Small Business Help: Your Ultimate Guide to Thriving in Australia

Running a small business in Australia is a journey of passion, but it can often feel like you’re navigating a complex maze of compliance, tax obligations, and financial uncertainty alone. When you are buried in the day-to-day operations, finding reliable small business help can feel like another item on an endless to-do list, leaving you stuck in survival mode instead of planning for strategic growth. You know you need guidance, but it’s hard to know who to trust.

This is where that changes. Consider this guide your trusted partner on the path to success. We have created a clear roadmap to help you build confidence and take control. Inside, we provide the support you need to master financial management, access Australian government support, and implement practical strategies for sustainable growth. Let’s move beyond the daily pressures and build a thriving business with a strong foundation and the right expert advice by your side.

Key Takeaways

- Mastering key financial tasks like cash flow management and tax planning is the non-negotiable foundation for sustainable business growth.

- Understand the distinct roles of key Australian agencies like the ATO and ASIC to confidently manage your compliance obligations without the overwhelm.

- Effective small business help shifts your focus from daily operations to strategic planning, allowing you to work on your business, not just in it.

- Learn how to identify the right time to engage professional advisors, turning a perceived cost into a strategic investment that saves you time and money.

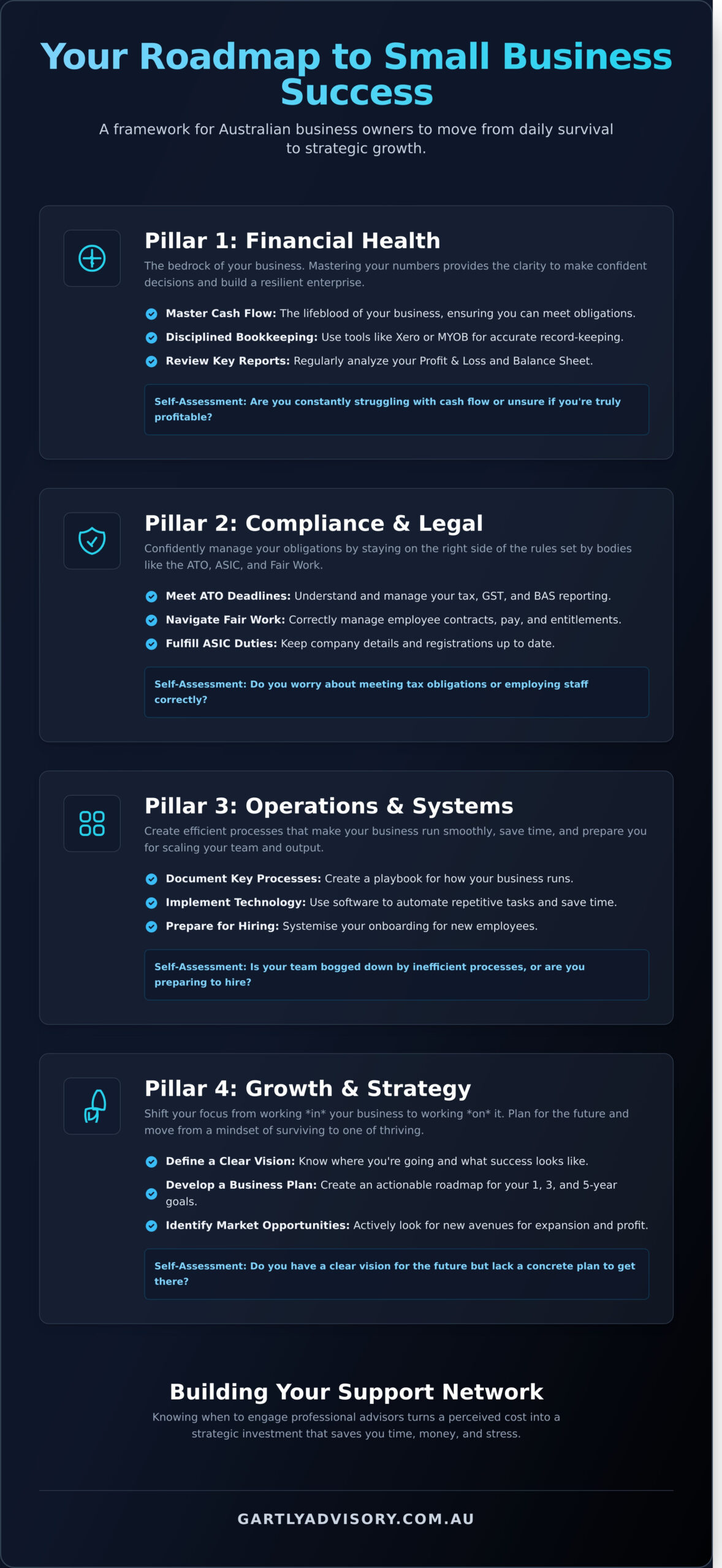

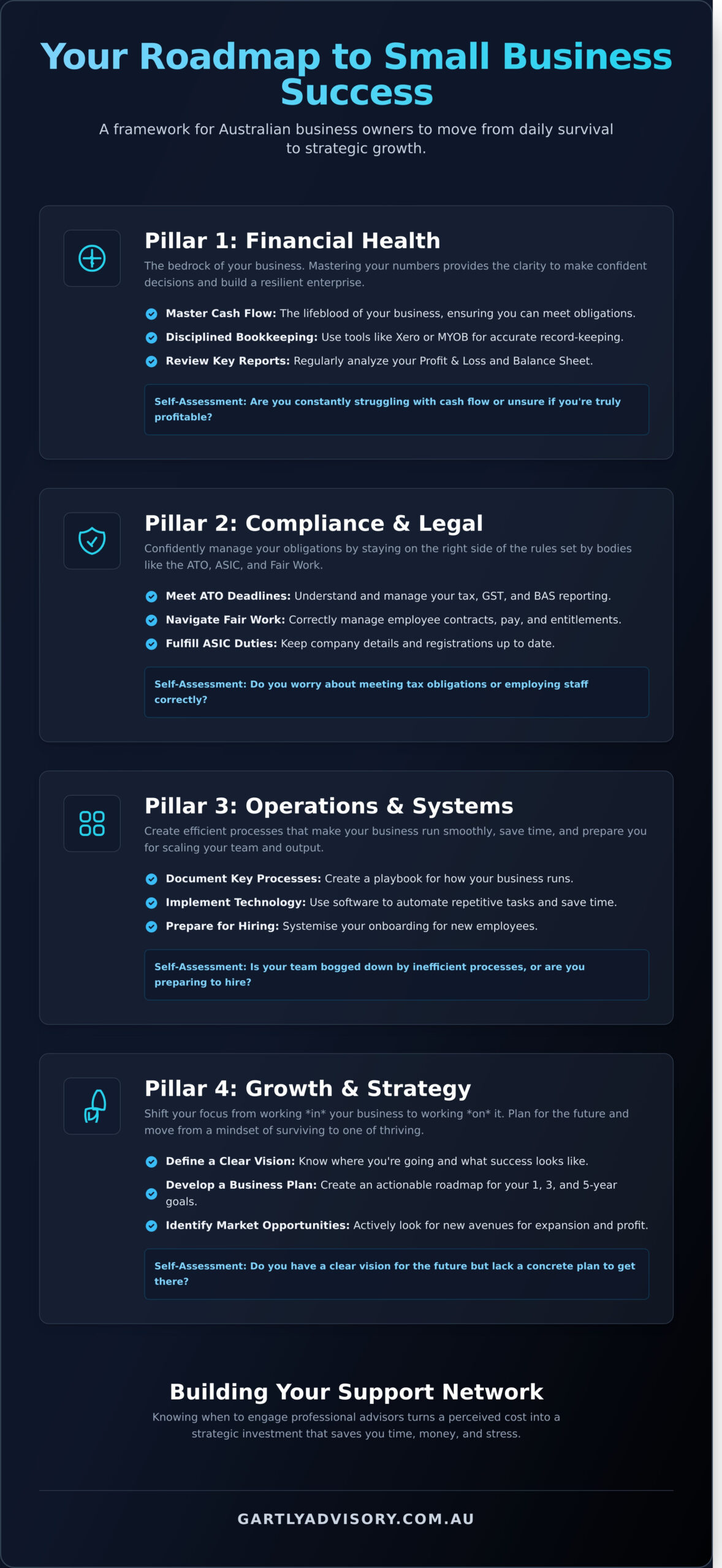

The Four Pillars of Small Business Success: A Framework for Help

Running a small business in Australia is a journey filled with passion, but it can also be overwhelming. The to-do list seems endless, and it’s often difficult to know where to focus your energy. From managing finances to marketing and compliance, wearing every hat can lead to burnout. The key is understanding that seeking targeted small business help isn’t a sign of weakness; it’s a strategic move towards sustainable success. The first step is to bring structure to the chaos. While every enterprise is unique, understanding the official definition of what is a small business highlights the common challenges owners face across the board.

