Regulatory Changes: The Australian government frequently reviews and updates regulations related to SMSFs. SMSF trustees must stay informed about changes to compliance requirements, reporting obligations, investment restrictions, or contribution caps.

What we will cover

• New Labour Government – whats changing after the May 2023 Budget

• Investment Strategy Compliance: SMSFs must have an investment strategy that aligns with the retirement goals and risk profile of the fund’s members

• Limited Recourse Borrowing Arrangements (LRBAs): LRBAs allow SMSFs to borrow funds to invest in property or other assets. However, there are specific rules and restrictions around LRBAs, and trustees must ensure they comply with these regulations to avoid penalties or possible disqualification of the fund. Review

• Contributions and caps – what can I contribute and the work test

• Valuation of Assets: SMSFs must report their assets’ market value each financial year. What Trustees need to do.

• What the Super Fund auditor looks for

• Cybersecurity and Data Protection: With the increasing reliance on technology, SMSFs are exposed to cybersecurity risks. Trustees should implement robust security measures – discussion scams and how to protect your data.

• When a Self-Managed Superannuation Fund (SMSF) member passes away, several important considerations exist for the fund and its trustees. Here are some critical points regarding SMSFs and death:

• Trust Deed and Member’s Will – is your aligned

• Taxation of Death Benefits: Depending on various factors, including the age of the deceased member and the recipient, death benefit payments from an SMSF may be subject to taxation. Tax treatment may differ between dependents and non-dependents, and it is crucial to understand the applicable tax rules and seek professional advice. – let’s discuss

• Reversionary Pensions: If the deceased member passes, does this help in the estate planning process

• Death Benefit Nominations: SMSF members can make binding or non-binding death benefit nominations. Should I do one?

• Trustee Succession Planning: SMSF trustees need to have a succession plan in place in case of the death or incapacity of a member/trustee.

• Downsider strategy – how it can help me?

• Super above 3 million balance, or if one partner dies and it pushes you over – what should you do?

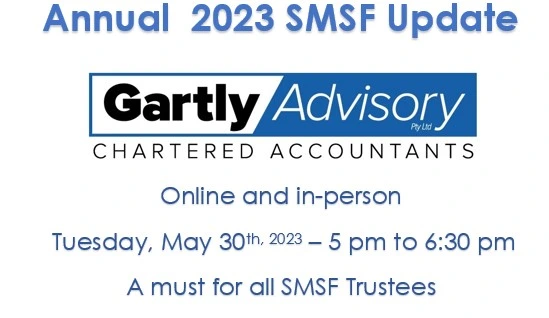

Let us know if you can join us either in person or online via zoom !

Essential for all those who run and operate an SMSF, both using our services or other professionals. All welcome!

Please RSVP to Chris @ chris@gartlyadvisory.com.au