What is the Downsizer Contribution? A Simple Guide for Australians

Selling your family home is a significant financial milestone, but navigating what to do with the proceeds can feel complex and overwhelming. You may have heard about the opportunity to boost your superannuation, but the official rules often seem confusing, raising valid concerns: Am I eligible? What if I make a mistake that leads to a penalty? How will this affect my Age Pension? These are critical questions, and the fear of getting it wrong can be paralysing when planning for your retirement.

This is where the downsizer contribution scheme presents a powerful opportunity, and we are here to provide the clear guidance you need. In this simple guide, we will be your trusted partner, breaking down the rules, benefits, and potential traps in plain English. We will walk you through the eligibility criteria step-by-step, helping you understand if this strategy is the right choice for your retirement savings. Our goal is to replace uncertainty with confidence, empowering you to make the best decision for your financial future.

What is the Downsizer Contribution? The Basics Explained

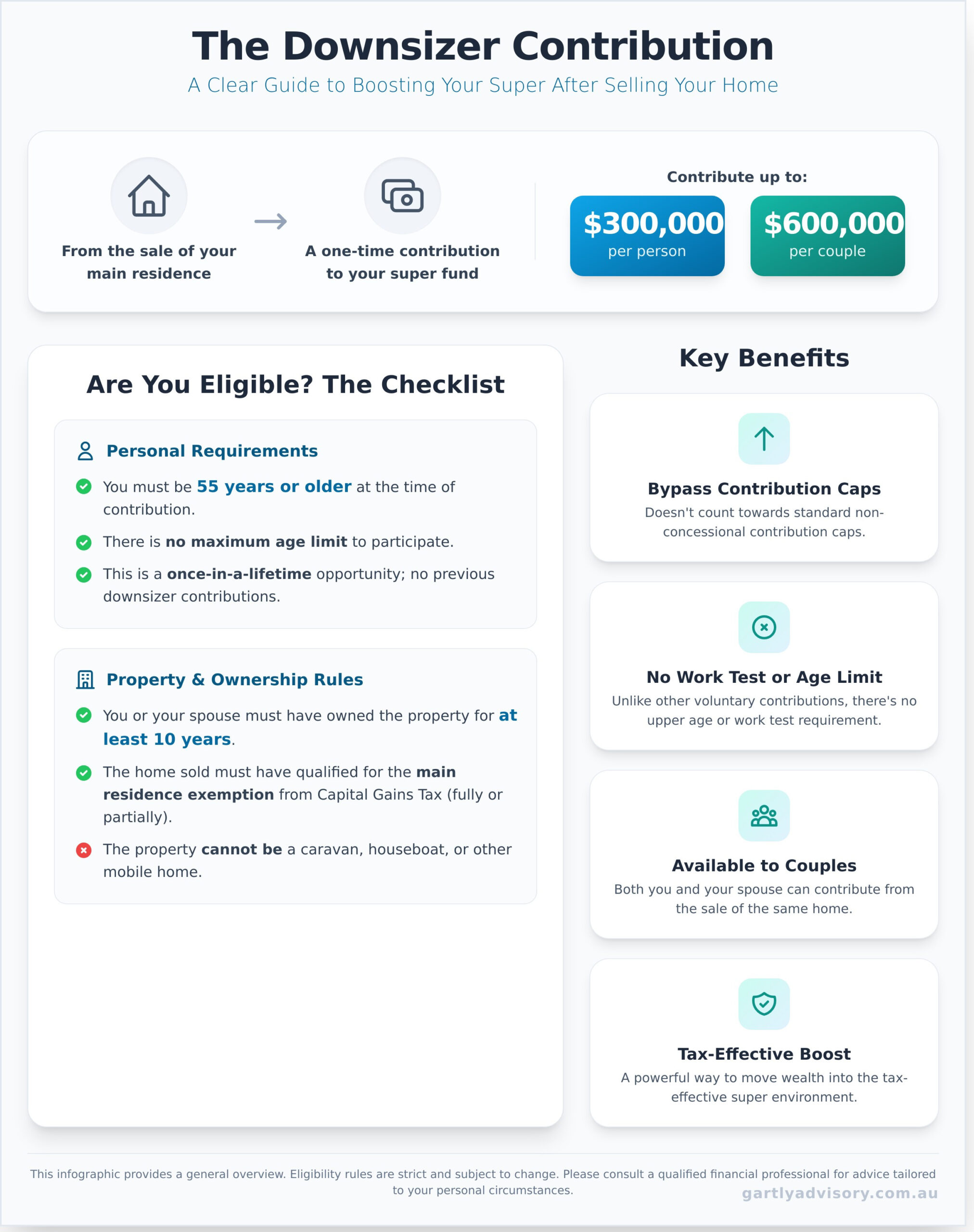

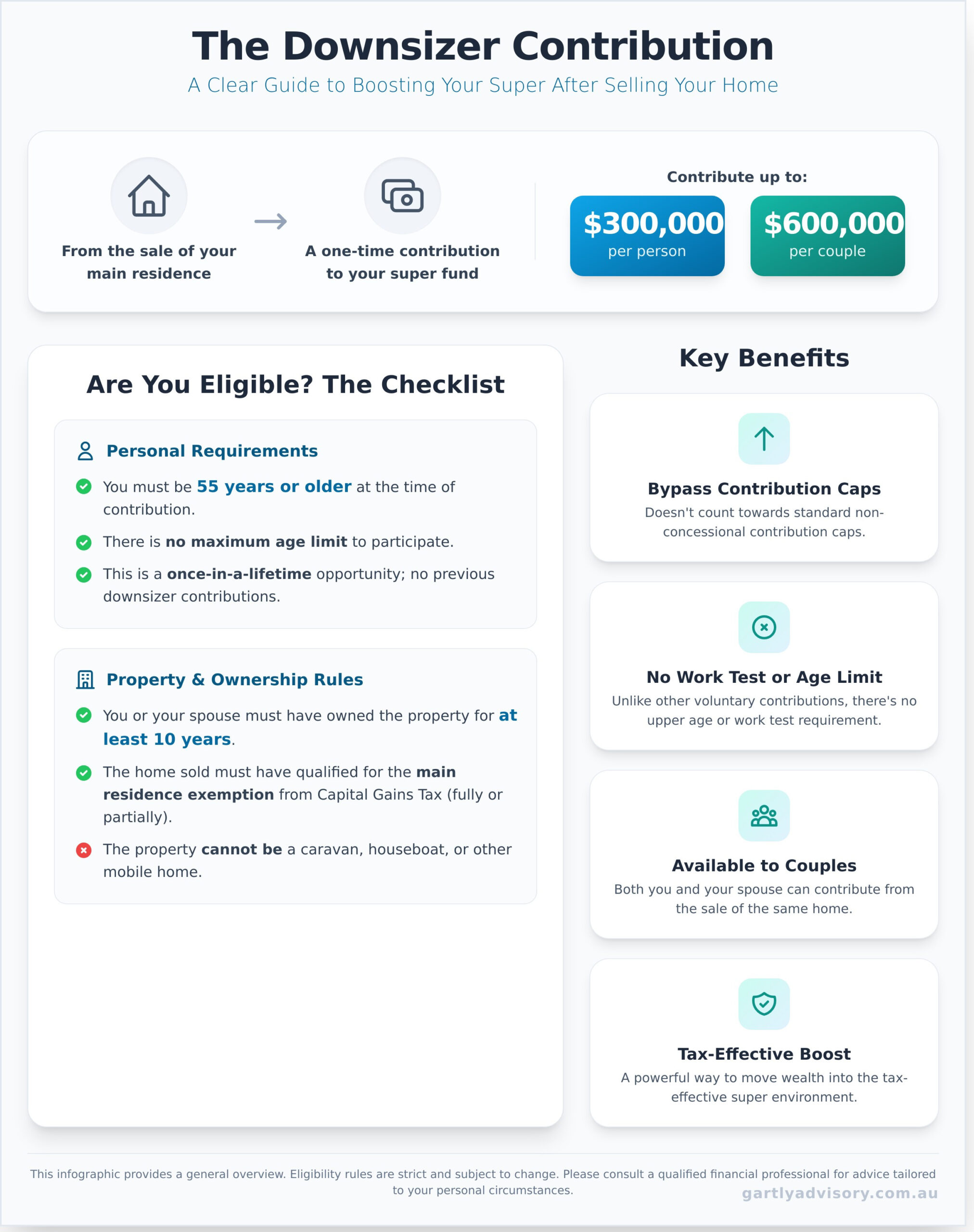

The downsizer contribution scheme is a powerful opportunity for older Australians to significantly boost their superannuation savings. In simple terms, it allows eligible individuals to make a one-time contribution to their super fund using the proceeds from the sale of their main residence. The primary purpose of this scheme is to provide a way for those nearing or in retirement to transfer wealth locked in their family home into the tax-effective superannuation environment, supporting a more comfortable retirement.