This short video offers a great perspective on the unique challenges and advantages small businesses face:

To provide clear guidance, we can categorise these challenges into four core pillars. This framework helps you identify where you need support most, allowing you to move forward with confidence. As your trusted partner, we can help you build a strong foundation across all four areas.

- Pillar 1: Financial Health – The bedrock of your business, covering cash flow, profitability, and funding.

- Pillar 2: Compliance & Legal – Staying on the right side of the rules set by bodies like the ATO and Fair Work.

- Pillar 3: Operations & Systems – Creating efficient processes that make your business run smoothly day-to-day.

- Pillar 4: Growth & Strategy – Planning for the future and moving from a mindset of surviving to one of thriving.

Why a Framework Matters

Thinking in terms of these pillars transforms a chaotic list of tasks into an organised, actionable plan. It allows you to prioritise your most urgent needs instead of reacting to every small issue. Most importantly, this balanced approach ensures you don’t neglect a critical area of your business, which could undermine your hard work elsewhere. It’s about building a stable, well-rounded enterprise ready for long-term growth.

Self-Assessment: Which Pillar Needs Your Attention Now?

Take a moment to honestly assess where your business stands. Answering these questions can provide clarity on where you need to seek guidance first.

- Are you constantly struggling with cash flow or unsure if you’re truly profitable? (Financial Pillar)

- Do you feel worried about meeting your tax obligations with the ATO or employing staff correctly? (Compliance Pillar)

- Is your team bogged down by inefficient processes or are you considering hiring your first employee? (Operations Pillar)

- Do you have a clear vision for the future but lack a concrete plan to get there? (Growth Pillar)

Financial Help: Mastering Your Numbers for Stability and Growth

For any small business owner, financial literacy is non-negotiable. It’s the language of your business, telling you what’s working, what isn’t, and where the opportunities lie. Understanding your numbers moves you from simply running your business to strategically directing it. This is arguably the most crucial form of small business help you can master, as it provides the clarity needed to make confident decisions, secure funding, and build a resilient enterprise.

Essential Bookkeeping and Accounting

A strong financial foundation starts with disciplined bookkeeping. The first step is always to separate your business and personal finances to ensure clear and accurate records. Modern accounting software like Xero or MYOB can automate much of this work, helping you track income and expenses effortlessly. Regularly reviewing your core financial reports-the Profit and Loss (P&L) statement and the Balance Sheet-gives you a clear snapshot of your financial health and performance.

Cash Flow Management: The Lifeblood of Your Business

It’s a common trap for new owners: confusing profit with cash flow. Simply put, profit is the money your business has earned on paper, while cash flow is the actual A$ moving in and out of your bank account. A business can be profitable yet fail due to poor cash flow. To avoid this, create a simple cash flow forecast and implement strategies to improve it, such as shortening invoice terms, managing stock levels efficiently, and reviewing your major expenses.

Tax Compliance and Planning

Navigating your tax obligations in Australia is a critical responsibility. This includes managing Goods and Services Tax (GST), Pay As You Go (PAYG) withholding for employees, and your own income tax. It is vital to set aside money for these liabilities as you earn it. While there is extensive government support for your business available, a proactive accountant provides guidance that goes beyond lodging returns. They help with strategic tax planning to ensure you are operating as efficiently as possible.

Moving from basic compliance to strategic financial management is the key to unlocking sustainable growth. As your trusted partner, we provide the expert guidance and support to help you master your numbers. Let us help you build a strong financial foundation.

Government Support & Compliance: Navigating the System with Confidence

Navigating the maze of government regulations and compliance can feel daunting for any business owner. The websites can be complex and the obligations unclear. However, understanding the key agencies and your responsibilities is a critical step towards building a compliant and successful enterprise. This knowledge not only prevents costly mistakes but also unlocks valuable opportunities for growth and funding. Let us be your trusted partner in demystifying this process, providing the guidance you need to operate with confidence.

Who’s Who: Key Government Agencies Explained

To effectively manage your obligations, it helps to know who does what. These agencies provide essential frameworks and support for Australian businesses.

