Foreign Resident Capital Gains Withholding: A Complete Guide for 2026

Foreign Resident Capital Gains Withholding: A Complete Guide for 2025

Selling or purchasing Australian property should be an exciting milestone, not a source of stress and confusion. Yet, navigating the Australian Taxation Office’s (ATO) complex regulations can feel overwhelming, particularly when it comes to the rules on foreign resident capital gains withholding (FRCGW). The fear of misinterpreting your obligations, facing costly penalties, or causing delays at settlement is a common concern for both buyers and sellers, especially with key changes on the horizon for 2025.

This guide was created to be your trusted resource. We are here to provide clear, practical advice that cuts through the jargon. We will explain exactly who is responsible for what, how to manage the FRCGW process correctly, and when to apply for a clearance certificate or a variation. Our goal is to empower you with the knowledge to proceed with confidence, ensuring your property transaction is smooth, compliant, and free from any unwelcome surprises from the ATO.

What is Foreign Resident Capital Gains Withholding (FRCGW)?

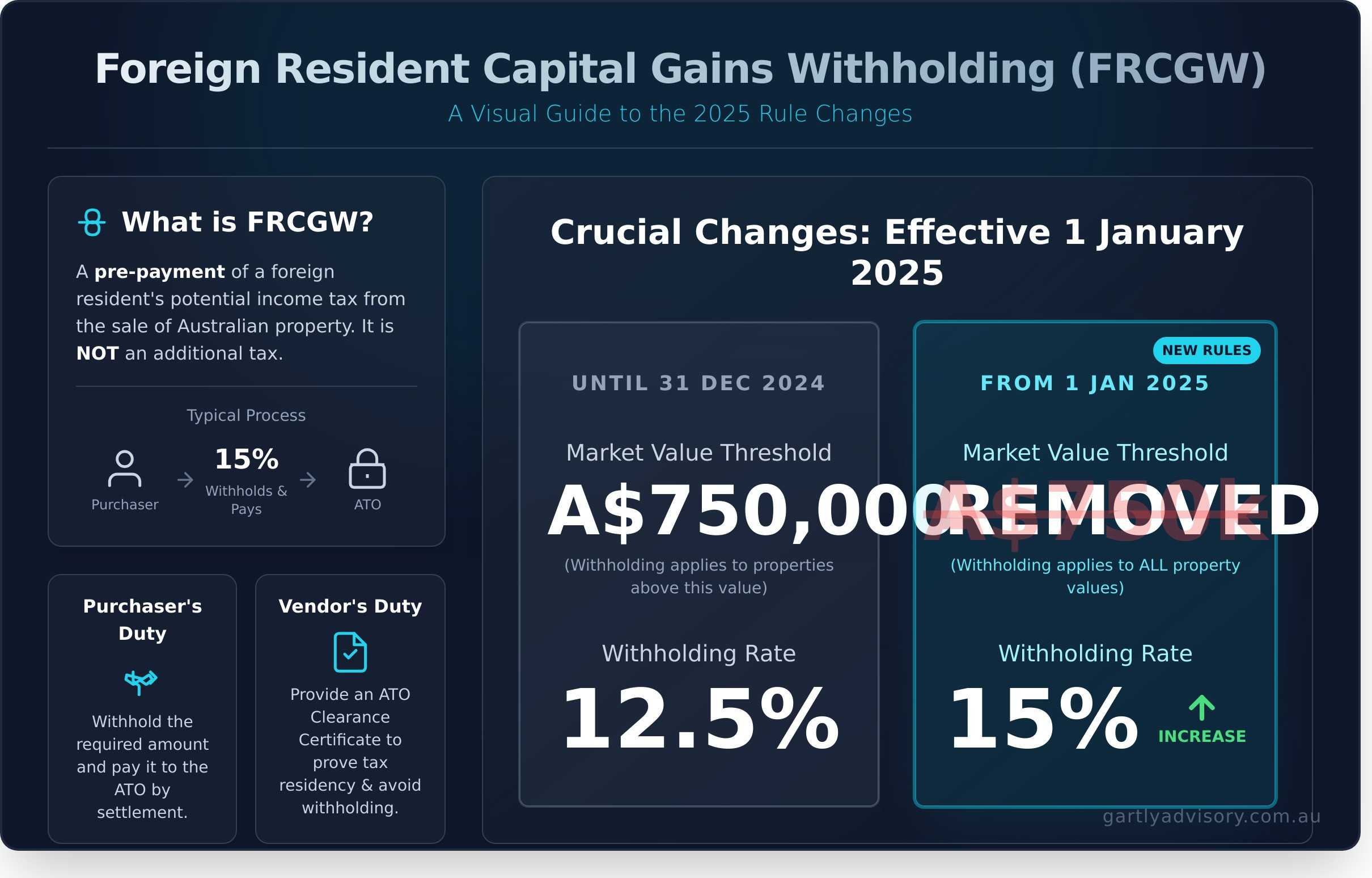

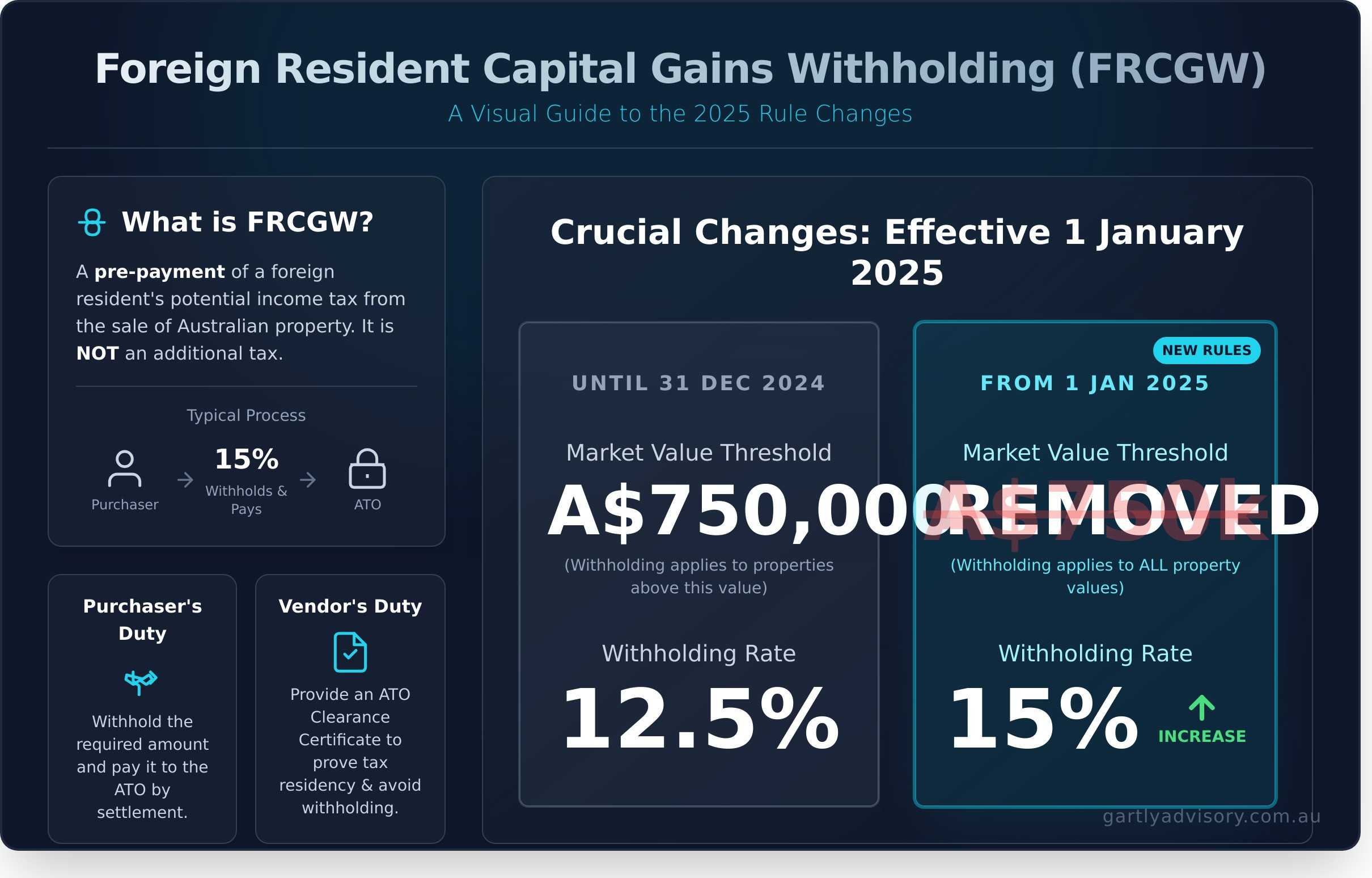

Navigating the complexities of Australian property transactions can be challenging, and the Foreign Resident Capital Gains Withholding (FRCGW) regime is a critical component that every buyer and seller must understand. In simple terms, FRCGW is a mechanism that ensures foreign residents meet their tax obligations when they sell certain Australian assets, most commonly real estate. It’s important to recognise that this is not an additional tax. Instead, it is a prepayment of the seller’s final income tax liability, which is withheld by the purchaser at settlement and paid directly to the Australian Taxation Office (ATO).