One of the most significant advantages of making a downsizer contribution is that it does not count towards the standard concessional or non-concessional contribution caps. This provides a unique pathway to grow your super, even if you have already maximised your other contributions. Each eligible person can contribute up to $300,000 from the sale of one home.

To better understand this valuable strategy, watch this helpful overview:

Who is the Downsizer Scheme For?

This scheme is specifically designed for individuals aged 55 or over who are selling a home that has been their main residence. It is particularly beneficial for those who have built substantial equity in their property over many years but may have limited superannuation savings. Interestingly, while the name suggests you must be downsizing your home, you are not required to purchase a new, smaller, or cheaper property to be eligible.

Key Benefits at a Glance

Understanding the advantages can help you decide if this is the right strategy for your retirement plan. Here are the core benefits:

- Bypass Contribution Caps: It is separate from the non-concessional contribution caps, allowing you to add a large sum to your super without penalty.

- No Work Test or Age Limit: Unlike many other types of super contributions, there is no work test requirement or upper age limit to be eligible.

- Available to Couples: Both members of a couple can make a contribution of up to $300,000 each (a total of $600,000) from the sale of the same home.

- A Tax-Effective Boost: It provides a significant, tax-effective injection of funds into your retirement nest egg, helping you secure your financial future.

Are You Eligible? A Detailed Eligibility Checklist

The downsizer contribution strategy can be a powerful way to boost your superannuation, but eligibility is strict. The Australian Taxation Office (ATO) has a clear set of rules, and you must meet every single one to qualify. This checklist breaks down the requirements to help you determine if this opportunity is right for you.

Age and Personal Requirements

First, let’s look at the personal criteria you must satisfy. These rules are straightforward and focus on your age and contribution history.

- You must be 55 years or older at the time you make your contribution to your super fund.

- There is no maximum age limit, making it a flexible option even if you are over the age of 75 and typically unable to make voluntary contributions.

- This is a once-in-a-lifetime opportunity; you cannot have made a downsizer contribution before from the sale of a previous home.

Your Property and Ownership Rules

The eligibility rules also extend to the property you have sold. The home must meet specific criteria related to its location and how long you have owned it.

- The property sold must be located in Australia and cannot be a caravan, houseboat, or other mobile home.

- You or your spouse must have owned the property for a continuous period of at least 10 years.

- This 10-year ownership clock is measured from the settlement date of your purchase to the settlement date of your sale.

The Main Residence Exemption Explained

This is a critical technical requirement. The home you sold must have been your main residence at some point, meaning it is eligible for the main residence exemption from Capital Gains Tax (CGT). For most homeowners, this simply means it was the primary home you lived in. Even if it was only your main residence for part of the 10-year ownership period (giving you a partial exemption), you may still be eligible. For a clear overview of the Downsizer contribution basics, the government’s Moneysmart website is an excellent resource. It’s also worth noting that properties owned continuously since before 20 September 1985 (known as pre-CGT assets) also qualify.

Navigating these criteria requires careful attention to detail. As the rules relate directly to complex tax and superannuation law, we strongly advise discussing your specific circumstances with a qualified professional. Let us provide the guidance you need to make this important financial decision with confidence.

How to Make a Downsizer Contribution: A Step-by-Step Process

Navigating the process to make a downsizer contribution is straightforward, but it requires careful attention to detail and timing. To ensure you meet all the requirements and your contribution is accepted without issue, we have broken down the process into three clear stages. Following these steps will provide you with the guidance needed to successfully boost your superannuation savings after selling your home.

Step 1: Before You Make the Contribution

Proper preparation is the key to a smooth process. Before you sell your home or make any payments, it’s essential to complete these preliminary checks. This proactive approach ensures you are eligible and that your super fund is ready to receive the funds.