- Australian Taxation Office (ATO): Your primary point of contact for all tax matters, including income tax, Goods and Services Tax (GST), and employee superannuation contributions.

- Australian Securities and Investments Commission (ASIC): Responsible for registering and regulating companies, business names, and financial services.

- Fair Work Ombudsman: Provides information and advice about workplace rights and obligations, including employee pay rates and conditions.

- business.gov.au: A central government resource hub offering tools, templates, and direct access to information on grants and support programs.

Your Business Registration Checklist

Getting your business structure and registrations right from the start is fundamental. This is a common area where owners seek professional small business help to ensure a solid foundation.

- Australian Business Number (ABN): You need an ABN to operate your business in Australia, issue invoices, and claim GST credits.

- Business Name vs. Company: A business name is a trading name registered with ASIC, while a company is a separate legal entity offering liability protection. We can help you decide which structure is right for you.

- GST Registration: It is mandatory to register for GST if your business has a current or projected annual turnover of A$75,000 or more.

Finding Grants and Funding

Beyond compliance, the government offers significant support to foster innovation, create jobs, and stimulate economic growth. A fantastic starting point is the official portal for government grants and programs, which features a filterable database to find relevant opportunities. Common grants support areas like research and development, exporting, or regional business expansion. Preparing a strong application requires a clear business case and detailed financial projections; this is strategic small business help where professional advice can make all the difference.

Strategic Growth Help: Moving Beyond Daily Operations

Once your business is established, the daily grind of operations can consume all your time and energy. However, sustainable success requires a crucial mindset shift: you must move from working in your business to working on it. This means stepping back from day-to-day tasks to focus on the bigger picture. It’s about building a resilient, scalable enterprise, not just surviving the week. This is where strategic guidance becomes invaluable, offering a level of proactive support that goes beyond standard compliance.

Creating a Simple, Actionable Business Plan

A business plan doesn’t need to be a hundred-page document. A simple, one-page plan can provide immense clarity and direction. The goal is to define your core purpose and path forward. Start by articulating your:

- Mission: Why does your business exist?

- Vision: Where do you want to be in 3-5 years?

- Target Customer: Who are you serving?

- 12-Month Goals: Set clear, measurable targets for revenue, customer acquisition, or product development.

Marketing and Sales Fundamentals

Growth is driven by effective marketing and sales. First, identify your Unique Selling Proposition (USP)-what makes you different and better than the competition? From there, you can implement simple, low-cost marketing strategies like optimising your Google Business Profile, networking locally, or encouraging customer reviews. Never underestimate the power of exceptional customer service; it’s one of the most powerful tools for generating repeat business and word-of-mouth referrals.

Building Your Team

You can’t do everything yourself forever. Knowing when to hire your first employee is a critical growth milestone. This involves understanding your obligations under Australian law, including superannuation, tax (PAYG), and adhering to Fair Work standards. Alternatively, outsourcing specific tasks to freelancers or contractors can be a flexible, cost-effective way to access specialised skills without the full commitment of hiring permanent staff. Evaluating which path is right for you is a key strategic decision.

Navigating these growth stages requires foresight and expertise. The right kind of small business help is about having a trusted partner who provides strategic advice to help you seize opportunities and build lasting value. If you’re ready to look beyond the numbers and plan for your future, talk to us about becoming your partner on the journey to success.

Building Your Support Network: When to DIY vs. When to Call an Expert

As a small business owner, the instinct to handle everything yourself to manage costs is strong. However, trying to be an expert in every field can lead to costly mistakes and divert your focus from what you do best. The most successful entrepreneurs understand that professional advice isn’t an expense; it’s a strategic investment that saves time, money, and stress in the long run. Knowing who to call and when is a critical part of your growth strategy.

Your Essential Team of Experts

While you are the captain of your ship, you need a skilled crew to navigate complex waters. The right kind of small business help comes from a core team of professionals:

- Bookkeeper: Manages the accurate, day-to-day recording of financial transactions, ensuring your data is always clean and up-to-date.

- Accountant/Tax Agent: Oversees compliance, tax planning, and financial reporting. They interpret your financial data to ensure you meet your obligations and identify opportunities.

- Business Advisor: Focuses on the future. They provide strategic guidance for growth, help you set goals, and hold you accountable for achieving them.