To see how this process works in practice, this short video provides a clear overview:

The system places the responsibility on the purchaser (the buyer) to withhold the funds. By default, the rules apply to every relevant transaction unless the vendor (the seller) can prove they are an Australian resident for tax purposes by providing a valid ATO clearance certificate. Without this certificate, the purchaser is legally obligated to withhold the specified amount from the sale proceeds.

Crucial Changes from 1 January 2025

Significant changes to the foreign resident capital gains withholding rules took effect from 1 January 2025, broadening their scope considerably. It is vital for all parties involved in property transactions to be aware of these updates:

-

Withholding Rate Increase: The withholding rate has been increased from 12.5% to 15% of the purchase price.

-

Threshold Removal: The previous A$750,000 market value threshold has been removed entirely.

This means the FRCGW rules now apply to all relevant real property contracts entered into from this date, regardless of the property’s value. This change heightens the importance of due diligence for every property purchaser in Australia, as the obligation to withhold now applies universally unless an exemption is established.

Who is Considered a ‘Foreign Resident’ for Tax Purposes?

Determining who is a ‘foreign resident’ is more complex than it sounds. It is not based on citizenship, visa status, or nationality. Instead, residency is a specific tax concept determined by a series of tests administered by the ATO.

This is a key part of the broader Capital Gains Tax in Australia framework, and an individual can be an Australian citizen living abroad and still be considered a foreign resident for tax purposes. The same applies to entities; companies and trusts can also be classified as foreign residents. Given the significant financial implications, it is crucial for vendors to determine their residency status early in the sale process to prevent unexpected withholding and ensure a smooth settlement.

The Purchaser’s Obligations: How to Withhold and Pay the ATO

When purchasing certain Australian assets from a foreign resident, the legal responsibility to withhold a portion of the purchase price falls squarely on you, the purchaser. This is a critical duty, as failing to comply with the foreign resident capital gains withholding (FRCGW) rules can result in significant penalties. The Australian Taxation Office (ATO) can hold you liable for the entire withholding amount, plus interest and other charges. It is essential to manage this process correctly, ensuring the withheld amount is paid to the ATO on or before the settlement day.

Step 1: Determine if Withholding is Required

Your first step is to confirm if the transaction falls under the FRCGW rules. This involves a few key checks:

-

Asset Type: The rules primarily apply to transactions involving taxable Australian real property with a market value of A$750,000 or more.

-

Vendor’s Residency: You must request a valid ATO Clearance Certificate from the vendor. This document confirms the vendor is an Australian resident for tax purposes, exempting the transaction from withholding.

-

Variation Notice: If the vendor provides an ATO Variation Notice instead, you must withhold the reduced rate specified in the notice.

-

No Certificate: If the vendor fails to provide a valid certificate or notice by settlement, you are legally required to proceed with withholding 12.5% of the purchase price.

Step 2: Lodging the Purchaser Payment Notification Form

Once you’ve determined that withholding is necessary, you must complete the FRCGW Purchaser Payment Notification form online via the ATO portal. This form must be lodged before you pay the withholding amount. You will need key information, including the details of the purchaser, vendor, and the property or asset being acquired. Upon successful lodgement, the ATO will provide you with a unique Payment Reference Number (PRN), which is essential for the next step.

Step 3: Making the Payment to the ATO

Using the PRN, you must pay the withheld amount to the ATO on or before the day of settlement. Navigating these steps correctly is critical, as errors can cause settlement delays. For complex transactions, understanding how a Chartered Accountant Can Help You Navigate FRCGW provides valuable insight into ensuring compliance. After making the payment, you will receive a receipt from the ATO. It is standard practice to provide a copy of this receipt to the vendor at settlement as proof that you have fulfilled your obligation.

This process can seem daunting, but it is a manageable part of the settlement process with the right guidance and support. Need help managing your obligations? Talk to our team.

The Vendor’s Responsibilities: Clearance Certificates & Variations

As the property vendor, your primary responsibility is to clarify your residency status to the purchaser. Your goal is to ensure the correct amount of tax is withheld at settlement—or, if you are an Australian resident, to prevent any withholding altogether. The Australian Taxation Office (ATO) provides two key documents to manage this obligation: a clearance certificate or a variation notice.

Proactively managing this process is critical. We strongly advise you to apply for the relevant document as soon as you decide to sell your property. Delays in obtaining these forms can lead to complications and postpone settlement, causing unnecessary stress and potential financial costs. By providing the correct documentation, you give the purchaser the legal certainty they need to proceed without withholding tax or to withhold at a reduced rate.