- Confirm your eligibility: Revisit the eligibility checklist in the previous section to ensure you meet all the criteria, from age to property ownership history.

- Speak with your super fund: Contact your fund to confirm they accept downsizer contributions and to understand their specific process for receiving the payment and form.

- Obtain the correct paperwork: Download the ‘Downsizer contribution into super form’ directly from the Australian Taxation Office (ATO) website. This form is mandatory.

Step 2: The 90-Day Contribution Window

Timing is the most critical element of making a successful downsizer contribution. You have a strict window of 90 days from the date you receive the proceeds of the sale to make your contribution. This date is typically the day of settlement. It is vital to have your funds and paperwork organised well before this deadline. The timing is strictly enforced, as detailed in the official ATO guidelines on downsizer contributions. While it is possible to apply to the ATO for an extension in limited circumstances, this should not be relied upon.

Step 3: Lodging the Form and Making the Payment

With your eligibility confirmed and timing understood, the final step involves submitting the form and transferring the funds to your superannuation account. You must complete the ‘Downsizer contribution into super form’ and provide it to your super fund before or at the same time you make your payment. Submitting the form afterwards can lead to your contribution being miscategorised. You can then make the payment to your super fund using their preferred method, which is typically BPAY or an Electronic Funds Transfer (EFT). Your fund will then process the payment and report it to the ATO as a downsizer contribution.

Strategic Considerations: Is It the Right Move for You?

Understanding the eligibility rules for the downsizer contribution is the first step, but the real question is whether it aligns with your long-term retirement strategy. At Gartly Advisory, we believe in looking beyond the numbers to help you make decisions that truly support your financial goals. This contribution strategy has significant benefits, but it also comes with important implications that every potential downsizer should consider.

Beyond the financial aspects, it’s also important to acknowledge the emotional weight of selling a family home filled with memories. This transition can bring feelings of grief or anxiety, and seeking support is a valid part of the process. If you find yourself struggling with these emotions, speaking with a grief counselor near me can provide valuable guidance during this significant life change.

Impact on the Age Pension and Centrelink

One of the most critical factors to weigh is the effect on your potential Age Pension entitlements. Your primary residence is an exempt asset under Centrelink’s assets test. However, when you sell your home and transfer a large sum into your superannuation fund, that money becomes an assessable asset. This increase in your assessable assets could reduce your Age Pension payments or even make you ineligible. It’s a classic case of solving one problem (boosting super) while potentially creating another (reducing government support).

Comparing Downsizer vs. Other Contribution Types

The downsizer contribution holds a unique position compared to other ways of getting money into super, particularly non-concessional contributions (NCCs). Here’s why it stands out:

- It bypasses contribution caps: It does not count towards your annual non-concessional contribution cap, allowing you to add a significant lump sum over and above the usual limits.

- No total super balance limit: Unlike NCCs, you can make a downsizer contribution even if your total super balance is already over the general transfer balance cap (currently $1.9 million).

This makes it an invaluable opportunity for individuals who have already maximised their other contribution options but wish to further bolster their retirement savings.

When to Seek Professional Advice

Navigating the interplay between property sales, superannuation rules, and Centrelink assessments is complex. A misstep can have long-lasting financial consequences. Seeking professional guidance ensures you not only meet all the eligibility criteria but also understand the full impact on your retirement plan.

An experienced advisor can model how a contribution will affect your Age Pension, help you structure your finances optimally, and provide the clarity needed to move forward with confidence. Let us be your trusted partner in planning for retirement.

Common Scenarios and Potential Traps to Avoid

The downsizer contribution is a powerful retirement planning tool, but its rules are strict. Understanding how they apply in practice can help you maximise the benefits and avoid costly mistakes. Navigating these complexities requires careful planning, and this is where professional guidance provides significant peace of mind.

Scenario: Can a Couple Both Contribute?

Yes, this is one of the most beneficial aspects of the scheme. A couple can potentially contribute up to a combined $600,000 into super from the sale of a single home. The key rule is that as long as one spouse meets the 10-year ownership test for the property, both partners can make a contribution of up to $300,000 each. However, it’s crucial to remember that each individual must personally meet the other eligibility criteria, such as the age requirement, at the time the contribution is made.

