Melbourne team. Let us help you build a stronger, more profitable business.

Your Partner in Financial Clarity and Growth

Mastering your finances is the cornerstone of sustainable growth for any Australian business. As we’ve explored, effective small business accounting is not merely about compliance and tracking expenses; it’s about transforming raw data into strategic intelligence. By setting up solid foundations and learning to decode your key financial statements, you empower yourself to make confident decisions that drive profitability and secure your future.

While these principles provide a clear roadmap, the true power of your financials is often unlocked with an expert guide. You don’t have to navigate this journey alone. At Gartly Advisory, our team of Chartered Accountants brings over 35 years of dedicated expertise, specialising in the unique challenges and opportunities within Melbourne’s small business landscape. Our reputation for proactive advice is reflected in our 70+ 5-Star Google Reviews from business owners just like you.

Your business has incredible potential. Let’s unlock it together.

Talk to us and let us become your trusted partner on your journey to success.

Frequently Asked Questions About Small Business Accounting

What’s the difference between an accountant and a bookkeeper?

Think of a bookkeeper as managing the day-to-day financial records of your business. They handle tasks like data entry, payroll, and reconciling bank accounts to ensure your financial information is accurate and current. An accountant uses this information for higher-level strategy. They analyse your financial health, provide strategic advice, prepare tax returns and financial statements, and help with future planning and compliance.

How much does it cost to hire an accountant for a small business in Australia?

The cost varies based on your business needs. A simple annual tax return for a sole trader might start from A$300-A$500. For more comprehensive, ongoing services like quarterly BAS preparation, payroll, and regular advisory meetings, a small business could expect to pay a monthly fee ranging from A$250 to over A$1,000. It’s a valuable investment in your financial clarity and peace of mind.

Do I really need accounting software like Xero, or can I use Excel?

While you can use Excel, we strongly advise against it for most businesses. Professional cloud accounting software like Xero, MYOB, or QuickBooks is far more efficient and less prone to human error. It automates bank feeds, simplifies GST tracking for your BAS, and provides real-time insights into your cash flow. This frees up your time and gives you the accurate data needed to make smart business decisions.

How often should I be doing my business bookkeeping?

Consistency is crucial for financial health. We recommend setting aside time to update your books at least once a week. This regular habit of reconciling transactions and categorising expenses prevents a stressful pile-up of work, especially when your BAS is due. Staying current provides a clear picture of your business performance and helps you manage cash flow effectively, allowing for proactive decisions rather than reactive ones.

What are the most common accounting mistakes small businesses make?

One of the most frequent errors is mixing business and personal expenses, which complicates tax time and obscures your true financial position. Another common issue is inconsistent or poor record-keeping, leading to missed tax deductions and potential ATO compliance problems. Neglecting regular bookkeeping is also a major pitfall. Establishing solid small business accounting practices early is the best way to avoid these costly mistakes.

As a sole trader, do I need a separate bank account?

While not a strict legal requirement from the ATO, it is an absolute best practice that we strongly recommend. Using a separate bank account exclusively for your business makes tracking income and expenses infinitely simpler. It ensures cleaner records for tax purposes, provides a clear view of your business’s financial health, and presents a more professional image to clients and suppliers. It is a simple step that provides immense clarity.