For Australian Residents: The ATO Clearance Certificate

This certificate serves as official confirmation from the ATO that you are an Australian resident for tax purposes. When you provide a valid clearance certificate to the purchaser before settlement, you exempt them from their obligation to withhold any funds. You can apply online via myGov or ask a registered tax agent to assist you. A clearance certificate is valid for 12 months and covers all properties you sell during that period. Without it, the purchaser must legally withhold 12.5% of the purchase price.

For Foreign Residents: The FRCGW Variation Notice

If you are a foreign resident, the default 12.5% withholding rate may be higher than your actual capital gains tax liability. In these circumstances, you can apply to the ATO for a variation to reduce the rate, potentially to zero. A successful variation ensures the amount withheld is a more accurate reflection of your tax situation, improving your cash flow from the sale.

Common reasons for applying to vary the foreign resident capital gains withholding rate include:

-

- The sale of the property will result in a capital loss, not a gain.

-

- You have sufficient carried-forward capital losses from prior years to offset the current capital gain.

-

- There are specific circumstances, such as a deceased estate, where a full or partial exemption may apply.

The application requires detailed calculations and supporting evidence to justify the varied rate. Seeking professional guidance can provide peace of mind and ensure your application is robust and processed without delay.

Key Assets and Transactions Affected by FRCGW

A common misunderstanding is that the foreign resident capital gains withholding (FRCGW) rules apply only to the sale of residential houses. In reality, the scope is far broader, designed to capture a wide range of Australian assets. The key concept to understand is ‘taxable Australian real property’ (TARP), which includes not only direct ownership of land and buildings but also certain indirect interests.

Navigating these definitions is crucial for compliance. To provide clarity, we have outlined the primary asset classes that fall under the FRCGW regime, as well as those that are typically excluded.

Direct Real Estate Interests

These are the most straightforward assets captured by the withholding obligation. If the property’s market value is A$750,000 or more, the rules will likely apply. This category includes:

-

Residential Property: Houses, apartments, units, and townhouses.

-

Commercial Property: Office buildings, retail shops, and industrial warehouses.

-

Land: Both vacant land and rural properties like farms.

-

Leasehold Interests: A long-term lease over real property can also be considered a TARP asset.

Indirect Interests and Other Assets

The FRCGW regime extends beyond physical property. It also applies to the disposal of indirect interests where the underlying value is derived from Australian real property. This ensures that the substance of the transaction, not just its form, is considered. Key examples include:

-

Shares in a Company: Selling shares in a private company where more than 50% of the company’s asset value is attributable to TARP.

-

Units in a Trust: The disposal of units in a trust that holds significant Australian real property assets.

-

Mining and Quarrying Rights: Certain mining, quarrying, or prospecting rights are also classified as TARP.

Exemptions and Excluded Assets

Not every transaction involving a foreign resident triggers a withholding obligation. The Australian Taxation Office (ATO) has specified several key exemptions. Assets and transactions typically excluded from FRCGW include:

-

Transactions conducted through an approved stock exchange.

-

The sale of business assets that are not real property, such as trading stock or equipment.

-

Certain transactions resulting from an inheritance or relationship breakdown are subject to specific, complex rules that require professional assessment.

Determining whether an asset falls under these rules can be complex. As your trusted partner, Gartly Advisory provides the expert guidance needed to ensure you meet your obligations correctly. If you need support with your transaction, please contact us for a consultation.

How a Chartered Accountant Can Help You Navigate FRCGW

Navigating the Australian Taxation Office’s (ATO) requirements for property transactions can be complex, especially when they involve foreign residents. The rules are strict, and a simple oversight can lead to significant penalties and costly settlement delays. This is where the guidance of an experienced Chartered Accountant becomes invaluable, providing the support you need to ensure full compliance with the foreign resident capital gains withholding regime.

Our proactive approach is designed to protect your interests. We manage all necessary applications and liaise directly with the ATO on your behalf, ensuring every detail is handled correctly and efficiently. This allows you to proceed with your property transaction with confidence and peace of mind.

Services for Purchasers

As a purchaser, your obligation is to withhold and remit the required amount to the ATO. We simplify this process and ensure you meet your legal duties. Our support includes:

-

Verifying the validity of any clearance certificates or variation notices supplied by the vendor.

-

Accurately completing and lodging the Purchaser Payment Notification form with the ATO.

-

Ensuring the withheld amount is paid to the ATO on time to avoid interest and penalties.

-

Providing clear guidance throughout the transaction, so you always know what to expect.