- Lawyer: Essential for setting up the correct legal structure, drafting contracts, reviewing leases, and protecting your intellectual property.

Choosing the Right Accountant and Advisor

Your accountant and business advisor often become your most trusted confidants. Look for a partner, not just a service provider. Seek a qualified professional, such as a Chartered Accountant, with proven experience in your specific industry. They should be a proactive communicator who translates complex financial information into clear, actionable advice. The best advisors offer guidance ‘beyond the numbers’, helping you connect your finances to your broader business goals.

How Gartly Advisory Acts as Your Central Partner

Coordinating advice from different experts can be overwhelming. At Gartly Advisory, we simplify this by combining expert accounting services with strategic business advice under one roof. We act as your central partner, helping you make sense of all the moving parts. Our goal is to provide the comprehensive small business help you need to build a secure and prosperous future. We are here to be your trusted partner for the long term, supporting you on your journey towards success.

Ready to build a team that drives your business forward? Schedule a complimentary chat to build your support network.

Your Journey to Success Starts with the Right Support

Thriving as an Australian business owner comes down to mastering several key pillars: diligent financial management, confident compliance, and a clear strategy for growth. But perhaps the most powerful takeaway is that you don’t have to navigate this journey alone. While this guide provides a roadmap, personalised small business help is what transforms a solid plan into tangible success.

At Gartly Advisory, we are more than just Chartered Accountants; we are your trusted partners. With over 35 years of experience and the trust of Melbourne business owners-reflected in our 70+ 5-star Google reviews-we provide the proactive advice that goes beyond the numbers. We are here to offer guidance and support, helping you solve problems and seize every opportunity.

If you’re ready to build a more resilient and profitable future, we invite you to take the next step. Let’s discuss your business. Schedule your complimentary consultation today. Your vision is achievable, and we’re here to help you build it.

Frequently Asked Questions

What is the most common reason small businesses fail in Australia?

While many factors contribute, poor cash flow management is consistently a leading cause of small business failure in Australia. This isn’t just about a lack of sales; it’s about managing the timing of money coming in and going out. A lack of financial literacy, inadequate starting capital, and failing to plan for large expenses can quickly exhaust resources. Securing professional guidance to create robust financial forecasts and controls is a crucial step towards long-term stability and success.

Do I need a business advisor if I already have an accountant?

While there can be overlap, an accountant traditionally focuses on historical data, tax compliance, and financial reporting. A business advisor takes a forward-looking, strategic role. They use your financial data to provide guidance on growth, profitability, operational efficiency, and long-term strategy. Think of it this way: your accountant ensures you are compliant, while your business advisor partners with you to build a more valuable and successful future, going beyond the numbers.

How much should I expect to pay for small business accounting help?

The cost for small business accounting help in Australia varies based on complexity and expertise. Basic bookkeeping services can range from A$50 – A$100 per hour. For more comprehensive support, many businesses opt for a fixed monthly package, which might start from A$300 – A$500 for compliance and reporting. Strategic advice from an experienced Chartered Accountant is a higher-value service, priced accordingly. It’s best to view these costs as an investment in your financial clarity and growth.

What’s the first step I should take to get help for my struggling business?

The most critical first step is to gain absolute clarity on your financial position. Stop guessing and get an objective assessment of your cash flow, debts, and profitability. A confidential consultation with a trusted business advisor can provide this clarity and help you identify the core issues. This initial diagnostic review is the foundation for creating a viable turnaround plan. Seeking professional small business help early is not a sign of failure, but a proactive step towards recovery.

Can I run my business as a sole trader, or do I need to register a company?

Choosing between a sole trader and a company structure in Australia depends on your liability and goals. As a sole trader, you are personally liable for all business debts, but setup is simpler and cheaper. Registering a company (Pty Ltd) creates a separate legal entity, limiting your personal liability. While it involves higher setup and ongoing compliance costs, it is often preferred for businesses planning to grow, seek investment, or employ staff. Professional advice is essential to choose the right structure.

Where can I get free help or mentoring for my small business?

Yes, several excellent free and low-cost resources are available. The Australian government’s business.gov.au website offers a wealth of guides, templates, and information. State-based services, like Small Business Victoria or Service NSW, provide low-cost workshops and advisory sessions. Additionally, non-profit organisations such as the Small Business Mentoring Service (SBMS) connect experienced mentors with business owners for confidential, low-cost guidance. These are great starting points for foundational support and direction.