Trap: The ‘One-Time-Only’ Rule

It is critical to understand that the downsizer contribution is a one-time opportunity per person. You cannot make multiple contributions from the same home sale, nor can you use the concession again if you sell another eligible home in the future. For example, if you are eligible to contribute the full $300,000 but only choose to contribute $200,000, you forfeit the remaining $50,000 permanently. This makes upfront strategic planning essential to ensure you make the most of this single chance.

Trap: Getting the Timing Wrong

The Australian Taxation Office (ATO) enforces a strict deadline. You must make your contribution within 90 days of receiving the sale proceeds, which is typically the date of settlement. Missing this deadline can have significant financial consequences.

If your contribution is late, it may not be accepted as a downsizer contribution. Instead, it could be treated as a regular non-concessional contribution. This could inadvertently cause you to exceed your contribution caps, potentially leading to substantial penalty tax. Given the inflexibility of this rule, timely action is paramount.

To ensure your strategy is sound and you are positioned to take full advantage of this opportunity, we recommend seeking professional support. Talk to us to receive trusted advice for your retirement journey.

Making the Downsizer Contribution Work for You

As we have explored, the downsizer contribution scheme offers a powerful opportunity for eligible Australians to significantly boost their superannuation after selling their family home. However, navigating the strict eligibility criteria and understanding the long-term strategic implications is crucial. This is more than just a transaction; it is a key decision that can shape your entire retirement lifestyle and requires careful planning to avoid potential traps.

Making this decision with confidence requires guidance from a partner who understands the complexities of retirement and SMSF strategies. With over 35 years of experience and more than 70 5-Star Google Reviews from Melbourne clients, the Chartered Accountants at Gartly Advisory specialise in providing the trusted support you need for your journey.

If you are ready to explore how this strategy fits into your financial future, we are here to provide the clarity you deserve. Schedule a consultation to discuss your retirement strategy with a trusted advisor. Let us be your partner in building a secure and prosperous future.

Frequently Asked Questions About the Downsizer Contribution

Do I have to buy a new, smaller home to be eligible for the downsizer contribution?

No, you are not required to buy another property. Despite the name, the rules do not require you to purchase a new or smaller home. Eligibility is based on the sale of your main residence, not what you do with the proceeds. This gives you the flexibility to rent, move into aged care, travel, or make other living arrangements that suit your retirement lifestyle. Our team can provide guidance on your options.

Does the downsizer contribution count towards my contribution caps?

No, it does not. This is a significant advantage of the scheme. The downsizer contribution is entirely separate from and does not count towards your annual non-concessional (after-tax) or concessional (pre-tax) contribution caps. This allows you to make a substantial one-off contribution to your super, even if you have already maximised your other caps for the financial year, providing a powerful boost to your retirement funds.

Can I use the proceeds from selling an investment property for a downsizer contribution?

No, the property sold must have been your main residence for at least part of the time you owned it. To qualify, the home must be eligible for at least a partial main residence exemption from Capital Gains Tax (CGT). A property that has exclusively been used for investment purposes and was never your primary place of residence will not meet the eligibility criteria for this particular scheme.

What happens if I contribute more than the sale proceeds of my home?

You cannot contribute more than the total capital proceeds from the sale of your home. The contribution amount is capped at the lesser of the sale proceeds or A$300,000 per eligible person. For example, if a couple sells their home for A$500,000, their total combined downsizer contributions cannot exceed A$500,000. The A$300,000 individual limit is the maximum, but the sale price always sets the ultimate ceiling.

Can I use the downsizer contribution to start a Self-Managed Super Fund (SMSF)?

Yes, absolutely. Using these funds can be an excellent strategy to establish a new Self-Managed Super Fund (SMSF) or add a significant sum to an existing one. This can provide your fund with the necessary capital to begin its investment strategy on a solid footing. As SMSF compliance can be complex, we recommend seeking our expert advice to ensure your fund is structured and managed correctly from day one.

Is there a ‘total super balance’ limit that prevents me from making a downsizer contribution?

No, there is no total super balance test for making a downsizer contribution. This is another key benefit that sets it apart from other contribution types. Even if your total super balance is above the general non-concessional cap threshold (currently A$1.9 million), you can still make an eligible contribution. This provides a valuable opportunity for those with larger super balances to add more funds to their retirement savings.