Services for Vendors

For vendors, our focus is on minimising your tax obligations and ensuring you receive your full entitlements. Our proactive support helps you avoid unnecessary withholding at settlement. We can:

-

Accurately assess your Australian tax residency status.

-

Prepare and lodge applications for clearance certificates or variations to reduce the withholding rate.

-

Provide strategic advice on the capital gains tax implications of your property sale.

-

Assist you in lodging your tax return to claim a credit for any amount that was withheld.

Your Trusted Partner in Property Transactions

At Gartly Advisory, we provide advice that goes beyond the numbers. We act as your strategic partner, working closely with your conveyancer or solicitor to facilitate a seamless and compliant process from start to finish. Our extensive experience in property tax means we can anticipate challenges and prevent issues before they arise, ensuring a smooth settlement.

While the tax laws discussed here are specific to Australia, the core principle of relying on seasoned professionals is universal in real estate. Whether it’s a tax advisor in Sydney or a brokerage like Ray Lyon Realty navigating the complexities of the Westside Los Angeles market, having an expert team is key to a successful transaction.

Don’t let tax complexities derail your property transaction. Schedule a consultation with our property tax experts today.

Your Trusted Partner for FRCGW Compliance

Navigating the complexities of the foreign resident capital gains withholding regime is crucial for a smooth property transaction in Australia. As we’ve covered, both purchasers and vendors have significant responsibilities, from the purchaser’s duty to withhold 12.5% of the purchase price to the vendor’s need to secure a valid clearance certificate from the ATO. Overlooking these obligations can lead to costly delays and financial penalties, turning an exciting milestone into a stressful ordeal.

You don’t have to manage these complexities alone. As Chartered Accountants and registered tax agents with over 35 years of experience in Australian tax law, we provide the clear, proactive guidance needed to ensure compliance and protect your interests. Let us be your trusted partner for navigating complex property matters. Contact our team for expert guidance on your property transaction. With the right support, you can proceed with confidence and peace of mind.

Frequently Asked Questions

What happens if the vendor doesn’t provide a clearance certificate before settlement?

If a vendor fails to provide a valid ATO clearance certificate by settlement, the purchaser is legally obligated to withhold 12.5% of the property’s purchase price. This amount must be paid directly to the Australian Taxation Office (ATO). This is a strict liability for the purchaser, and failure to comply can result in significant penalties. The vendor must then lodge an Australian tax return to claim the withheld amount, which can be a complex process without professional guidance.

How long does it take for the ATO to issue a clearance certificate or variation?

The ATO aims to process applications promptly. While most electronically lodged applications are processed automatically within days, more complex cases or those requiring manual review can take up to 28 days. To prevent settlement delays, we strongly advise vendors to apply for the certificate as early as possible in the sale process. A proactive approach is the best way to ensure a smooth and timely transaction for all parties involved.

Does FRCGW apply if I inherit a property or receive it in a divorce?

Generally, no. The Foreign Resident Capital Gains Withholding regime applies to the ‘purchase’ of a property. Transactions in which no money changes hands, such as a direct inheritance following a death or a property transfer under a court order in a divorce settlement, are typically exempt. The withholding obligation is triggered by a sale, so these non-monetary transfers fall outside the scope of the legislation. We always recommend seeking advice for your specific situation.

Are there penalties for the purchaser if they fail to withhold the correct amount?

Yes, the penalties for a purchaser who fails to meet their withholding obligation are substantial. The ATO can hold the purchaser liable for the entire 12.5% withholding amount, in addition to imposing interest charges and other administrative penalties. This responsibility rests solely with the purchaser, making it critical to ensure compliance. We can provide the support and advice needed to manage this obligation correctly and avoid these costly outcomes.

As a foreign resident, how do I claim back the withheld amount from the ATO?

To claim the withheld amount, a foreign resident vendor must lodge an Australian income tax return for the financial year in which the property was sold. The amount withheld is then treated as a tax credit against the final capital gains tax liability calculated on the sale. If the credit exceeds the tax owed, the ATO will issue a refund for the difference. Correctly navigating the foreign resident capital gains withholding credit system is vital for a timely refund.

What if there are multiple vendors, some of whom are foreign residents and others aren’t?

In a sale involving multiple vendors of mixed residency, the withholding amount is calculated solely on the basis of the ownership interests of the foreign residents. For instance, if two individuals own a property 50/50 and only one is a foreign resident, the purchaser withholds 12.5% of that one vendor’s 50% share of the purchase price. The Australian resident vendor must provide their own valid clearance certificate to the purchaser to ensure their portion is not withheld.